Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

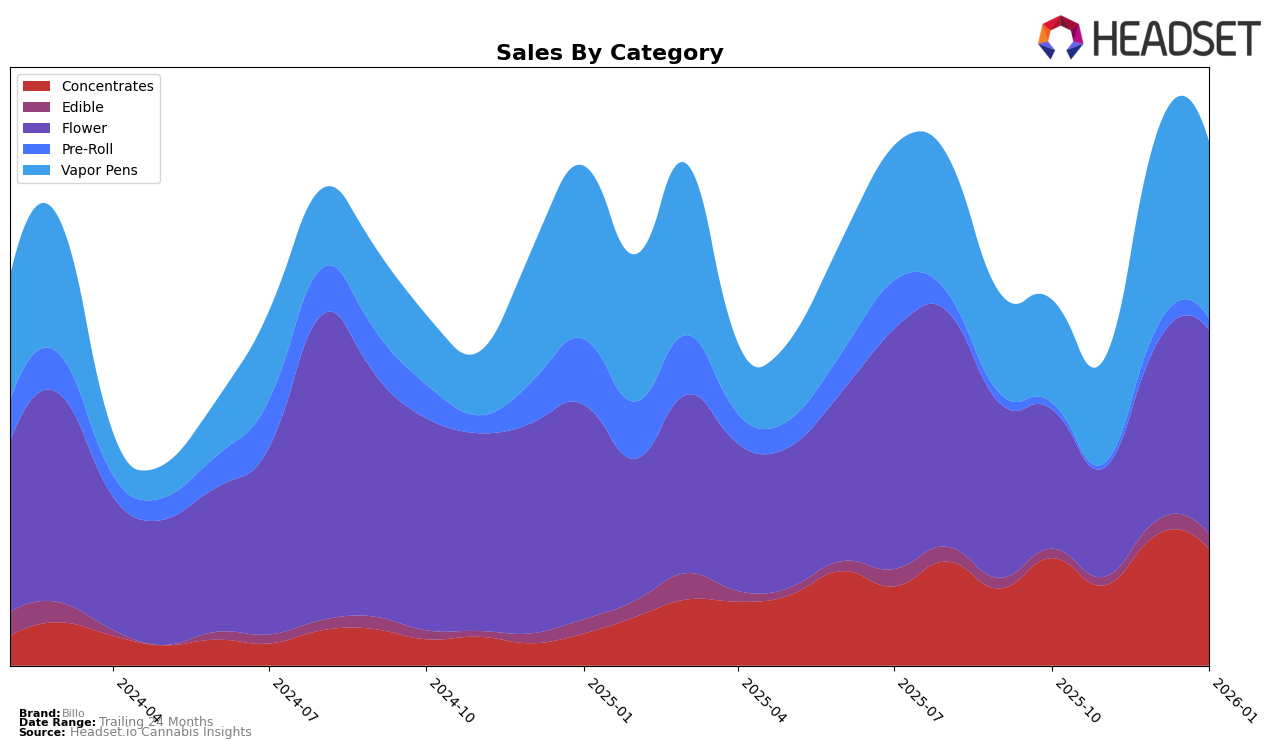

Billo's performance across categories in Colorado has shown notable fluctuations over the past few months. In the Concentrates category, Billo consistently maintained a strong presence, ranking 7th in October, December, and January, despite a drop to 12th in November. This consistency suggests a stable demand for their concentrates in the market. The Flower category also saw significant improvements, with Billo climbing from 30th in November to 14th by January, indicating a positive reception among consumers. However, the Pre-Roll category tells a different story, where Billo was not even in the top 30 in October and November, although it improved to 40th in December and settled at 43rd in January. This suggests challenges in gaining traction in the Pre-Roll segment.

In terms of Vapor Pens, Billo's performance in Colorado has been quite impressive, especially from November onwards, where they jumped from 28th to 17th and maintained this position into January. This indicates a growing consumer interest in their vapor pen offerings. The Edibles category also saw gradual improvement, with Billo moving from 26th in October to 20th by January, showing a steady increase in popularity. Overall, while Billo has experienced varying degrees of success across different categories, their ability to improve rankings in key segments like Flower and Vapor Pens suggests a strategic focus that is paying off in the competitive Colorado market.

Competitive Landscape

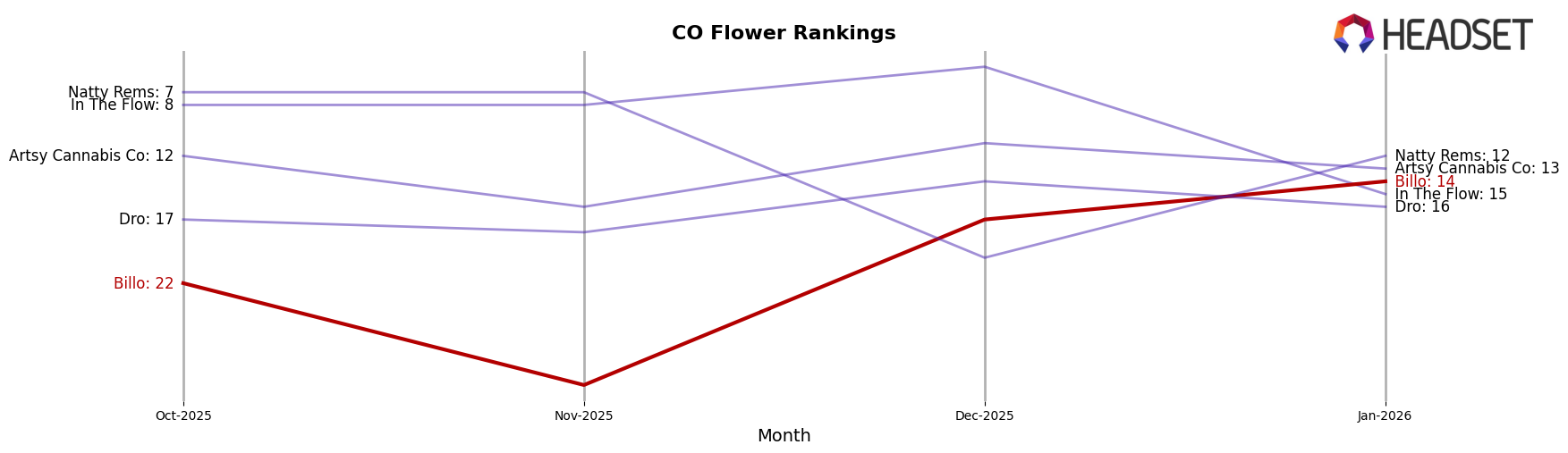

In the competitive landscape of the Colorado flower category, Billo has demonstrated notable fluctuations in its market position over the past few months. Starting from a rank of 22 in October 2025, Billo improved significantly to reach the 14th position by January 2026. This upward trend is indicative of a positive shift in consumer preference or strategic marketing efforts. In contrast, In The Flow experienced a decline, dropping from the 5th position in December 2025 to 15th in January 2026, which may have opened opportunities for Billo to capture a larger market share. Meanwhile, Natty Rems also saw a recovery from 20th in December 2025 to 12th in January 2026, indicating a competitive rebound. Despite this, Billo's consistent rise in rank, coupled with a steady increase in sales from November to January, suggests a strengthening brand presence amidst fluctuating performances from competitors like Artsy Cannabis Co and Dro, which maintained relatively stable positions but did not exhibit the same upward momentum as Billo.

```

Notable Products

In January 2026, the top-performing product for Billo was Crescendo Sour Cookies (Bulk) in the Flower category, which climbed to the number 1 rank from its previous position of 4 in December 2025, achieving sales of 3447 units. Gorilla Glue #4 (Bulk) secured the second spot, making its first appearance in the rankings for the given months. Mr. Nasty (Bulk) maintained a steady position at rank 3, showing consistent performance from December 2025. Cherry Cryostatis Wax (1g) entered the rankings at the fourth position, while Banana MAC (Bulk) achieved the fifth spot, both making their first appearances in the rankings. Notably, Crescendo Sour Cookies (Bulk) demonstrated the most significant improvement among the products, rising to the top spot in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.