Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

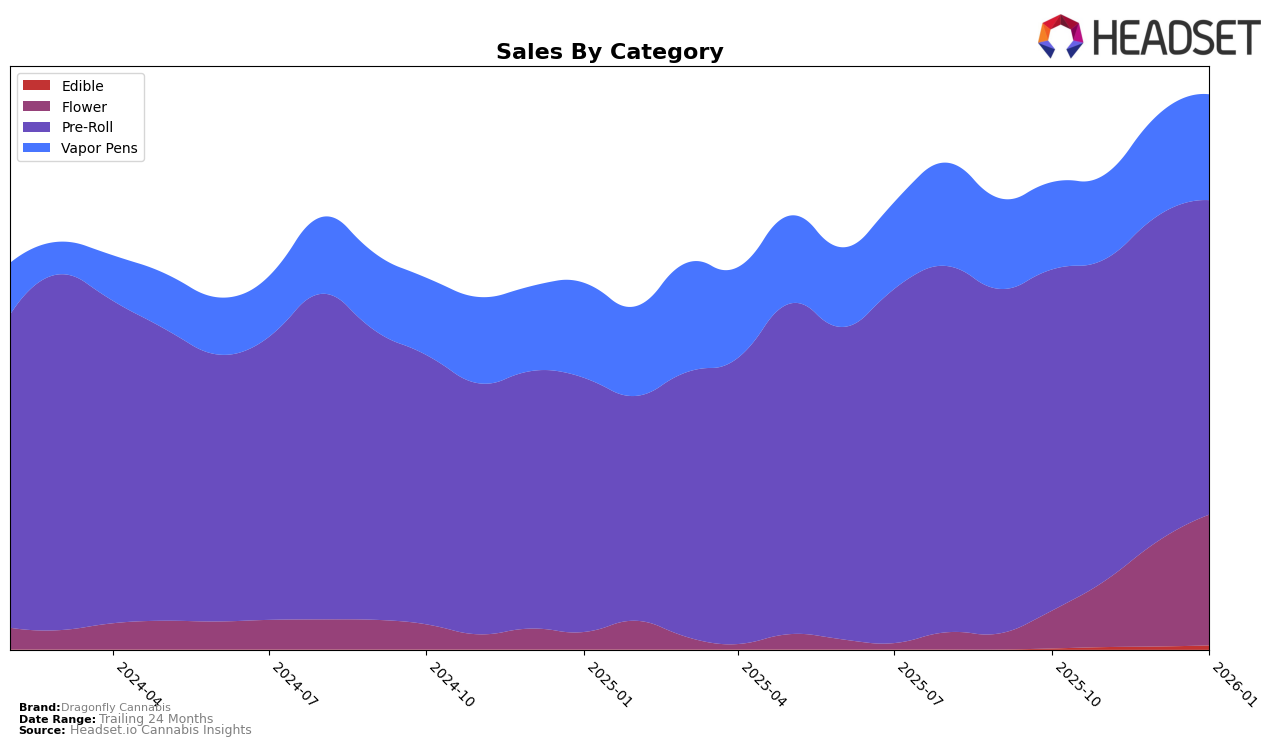

Dragonfly Cannabis has shown a varied performance across different categories and states. In Michigan, the brand's presence in the Flower category was notably absent from the top 30 rankings in October 2025, but it made a significant jump to 33rd place by January 2026. This upward trend indicates a growing acceptance or strategic push in the market. In contrast, their Pre-Roll category has maintained a consistent 3rd place ranking throughout the same period, showcasing a strong and stable market presence. However, their Vapor Pens have seen little movement, hovering around the 20th position, suggesting a need for strategic adjustments to enhance their competitive edge in this category.

In New York, Dragonfly Cannabis's performance in the Flower category has been quite dynamic, with rankings fluctuating from 42nd to 34th over the observed months. This volatility could be indicative of a competitive market or varying consumer preferences. The Pre-Roll category has seen a slight decline from 29th to 31st place, which might suggest increasing competition or a shift in consumer interest. Meanwhile, the Vapor Pens category has shown improvement, moving from 43rd to 33rd place, which could reflect successful marketing strategies or product enhancements. These movements highlight the importance of adapting to regional market dynamics to sustain and improve brand positioning.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Dragonfly Cannabis consistently holds the third position from October 2025 through January 2026. Despite maintaining this steady rank, Dragonfly Cannabis faces stiff competition from top-ranked brands like Jeeter and Cali-Blaze, which have consistently occupied the first and second spots, respectively. Notably, Jeeter's sales are significantly higher, showcasing a robust market presence that Dragonfly Cannabis could aspire to challenge. Meanwhile, Goodlyfe Farms and Mitten Extracts trail behind Dragonfly Cannabis, indicating a solid buffer for maintaining its current rank. However, Dragonfly Cannabis's sales exhibit a slight downward trend over the months, suggesting a potential area of concern that could impact future rankings if not addressed strategically.

Notable Products

In January 2026, the top-performing product from Dragonfly Cannabis was the Afternoon Tea Pre-Roll (1g), which climbed to the number one spot with sales of 126,844 units. The Sour Lemons Pre-Roll (1g) slipped from its top position in December 2025 to second place in January 2026. Super Yuzu Pre-Roll (1g) maintained its third-place ranking for the second consecutive month, despite a decrease in sales. Newcomers Gym Bag Pre-Roll (1g) and Fruity Pebbles Pre-Roll (1g) secured fourth and fifth places, respectively, indicating a strong entry into the market. Overall, the rankings show a dynamic shift among the top products, with Afternoon Tea Pre-Roll (1g) emerging as the leader after consistent performance in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.