Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

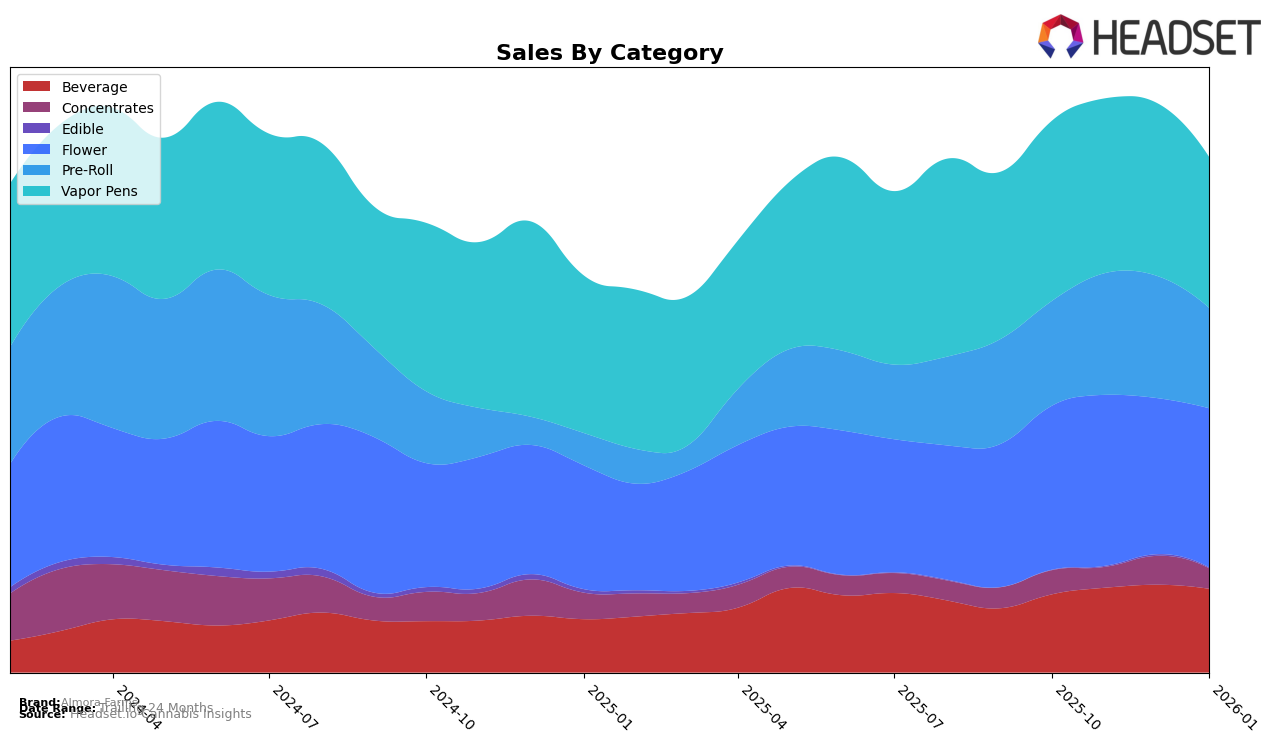

Almora Farms has shown a consistent performance in the California market, particularly in the Beverage category. The brand maintained a strong presence, ranking within the top 10 throughout the last quarter of 2025 and into January 2026, with a slight dip in December but quickly stabilizing. This indicates a steady consumer demand and a strong foothold in the Beverage category. In contrast, their performance in the Concentrates category fluctuated significantly. Notably, Almora Farms dropped out of the top 30 in November before bouncing back to 26th in December, only to fall again in January. This inconsistency suggests potential challenges in maintaining a competitive edge in the Concentrates market.

In other categories, Almora Farms has experienced both challenges and opportunities. In the Pre-Roll category, the brand showed a promising upward trend from October to December 2025, peaking at 22nd place before a slight decline in January 2026. Meanwhile, their Flower category rankings hovered around the 30th position, showing modest improvements but not breaking into the top 20. The Vapor Pens category saw a minor decline, with Almora Farms slipping from 26th in November to 27th in January. These movements indicate that while Almora Farms has a solid presence in some categories, there are areas where they face stiff competition and potential growth opportunities.

Competitive Landscape

In the competitive landscape of the California flower category, Almora Farms has demonstrated a relatively stable performance in recent months, maintaining a rank within the top 30 brands. While Almora Farms experienced a slight dip from 29th in November 2025 to 31st in December 2025, it rebounded to 30th in January 2026, indicating resilience amidst fluctuating market conditions. Notably, Heirbloom by CBX has shown significant upward momentum, climbing from 52nd in October 2025 to 28th by January 2026, which could pose a competitive threat if this trend continues. Meanwhile, Smoken Promises experienced a decline, dropping from 21st in October 2025 to 29th in January 2026, which may provide Almora Farms with an opportunity to capture market share if it can capitalize on this shift. Overall, Almora Farms' consistent sales figures, despite minor rank fluctuations, suggest a solid market presence, although keeping an eye on rising competitors like Heirbloom by CBX will be crucial for maintaining its position.

Notable Products

In January 2026, the top-performing product from Almora Farms was the Strawberry Live Resin Lemonade (100mg THC, 12oz) in the Beverage category, maintaining its first-place ranking for four consecutive months with sales of 14,886 units. The Pomberry Rose Live Resin Lemonade (100mg THC, 12oz) also held steady in the second position, showing a slight increase in sales compared to the previous month. The OG Classic Live Resin Lemonade (100mg THC, 12oz) remained in third place, experiencing a small decline in sales from December 2025. The Hybrid Pre Ground (28g) in the Flower category showed improvement, moving up from fifth place in October and November to fourth place in December and January. Indica Pre Ground (28g) maintained its fifth position since it entered the rankings in December 2025, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.