Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

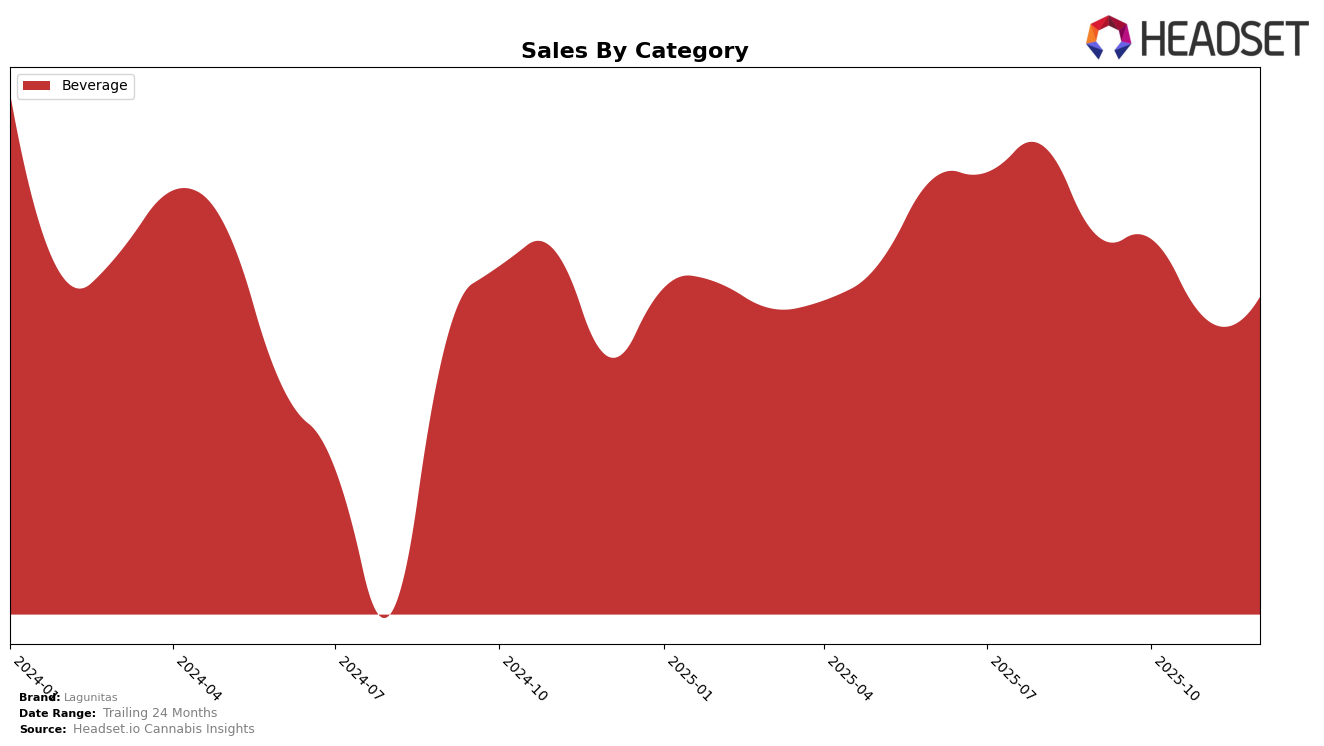

Lagunitas has shown a consistent presence in the California beverage category, maintaining its position within the top 10 brands over the last four months of 2025. Although the brand experienced a slight dip in its ranking from 7th in September to 8th in October, it stabilized at 8th place through December. This stability suggests a solid consumer base and a strong brand presence in the competitive California market. However, the decrease in sales from September to November, followed by a slight recovery in December, indicates potential challenges that may require strategic adjustments to regain momentum and improve future rankings.

Interestingly, Lagunitas does not appear in the top 30 brands for the beverage category in any other state or province, highlighting a potential area for growth and expansion. The absence from other markets could be seen as a missed opportunity, especially given the brand's established reputation in California. Expanding into new markets could diversify its consumer base and mitigate risks associated with relying heavily on a single state. This data suggests that while Lagunitas has a strong foothold in California, there is significant room for growth in other regions, which could enhance its overall market performance and brand recognition.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Lagunitas has experienced a notable shift in its ranking and sales performance from September to December 2025. Initially ranked 7th in September, Lagunitas slipped to 8th place in October and maintained this position through December. This decline in rank is partly due to the impressive performance of CANN Social Tonics, which climbed from 9th to 7th place, driven by a significant increase in sales, nearly doubling from October to December. Meanwhile, Almora Farms consistently outperformed Lagunitas, holding a steady rank of 6th or higher throughout the period. Despite Lagunitas's sales dip in November, it showed a recovery in December, although not enough to reclaim its earlier ranking. The brand faces a competitive challenge from both established players and rising stars in the market, necessitating strategic adjustments to regain its footing and boost sales.

Notable Products

In December 2025, Lagunitas's HiFi Sessions Mango Sparkling Water (10mg THC, 12oz) reclaimed its top position as the leading product, maintaining its number one rank from September and October, despite a slight dip in November. The Hi-Fi Sessions CBD/THC 1:1 Hoppy Balance Infused Sparkling Water (5mg CBD, 5mg THC, 12oz) consistently held the second position throughout the last four months. The Hi-Fi Sessions Hoppy Chill Sparkling Water (10mg THC, 12oz) dropped to third place in December after leading in November, with sales reaching 2341 units. The Cloudberry Sparkling Water (10mg THC, 12oz) remained steady in fourth place, showing a gradual increase in sales figures over the months. Meanwhile, the Hi-Fi Sessions Hoppy Chill Sparkling Water 10-Pack (100mg THC, 12oz) reappeared in the rankings at fifth place in December, after missing out in November, indicating a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.