Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

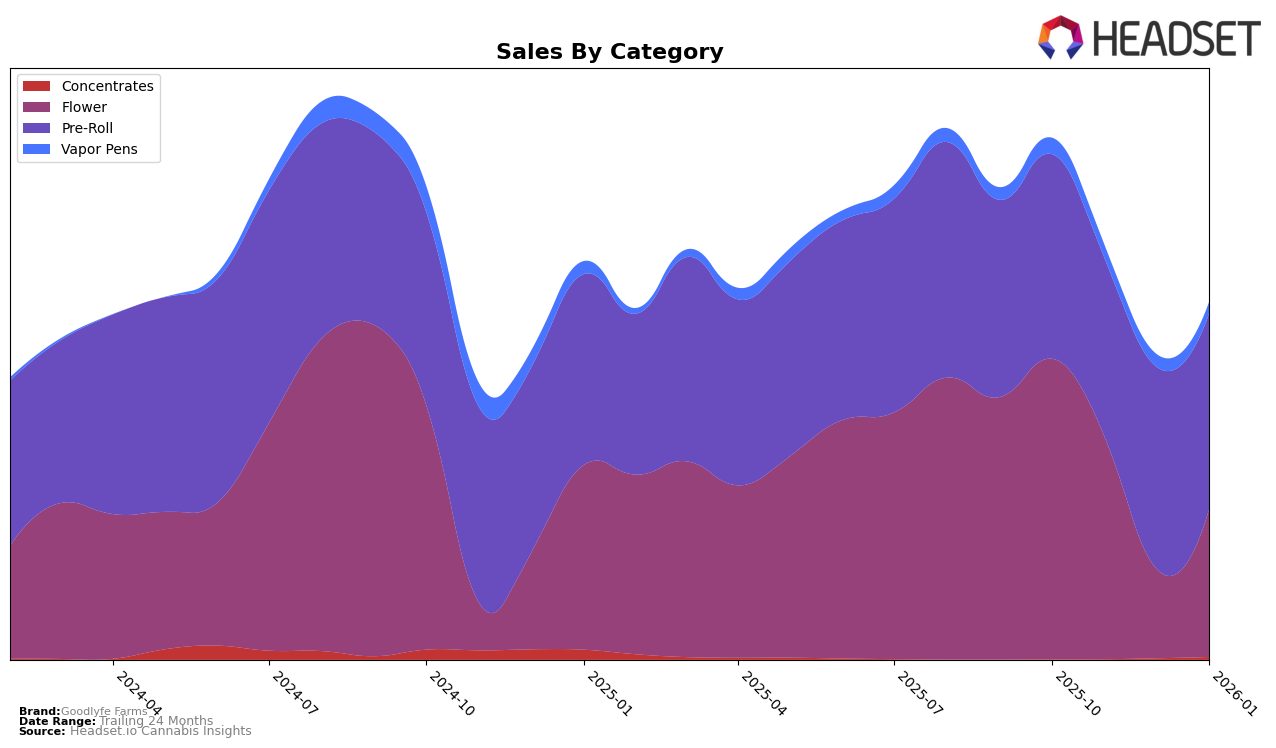

Goodlyfe Farms has demonstrated varied performance across different product categories and states, with notable fluctuations in rankings. In Michigan, the brand's Flower category saw a decline from a strong 3rd place in October 2025 to 20th in December 2025, before recovering to 9th in January 2026. This indicates a volatile market presence in the Flower category. Conversely, their Pre-Roll products maintained a consistent 4th place ranking throughout the same period, suggesting a stable demand and strong brand positioning in this category. However, their Vapor Pen category did not make it into the top 30 rankings, highlighting a potential area for growth or reevaluation of strategy.

In New York, Goodlyfe Farms has shown positive momentum in the Pre-Roll category, improving from a 34th place ranking in October 2025 to 13th by January 2026. This upward trend suggests increasing consumer acceptance and market penetration in the state. The rise in ranking is accompanied by a steady increase in sales, underscoring the brand's growing influence in the New York market. While the brand's presence in New York is not as diverse in terms of product categories as in Michigan, the notable improvement in Pre-Roll rankings can be seen as a promising development for Goodlyfe Farms.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Goodlyfe Farms consistently held the 4th rank from October 2025 to January 2026. Despite maintaining its position, Goodlyfe Farms faced pressure from both higher-ranked and emerging competitors. Cali-Blaze and Dragonfly Cannabis maintained their stronghold at the 2nd and 3rd ranks, respectively, with sales figures notably higher than Goodlyfe Farms throughout this period. Meanwhile, Mitten Extracts remained a steady competitor at the 5th position, closely trailing Goodlyfe Farms in sales. Interestingly, HY-R showed a promising upward trend, moving from the 8th to the 6th rank, indicating a potential threat if this momentum continues. For Goodlyfe Farms, the challenge lies in differentiating its offerings to solidify its market position and potentially climb the ranks amidst these competitive dynamics.

Notable Products

In January 2026, the top-performing product for Goodlyfe Farms was Unicorn Piss Infused Pre-Roll (1g), maintaining its first place position for four consecutive months with a notable sales figure of $111,194. Watermelon Zkittles Infused Pre-Roll (1g) emerged as a strong contender, securing the second spot. Blueberry Banana Pancakes Infused Pre-Roll (1g) re-entered the rankings in third place after being absent in November and December 2025. Sweet Peach Infused Pre-Roll (1g) debuted in fourth place for January 2026. Mango Kush Infused Pre-Roll (1g) experienced a slight drop, moving from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.