Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

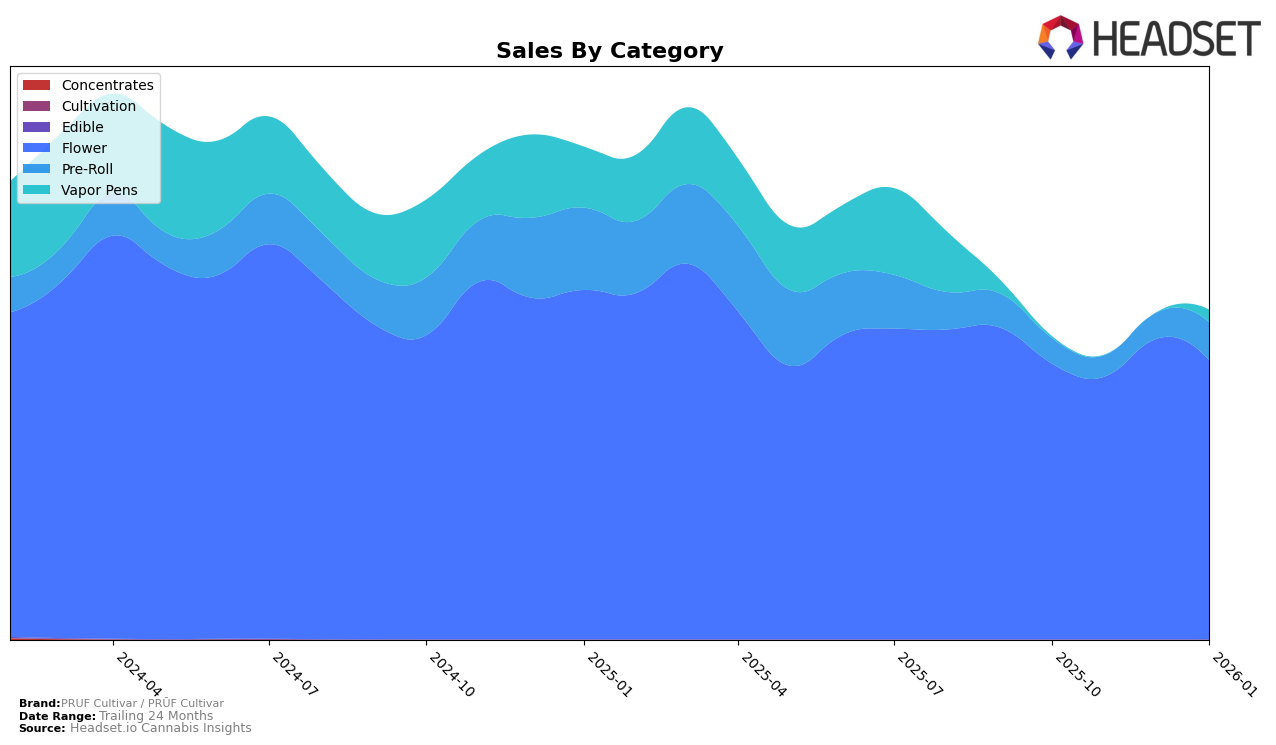

PRUF Cultivar / PRŪF Cultivar has shown a strong and consistent performance in the Flower category within Oregon. Over the last four months, the brand has maintained its top position, ranking first consistently from October 2025 through January 2026. This stability suggests a robust consumer base and effective market strategies that have solidified their dominance in this category. Despite slight fluctuations in monthly sales figures, the brand's leadership position underscores its stronghold in the Oregon Flower market.

In contrast, the brand's performance in the Pre-Roll category in Oregon has been more variable. Initially ranked 37th in October 2025, PRUF Cultivar / PRŪF Cultivar improved its standing to 24th by January 2026. This upward trend indicates a positive reception and growing popularity in this segment, although it still falls outside the top 20. Meanwhile, the Vapor Pens category shows a different story, as the brand did not rank in the top 30 until January 2026, when it entered at 54th. This late entry could suggest an emerging interest or recent product introduction in the market.

Competitive Landscape

In the competitive landscape of the flower category in Oregon, PRUF Cultivar / PRŪF Cultivar has consistently maintained its position as the leading brand from October 2025 through January 2026, holding the number one rank each month. This stability in rank underscores the brand's strong market presence and consumer preference. Despite fluctuations in sales figures, with a notable peak in December 2025, PRUF Cultivar / PRŪF Cultivar has managed to outperform its competitors significantly. For instance, Bald Peak consistently held the second rank but with sales figures trailing behind PRUF Cultivar / PRŪF Cultivar by a substantial margin. Meanwhile, Oregrown experienced more volatility, dropping from 8th to 13th place in November 2025 before climbing to 3rd in January 2026, indicating a more unstable market position. These insights highlight PRUF Cultivar / PRŪF Cultivar's dominance and suggest a strong brand loyalty among consumers in Oregon's flower market.

```

Notable Products

In January 2026, the top-performing product for PRUF Cultivar / PRŪF Cultivar was Jack Herer (Bulk) in the Flower category, maintaining its first-place rank from December 2025 with impressive sales of 14,999 units. Key Lime Guava #10 (Bulk) followed closely in second place, although it saw a decline from its top position in November 2025 to third in December 2025. Doom Berries (Bulk) rose to third place, showing a positive trend in sales since its fifth-place debut in December 2025. Tangie Biscotti (Bulk) secured the fourth position, consistent with its ranking in November 2025, while Crater Lake (Bulk) made an entry into the top five for the first time. This month’s rankings reflect a dynamic shift in consumer preferences with new entries and consistent top performers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.