Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

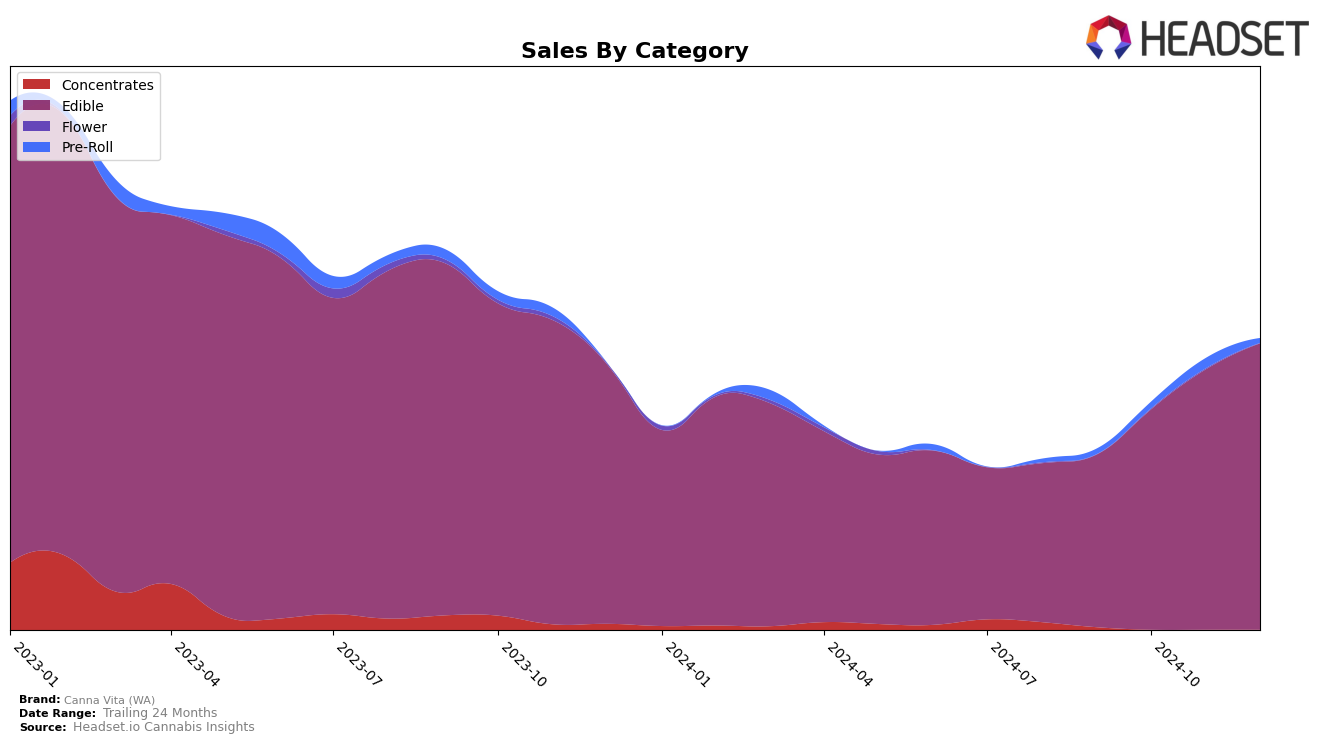

Canna Vita (WA) has shown a steady improvement in its performance within the edible category in Washington. Starting in September 2024, the brand was positioned at the 30th rank and maintained this position through October and November. However, in December 2024, Canna Vita (WA) made a notable advancement, climbing to the 28th rank. This upward movement indicates a positive trend in consumer acceptance and market penetration within the state, suggesting that their products are gaining traction among consumers, likely due to successful marketing strategies or product innovations.

The consistent presence of Canna Vita (WA) in the top 30 brands in the edible category in Washington is a positive sign, especially considering the competitive nature of the cannabis market. The fact that they were not ranked higher than 30th in the earlier months of the period under review could be seen as a challenge; however, the improvement by December suggests a strong finish to the year. This performance could be the result of strategic adjustments or seasonal factors impacting consumer preferences. Overall, the brand's ability to improve its ranking in December highlights its potential for further growth in the coming months.

```Competitive Landscape

In the competitive landscape of the edible category in Washington, Canna Vita (WA) has shown a consistent improvement in its market position, moving from a rank of 30 in September 2024 to 28 by December 2024. This upward trend in rank is indicative of a positive trajectory in sales, which have steadily increased over the same period. Despite this progress, Canna Vita (WA) faces stiff competition from brands like Chewee's, which maintained a slightly higher rank throughout the months, and Hi-Burst, which although experienced a slight decline, still remained ahead in terms of sales. Meanwhile, Agro Couture and Flav have not shown significant rank changes, with Flav not making it into the top 20, highlighting a potential opportunity for Canna Vita (WA) to capitalize on its current momentum and further climb the ranks in the Washington edible market.

Notable Products

In December 2024, Canna Vita (WA) maintained its leading position with CBD Milk Chocolate Squares 10-Pack (100mg CBD) as the top-performing product, achieving the number one rank consistently from October through December, with sales reaching 412 units. Dark Chocoate Espresso (100mg) held its steady position at rank two over the same period. Corner Stones - Milk Chocolate Candies 10-Pack (100mg CBD) climbed to the third rank, showing a notable improvement from its previous absence in November. Dark Chocolate Mint Sugar Free Candies (100mg) remained stable at rank four, while Summit - Milk Chocolate Sugar Free Candies (100mg) saw a consistent performance at rank five despite a slight decline in sales. Overall, the rankings indicate a strong preference for chocolate-based edible products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.