Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Flav's performance in the Arizona market shows a stable presence in the Edible category, maintaining a consistent ranking around the 8th position from October 2025 through January 2026. This stability is accompanied by a gradual increase in sales, indicating a positive reception among consumers. In contrast, their Vapor Pens category experienced a more volatile trajectory, with rankings fluctuating between 20th and 27th. Despite this inconsistency, there was a notable uptick in sales in January 2026, suggesting a recovery or successful promotional efforts. However, Flav's absence from the top 30 in the Missouri Vapor Pens category after November 2025 highlights a challenge in maintaining market presence there.

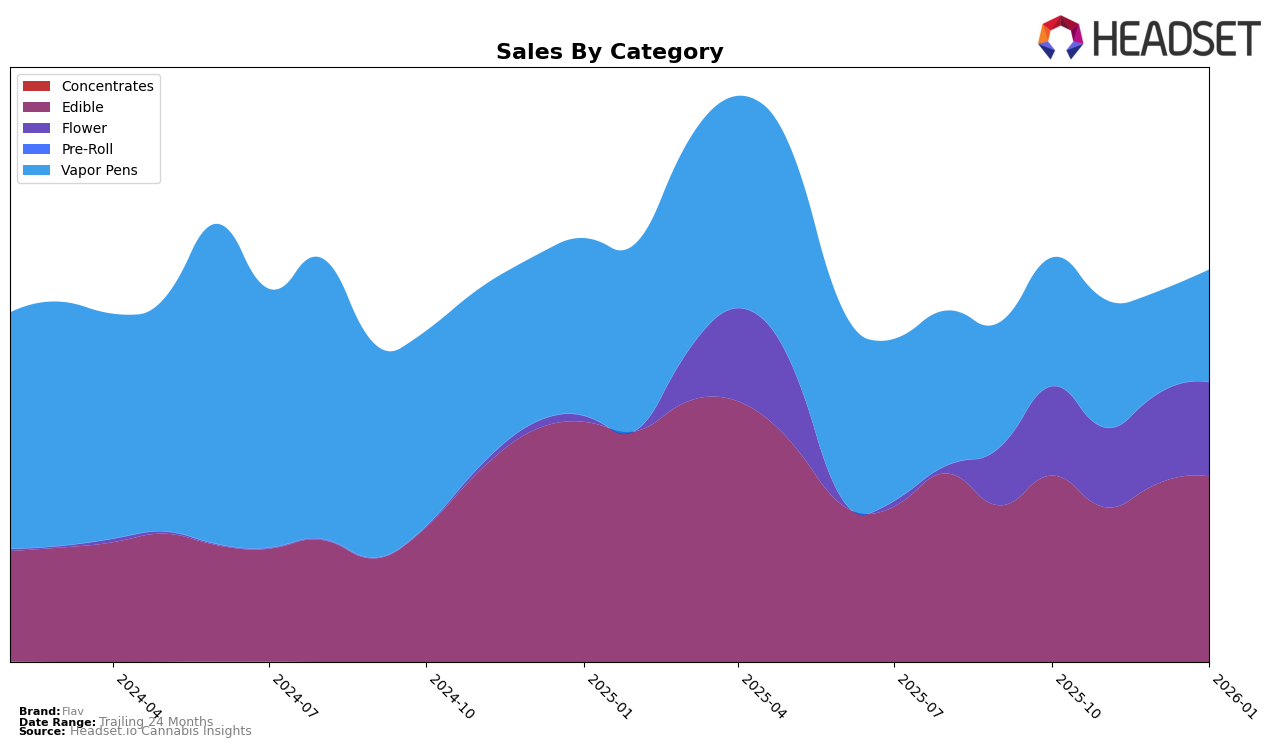

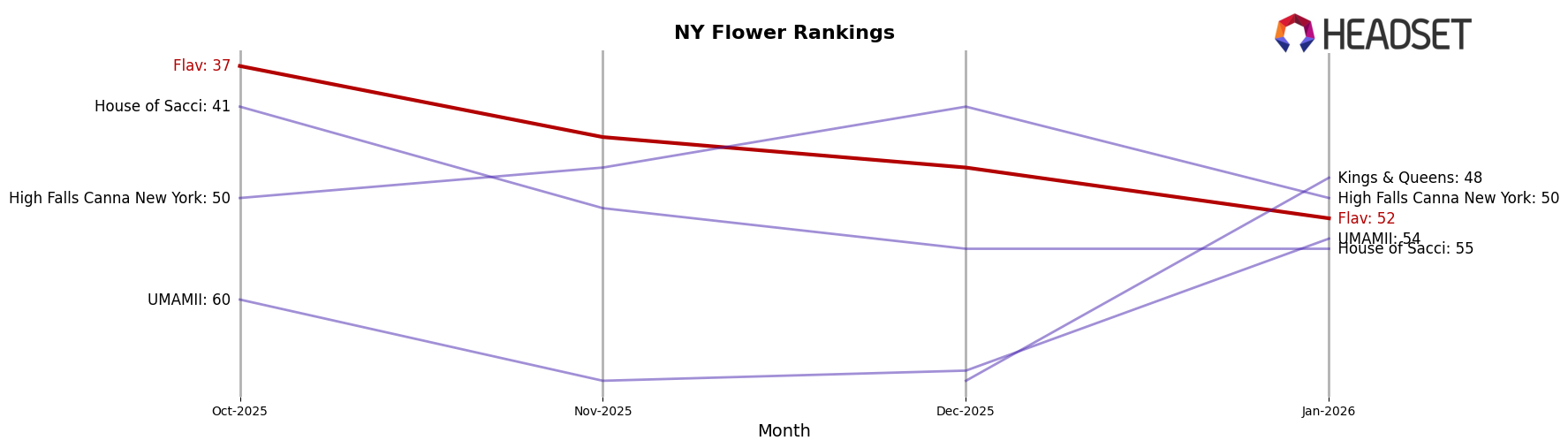

In New York, Flav's performance in the Edible category shows a fluctuating ranking but a strong finish at 23rd in January 2026, with sales rebounding from a dip in November. The Flower category, however, indicates a downward trend in rankings, slipping from 37th to 52nd over the four-month period, despite relatively stable sales. This could suggest that while sales volume remains steady, competitors are gaining ground. The Vapor Pens category in New York saw a significant drop in both ranking and sales, ending January 2026 outside the top 60, which could point to a need for strategic adjustments in this segment to regain market share.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Flav has experienced a downward trend in rankings from October 2025 to January 2026, moving from 37th to 52nd place. This decline is notable as other brands like High Falls Canna New York have shown a more dynamic performance, improving their rank from 50th in October to 41st in December before settling at 50th in January. Meanwhile, Kings & Queens entered the top 20 in January 2026 at 48th place, indicating a significant sales boost. House of Sacci has maintained a relatively stable position, though slightly declining, while UMAMII improved its rank from 68th to 54th. These shifts suggest that Flav may need to reassess its market strategies to address the competitive pressures and regain its standing in the New York Flower market.

Notable Products

In January 2026, the top-performing product from Flav was the Rainbow Sour Live Resin Gummy Belts 10-Pack (100mg), maintaining its consistent first-place ranking since October 2025, with sales reaching 7,739 units. The Sour Blueberry Live Resin Gummy Belts 10-Pack (100mg) also held steady in second place, following a similar pattern of stable performance over the past months. The Strawberry Live Resin Gummy Belts 10-Pack (100mg) remained in third place, showing no change in ranking from previous months. The Sour Mango Live Resin Mega Gummy Belts (100mg) continued to secure the fourth position, reflecting a stable market presence. Notably, the Mega Cherry Rings 10-Pack (100mg) entered the rankings in January 2026 at fifth place, indicating a positive reception in its debut month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.