Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

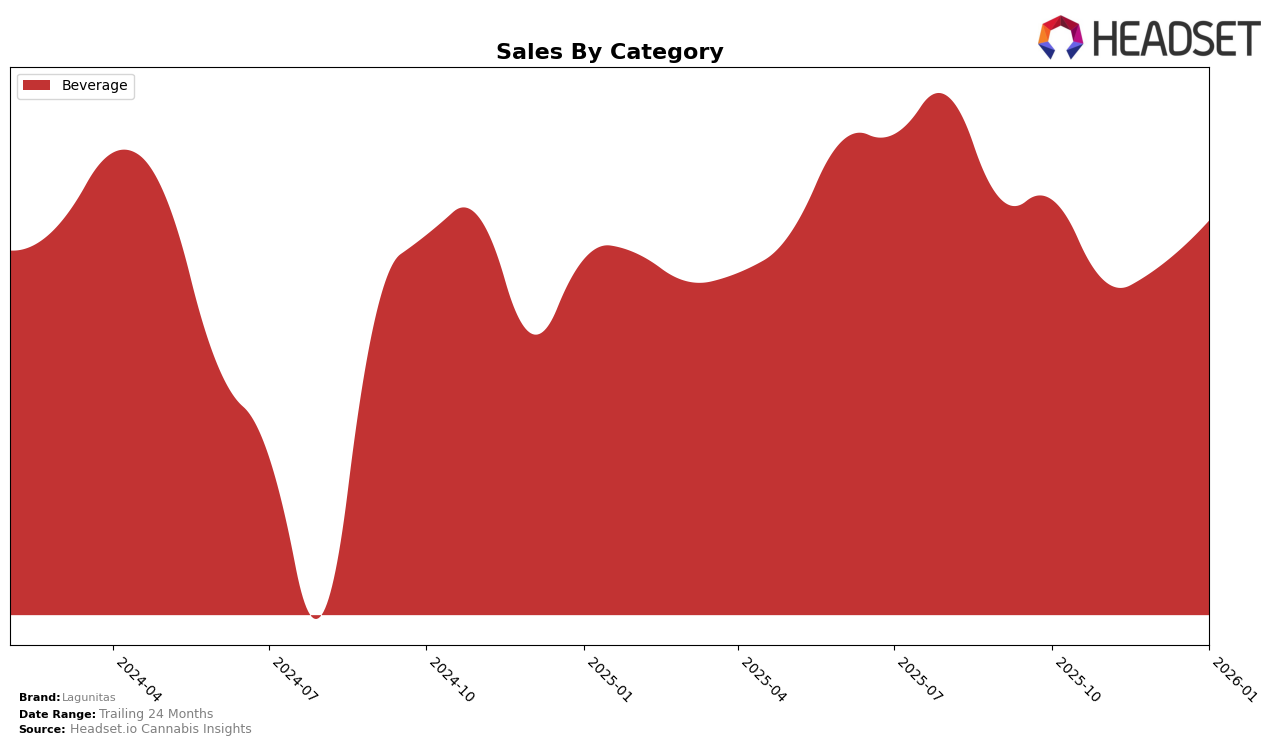

Lagunitas has shown a consistent performance in the Beverage category in California, maintaining a steady rank of 8th place from October 2025 through January 2026. This consistency indicates a stable market presence and consumer preference in the state. Despite a dip in sales in November 2025, where sales fell to $172,010 from $205,011 in October, the brand managed to recover to $196,616 by January 2026. This rebound suggests effective strategies in place to retain consumer interest even amidst fluctuations.

One notable observation is that Lagunitas did not appear in the top 30 rankings for any other states or provinces besides California. This absence could point to a more regionally focused strategy or varying levels of competition and consumer interest in other markets. The lack of presence in other states' top 30 rankings could be seen as a potential area for growth or a reflection of different market dynamics outside of California. The data suggests that while Lagunitas holds a strong position within its home state, there is room for expansion and increased brand recognition in other regions.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Lagunitas consistently maintained its position at rank 8 from October 2025 to January 2026. Despite a stable ranking, Lagunitas faces stiff competition from brands like Manzanita Naturals, which fluctuated between ranks 5 and 7, and Almora Farms, which showed a slight improvement in rank over the same period. Notably, Keef Cola maintained a consistent rank of 9, trailing closely behind Lagunitas. While Lagunitas' sales figures showed a slight decline in November 2025, they rebounded by January 2026, indicating resilience in a competitive market. This stability in rank and sales suggests that while Lagunitas is holding its ground, the brand must continue to innovate and differentiate itself to stay ahead of competitors like Manzanita Naturals and Almora Farms, which have shown stronger sales performance.

Notable Products

In January 2026, the top-performing product for Lagunitas was HiFi Sessions - Mango Sparkling Water, maintaining its leading position from previous months and achieving a sales figure of 3,430 units. Hi-Fi Sessions - Hoppy Chill Sparkling Water moved up to the second rank, showing an improvement from its third position in December 2025. Hi-Fi Sessions - CBD/THC 1:1 Hoppy Balance Infused Sparkling Water dropped to third place, marking a decline from its consistent second-place ranking in prior months. Hi-Fi Sessions - Cloudberry Sparkling Water remained steady at fourth place, showing little variation in its ranking. Lastly, Hi-Fi Sessions - Hoppy Chill Sparkling Water 10-Pack secured the fifth position, consistent with its December 2025 rank, but with an increase in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.