Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

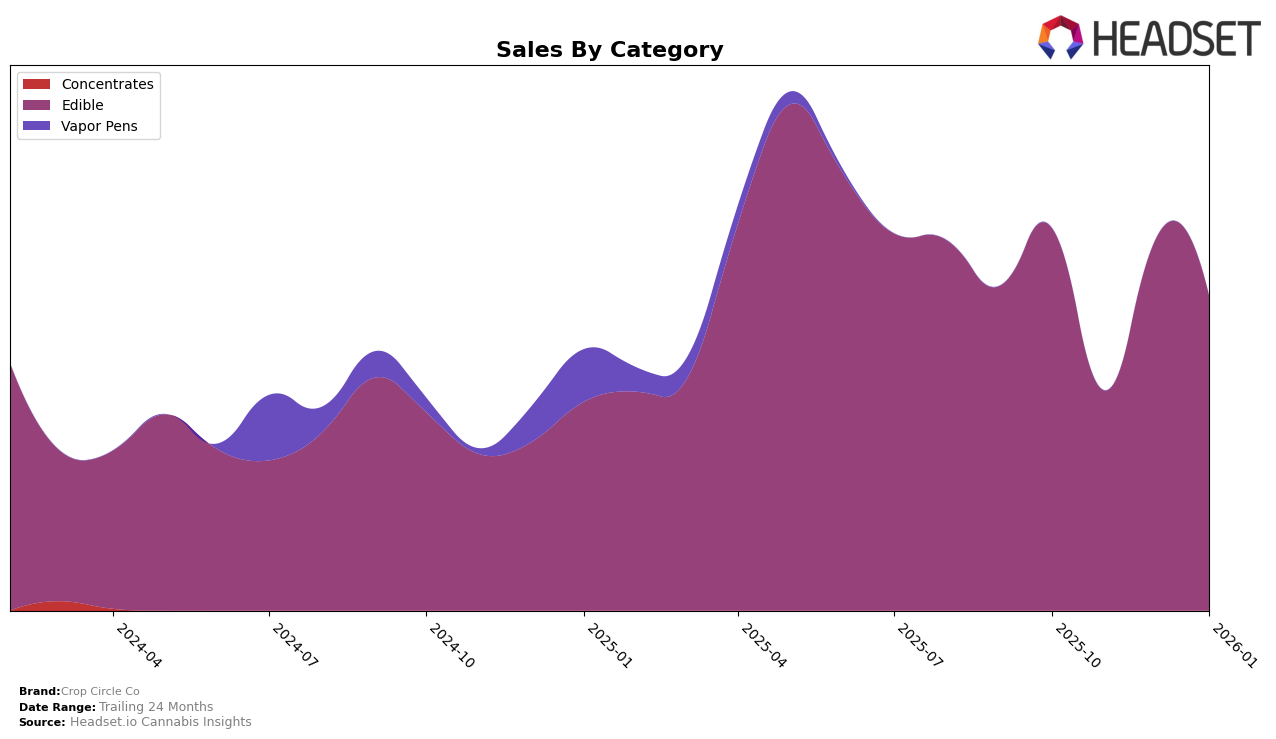

Crop Circle Co has shown varied performance across different states and categories. In Oregon, the brand has maintained a presence in the Edible category, although it experienced fluctuations in its ranking over the months. Starting at the 25th position in October 2025, the brand dropped out of the top 30 in November, only to recover to the 27th position by December and maintain that rank into January 2026. This indicates a resilience in the market despite the initial setback. However, the drop in ranking during November could suggest challenges that the brand faced during that period, possibly due to increased competition or a dip in consumer demand.

Sales figures for Crop Circle Co in Oregon's Edible category reveal an intriguing trend. While there was a noticeable dip in sales from October to November, with sales falling from $24,673 to $14,164, the brand managed to bounce back in December with sales recovering to $24,009. This recovery suggests effective strategies to regain market share or possibly a seasonal boost in demand. However, the brand's sales in January 2026 saw another decline to $20,229, which could indicate ongoing volatility or market saturation. The absence of Crop Circle Co from the top 30 in November highlights a significant challenge that the brand needs to address to ensure consistent performance in this competitive market.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Crop Circle Co has experienced notable fluctuations in its ranking and sales performance. Over the past months, Crop Circle Co's rank shifted from 25th in October 2025 to 27th by January 2026, indicating a relatively stable position amidst a competitive field. Despite this stability, Crop Circle Co faces stiff competition from brands like Sour Bhotz, which consistently outperformed it, maintaining a rank within the top 25 throughout the period. Meanwhile, She Don't Know and Tasty's (OR) showed dynamic rank changes, occasionally surpassing Crop Circle Co, especially in November and December 2025. The sales trends reveal that while Crop Circle Co's sales dipped significantly in November, they rebounded in December, though not enough to overtake competitors like Sour Bhotz, which consistently reported higher sales figures. This competitive pressure suggests that Crop Circle Co must strategize to enhance its market presence and sales performance to climb the rankings in the Oregon edible market.

Notable Products

In January 2026, the top-performing product for Crop Circle Co was Mint Meltaway Rosin Truffles 5-Pack (100mg), which climbed from fourth place in the previous two months to first, with notable sales of 340 units. Raspberry Rosin Truffles (100mg) maintained a strong position, holding steady in second place despite a slight decrease in sales from December. High Dose Truffle Mint Chocolate (50mg) entered the top three, moving up from its absence in December rankings to third place. Almond Sea Salt Rosin Chocolate Truffles 5-Pack (100mg) improved its standing, rising from fifth to fourth place. Meanwhile, Orange Yuzu Rosin Truffle (100mg) slipped from second in December to fifth in January, reflecting a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.