Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

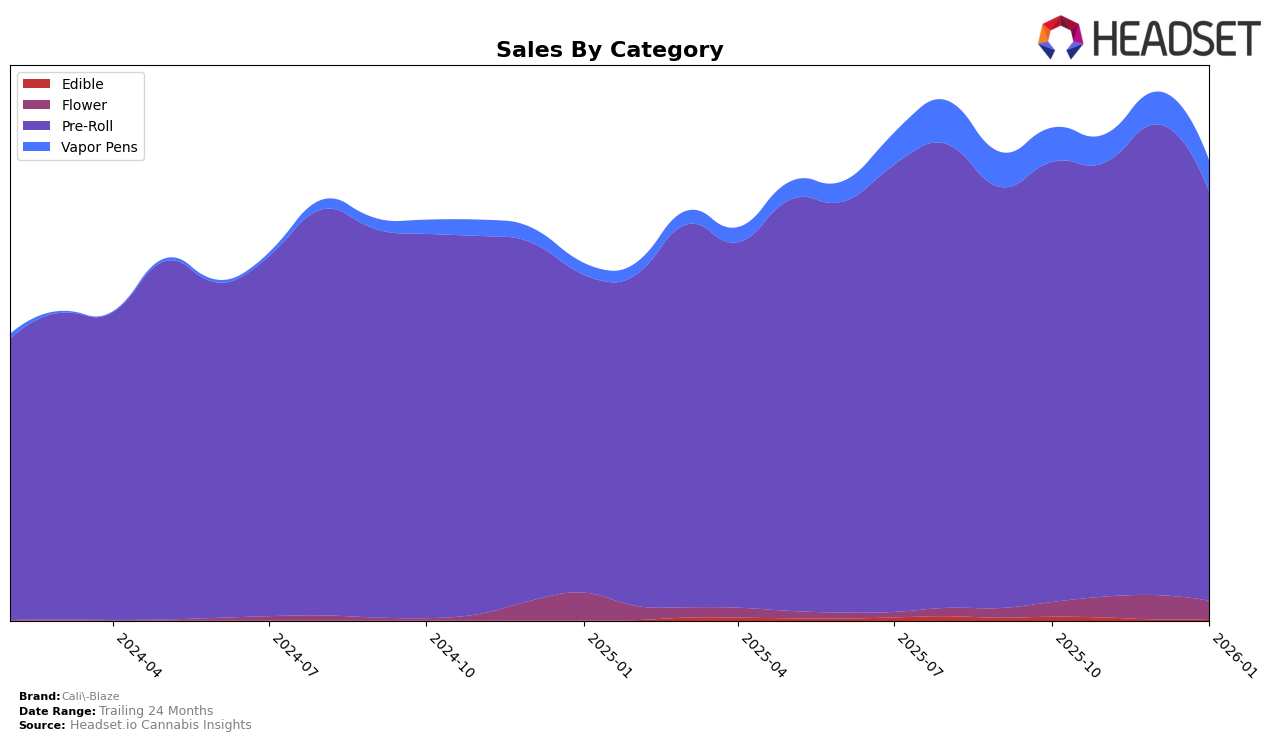

Cali-Blaze has maintained a strong presence in the Colorado pre-roll market, consistently holding the top rank from October to December 2025, before slipping slightly to the second position in January 2026. Despite this slight drop, their sales figures show robust performance with a peak in December 2025. In Massachusetts, Cali-Blaze also showed stability in the pre-roll category, holding the second rank consistently across the four months analyzed. This suggests a strong brand loyalty and consistent demand for their products in these states, even as the overall sales figures show some fluctuations.

In the vapor pen category, Cali-Blaze's performance varies between Massachusetts and Michigan. In Massachusetts, the brand saw an improvement in its ranking from 23rd in October 2025 to 19th by January 2026, indicating a positive trend in market penetration. However, in Michigan, the brand's presence was less stable, with rankings missing for certain months, suggesting challenges in maintaining a foothold in the competitive vapor pen market there. This inconsistency highlights the varying dynamics and competitive pressures in different state markets, which could be an area of focus for Cali-Blaze to strategize on for future growth.

Competitive Landscape

In the Michigan pre-roll category, Cali-Blaze consistently maintained its position as the second-ranked brand from October 2025 through January 2026. This stability in rank suggests a strong market presence, though it remains behind Jeeter, which held the top spot throughout the same period. Despite Cali-Blaze's robust sales performance, it faces a significant gap compared to Jeeter, whose sales figures were notably higher each month. Meanwhile, Cali-Blaze outperformed Dragonfly Cannabis and Goodlyfe Farms, both consistently ranked third and fourth, respectively. While Cali-Blaze's sales dipped slightly in January 2026, the brand's ability to maintain its rank suggests resilience in a competitive market, highlighting the importance of strategic marketing and product differentiation to potentially close the gap with Jeeter.

Notable Products

In January 2026, Cali-Blaze's top-performing product was the Raspberry Live Resin Donut Infused Blunt (1.2g) in the Pre-Roll category, securing the number one rank with sales of 22,108 units. The Cherry Lime Infused Pre-Roll (1.2g) closely followed as the second top product, showing a slight drop from its third position in November 2025. The Blue Muffin Liquid Diamond Infused Pre-Roll (1.2g) ranked third, having previously held the top position in December 2025. Dragon Fruit Infused Pre-Roll (1.2g) experienced a decline, moving from first in October and November 2025 to fourth in January 2026. The Key Lime Pie Infused Pre-Roll (1.2g) entered the rankings at fifth place, making its debut in the sales records.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.