Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

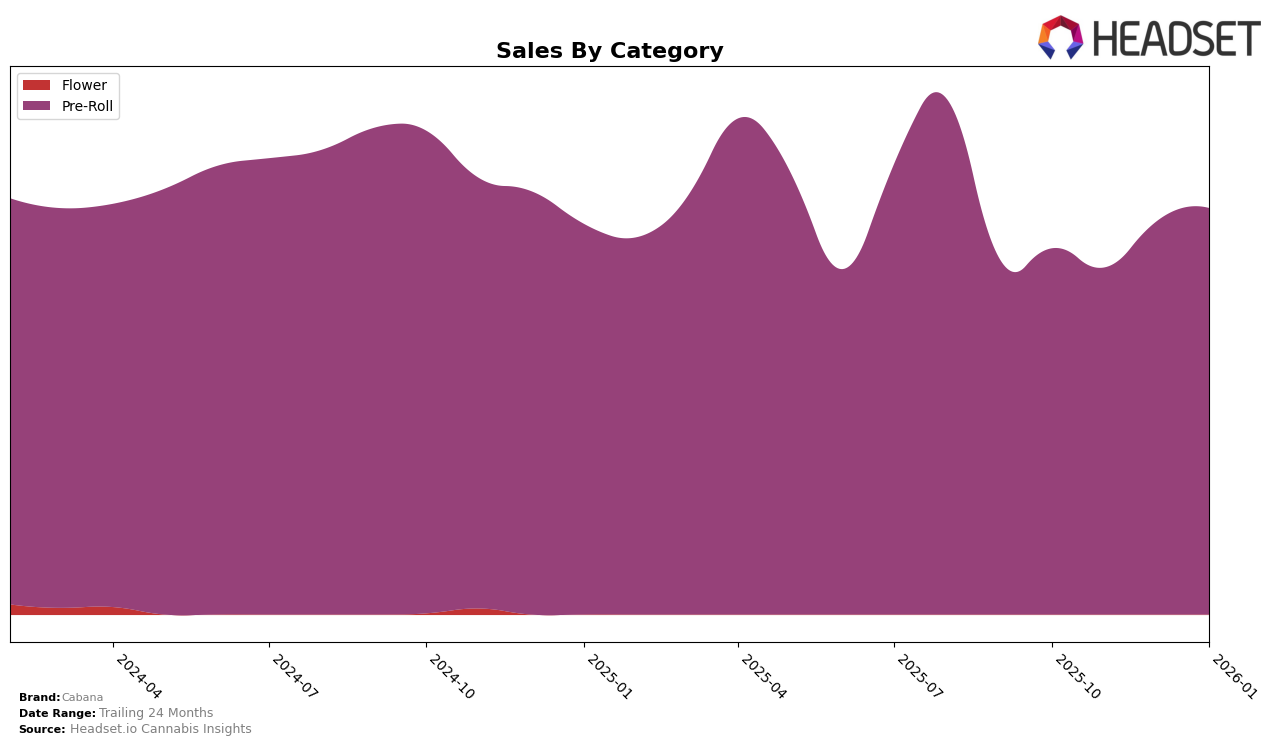

Cabana's performance in the Oregon market, particularly in the Pre-Roll category, has shown a stable presence with some fluctuations in rankings over recent months. Starting at 16th place in October 2025, Cabana saw a slight dip in November, moving to 17th, but quickly rebounded to 14th in December. By January 2026, the brand settled at 15th position, indicating a resilient hold within the top 20. This consistent ranking is noteworthy, as it suggests that Cabana maintains a steady consumer base in Oregon, despite the competitive nature of the Pre-Roll category.

Interestingly, Cabana's sales figures in Oregon reveal a positive trend, with sales increasing from approximately $180,616 in November to $211,511 in January. This upward trajectory in sales, despite minor fluctuations in rankings, highlights a potential growth in consumer demand or an effective strategy in market penetration. However, it's important to note that Cabana's absence from the top 30 in other states or categories could be a point of concern or an opportunity for expansion, depending on the brand's strategic goals. This performance in Oregon might serve as a benchmark for Cabana's efforts in other markets.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Cabana has experienced notable fluctuations in its ranking and sales performance. Over the period from October 2025 to January 2026, Cabana's rank shifted from 16th to 15th, with a dip to 17th in November, indicating a volatile position within the market. Despite these fluctuations, Cabana's sales showed a positive trend, increasing from October to January. In contrast, Entourage Cannabis / CBDiscovery consistently improved its rank from 15th to 13th, maintaining a steady upward trajectory in sales. Kites also demonstrated strong performance, ranking consistently higher than Cabana, except in December. Meanwhile, Derby's Farm and Drewby Doobie / Epic Flower showed less stability, with Derby's Farm dropping in rank and Drewby Doobie making a significant leap from 24th to 17th. These dynamics suggest that while Cabana is gaining momentum in sales, it faces stiff competition from brands like Entourage Cannabis and Kites, which are solidifying their positions in the market.

Notable Products

In January 2026, Cabana's top-performing product was Sour Candy Lope Pre-Roll (1g) in the Pre-Roll category, leading the sales with 2,388 units sold. Sunset Animal Pre-Roll (1g) followed as the second best-seller, while GMO Pre-Roll (1g) climbed back to the third position after previously ranking first in October 2025. Banana Chillz Pre-Roll (1g) and Hash Burger Pre-Roll (1g) secured the fourth and fifth ranks, respectively. Notably, GMO Pre-Roll (1g) showed a significant improvement from its fifth rank in November 2025 to third in January 2026, indicating a recovery in its popularity. This shift in rankings highlights the dynamic nature of product performance within Cabana's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.