Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

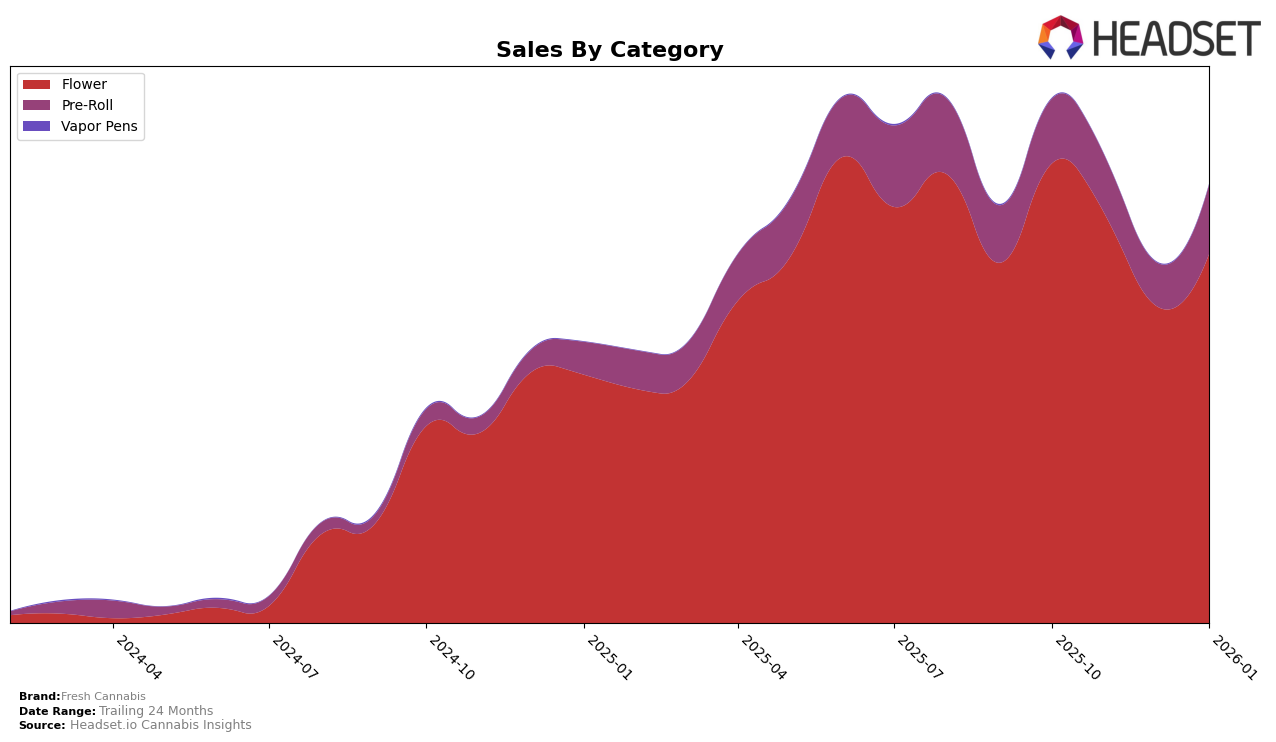

Fresh Cannabis has shown varied performance across different states and product categories. In Colorado, the brand's presence in the Flower category has been on the decline, with rankings slipping from 31st in October 2025 to 44th by January 2026. This downward trend is concerning, especially as they fell out of the top 30 entirely, indicating a potential struggle to maintain competitiveness in this market. On the contrary, New Jersey presents a more optimistic picture for Fresh Cannabis in the Flower category. Despite some fluctuations, the brand managed to remain within the top 30, peaking at 13th in November 2025 before stabilizing at 17th in January 2026, which suggests a relatively strong foothold in this state.

In terms of the Pre-Roll category, Fresh Cannabis's performance in New Jersey has been somewhat inconsistent. The brand maintained a rank of 25th in both October and November 2025 but dropped to 33rd in December before bouncing back to 24th in January 2026. This volatility could signal challenges in sustaining consumer interest or increased competition within the category. Notably, the absence of Fresh Cannabis from the top 30 in Colorado's Pre-Roll category throughout the analyzed period suggests a lack of significant market penetration or competitive edge in that product segment within the state. Overall, Fresh Cannabis's performance highlights the importance of strategic focus and adaptation to regional market dynamics.

Competitive Landscape

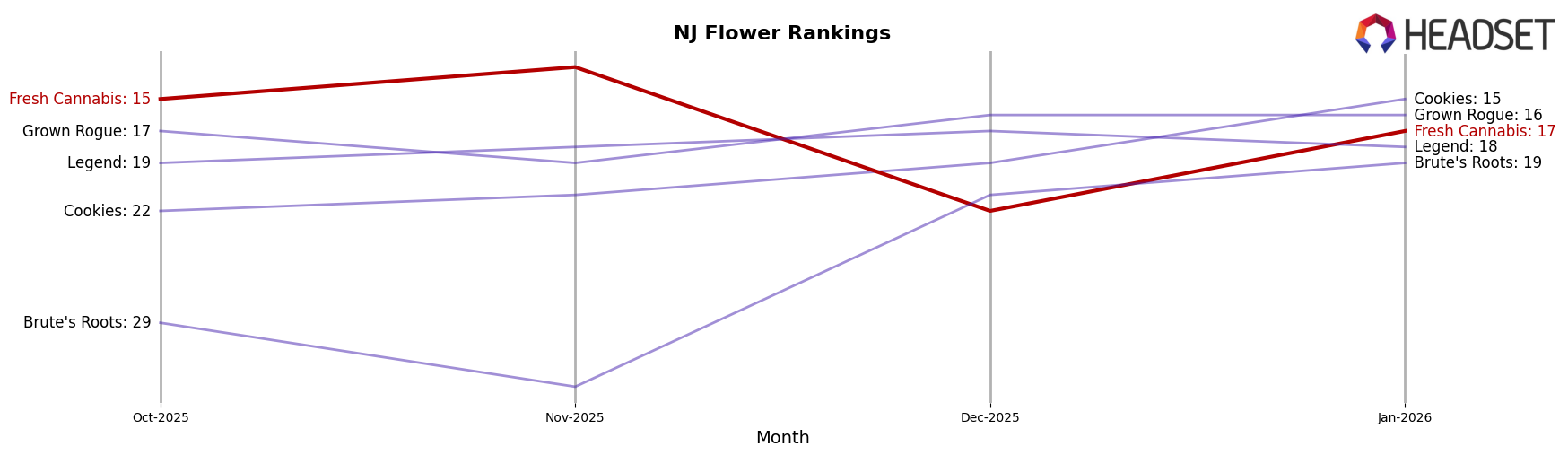

In the competitive landscape of the New Jersey flower category, Fresh Cannabis experienced notable fluctuations in its market position from October 2025 to January 2026. Starting at rank 15 in October 2025, Fresh Cannabis improved to rank 13 in November, only to drop significantly to rank 22 in December, before recovering slightly to rank 17 in January 2026. This volatility contrasts with the steady performance of Grown Rogue, which maintained a consistent presence in the top 20, and the upward trajectory of Cookies, which climbed from outside the top 20 in October to rank 15 by January. Meanwhile, Legend showed stable rankings, hovering around the 18th position, while Brute's Roots made a significant leap from rank 29 in October to rank 19 by January. These dynamics suggest that while Fresh Cannabis faces challenges in maintaining a stable rank, its ability to recover in January indicates potential resilience, albeit amidst a competitive and shifting market landscape.

Notable Products

In January 2026, the top-performing product from Fresh Cannabis was Animal Face x Kush Mints (3.5g), which rose to the number one rank with sales of 1828 units. Lemon Tree x Lemon Party (3.5g) followed closely, climbing to the second position from third in December 2025. Italian Soda (3.5g) secured the third rank, marking its re-entry into the top three after not being ranked in November 2025. Modern Marvel (3.5g) made its debut at the fourth position, while GSZ (3.5g) entered the rankings in fifth place. Compared to previous months, Animal Face x Kush Mints showed a significant recovery in sales, regaining the top spot after a dip in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.