Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

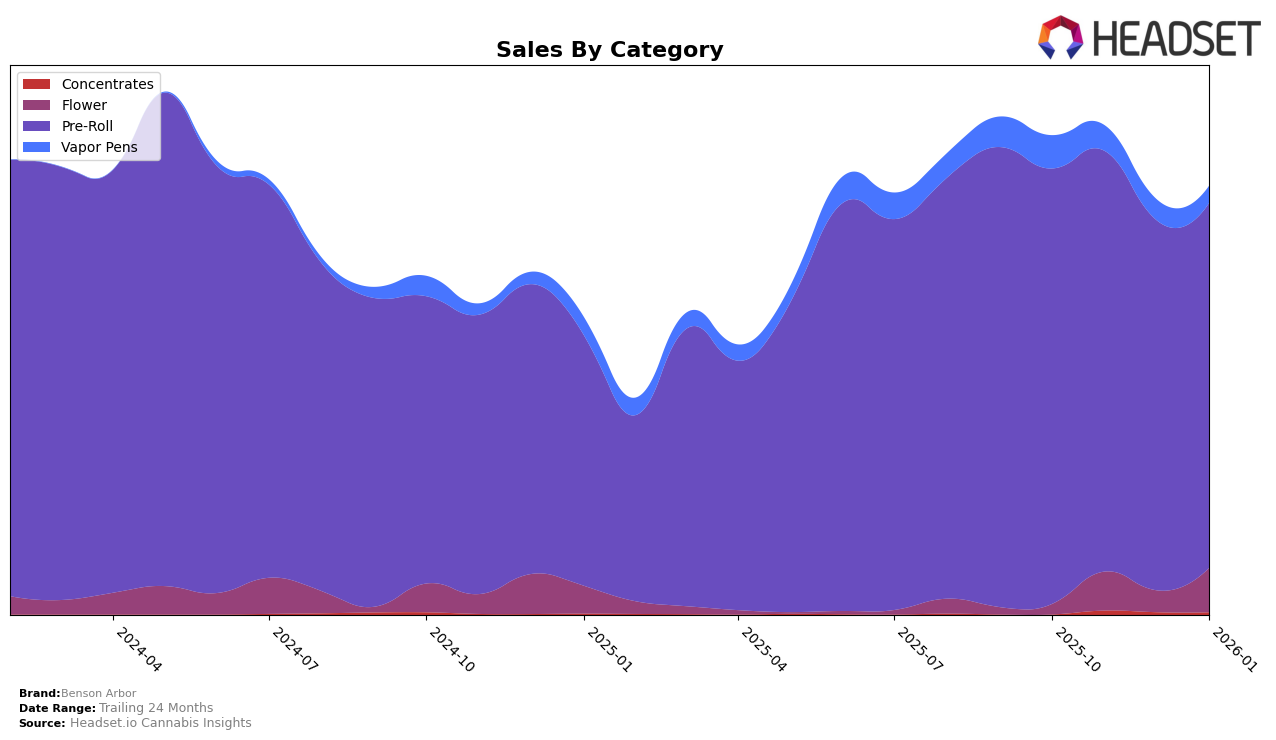

Benson Arbor's performance in the Oregon market showcases some interesting dynamics across different product categories. In the Flower category, the brand did not make it into the top 30 rankings in October and December 2025, but saw a notable improvement by January 2026, climbing to the 85th position. This suggests a potential upward trend that could be worth monitoring for future growth. Meanwhile, in the Pre-Roll category, Benson Arbor consistently held the 4th rank from October 2025 through January 2026, indicating a strong and stable market presence in this segment.

In contrast, the Vapor Pens category presents a different picture for Benson Arbor in Oregon. The brand's rank declined from 56th in October 2025 to 71st by January 2026, reflecting a downward trend in this category. This decline could be attributed to various factors, including increased competition or shifting consumer preferences. The consistent high ranking in Pre-Rolls, however, highlights Benson Arbor's stronghold in that area, suggesting that the brand's strategies and offerings in Pre-Rolls resonate well with consumers. Further insights into these dynamics could provide a deeper understanding of the brand's market positioning and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Benson Arbor has consistently maintained its position at rank 4 from October 2025 to January 2026. Despite this steady rank, Benson Arbor's sales have shown a downward trend, with a notable decrease from October's figures to January's. This decline in sales could be attributed to the strong performance of competitors like Hellavated and Portland Heights, which have consistently held the top two positions with higher sales figures. Additionally, Kaprikorn and Fire Dept. Cannabis are also showing competitive sales numbers, with Kaprikorn even experiencing a sales increase in December and January, potentially posing a threat to Benson Arbor's position if the trend continues. The data suggests that while Benson Arbor has maintained its rank, there is a need for strategic initiatives to boost sales and counteract the competitive pressures in the market.

Notable Products

In January 2026, Benson Arbor's top-performing product was the Alpine OG Pre-Roll (1g), maintaining its first-place ranking from the previous month with impressive sales of 3975 units. Headband Larry #14 Pre-Roll (1g) climbed to the second position, showing a significant increase from its third-place rank in December 2025. Gas Runtz #6 Pre-Roll (1g) secured the third spot, up from fifth place in the previous month, indicating a positive sales trend. Black Crown Blueberry Muffins #4 Rosin Distillate Infused Pre-Roll (1g) entered the rankings at fourth place, showcasing its rising popularity. Paris Sour #12 Diamond Water Hash Infused Pre-Roll 2-Pack (1.5g) rounded out the top five, marking its debut in the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.