Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

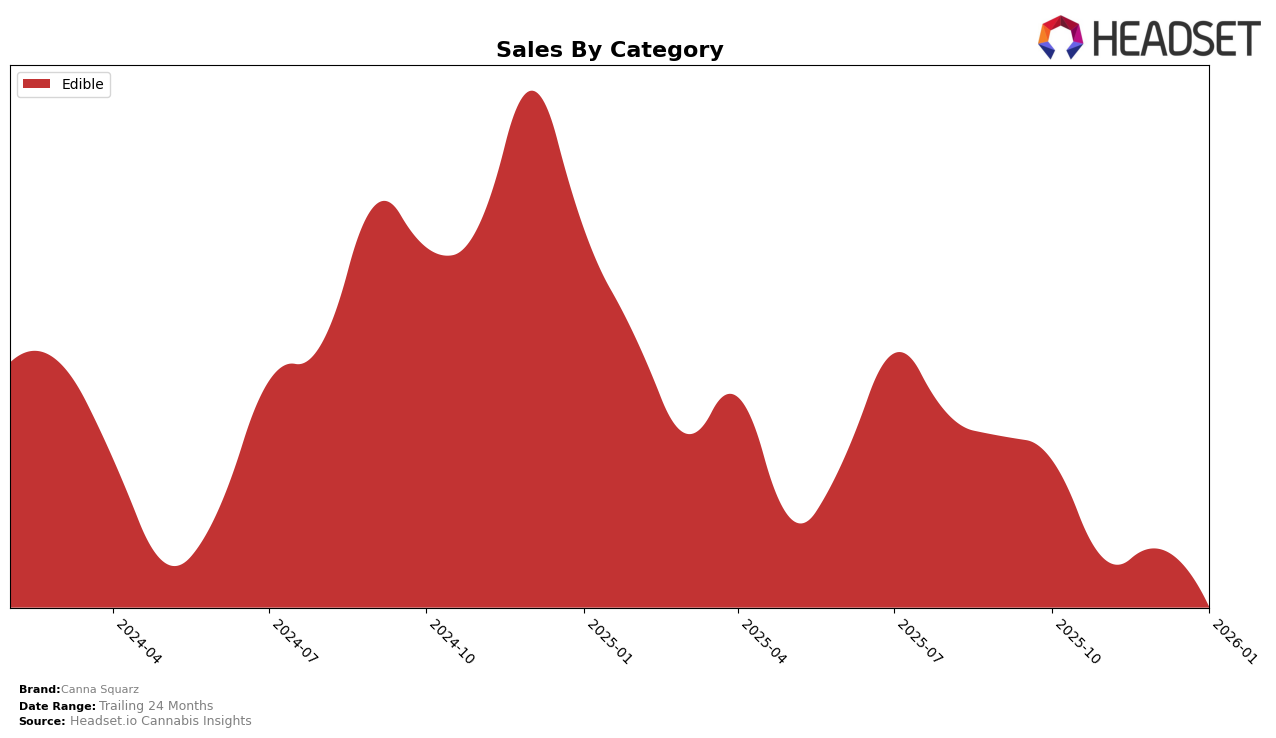

Canna Squarz has shown varied performance across different categories and states over the past few months. In the Edible category in Alberta, the brand was ranked 22nd in both October and December of 2025. This consistency suggests a stable presence in the market, although their absence from the rankings in November and January indicates fluctuations in their market position. The sales figures reflect this variability, with a notable drop from October to December, highlighting potential challenges in maintaining momentum.

The absence of Canna Squarz from the top 30 rankings in November and January in Alberta could be seen as a setback for the brand. This lack of presence in the top tier during these months might point to increased competition or changes in consumer preferences. However, their ability to regain a position in December suggests there may be opportunities for strategic adjustments to strengthen their market share. Observing how Canna Squarz navigates these dynamics in the coming months could provide valuable insights into their market strategies and resilience.

```Competitive Landscape

In the competitive landscape of the edible cannabis market in Alberta, Canna Squarz has experienced fluctuations in its rank and sales, highlighting both challenges and opportunities. While Canna Squarz was ranked 22nd in October and December 2025, it did not appear in the top 20 for November 2025 and January 2026, indicating potential volatility or increased competition. Comparatively, San Rafael '71 consistently maintained a presence in the top 20, albeit with a downward trend from 20th in November 2025 to 23rd in January 2026, suggesting a decline in their market hold. Meanwhile, Astro Lab showed a more erratic pattern, with a peak at 20th in October 2025, dropping out of the top 20 in December, and returning to 22nd in January 2026. This dynamic indicates a competitive environment where Canna Squarz must strategize to stabilize and improve its market position amidst fluctuating ranks and sales of its competitors.

Notable Products

In January 2026, the top-performing product for Canna Squarz was Mini Doughnuts Full Spectrum White Chocolate (10mg) in the Edible category, achieving the number one rank with sales of 584 units. This product rose from the fourth position in December 2025, demonstrating a significant increase in popularity. Rootbeer Float Full Spectrum Chocolate (10mg) secured the second position, maintaining a consistent presence in the top rankings, having been first in October 2025. Orange Dreamsicle Full Spectrum White Chocolate Bite (10mg) dropped to third place from its previous first position in December 2025. Peanut Butter Full Spectrum Chocolate (10mg) held steady at fourth place, showing stable performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.