Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

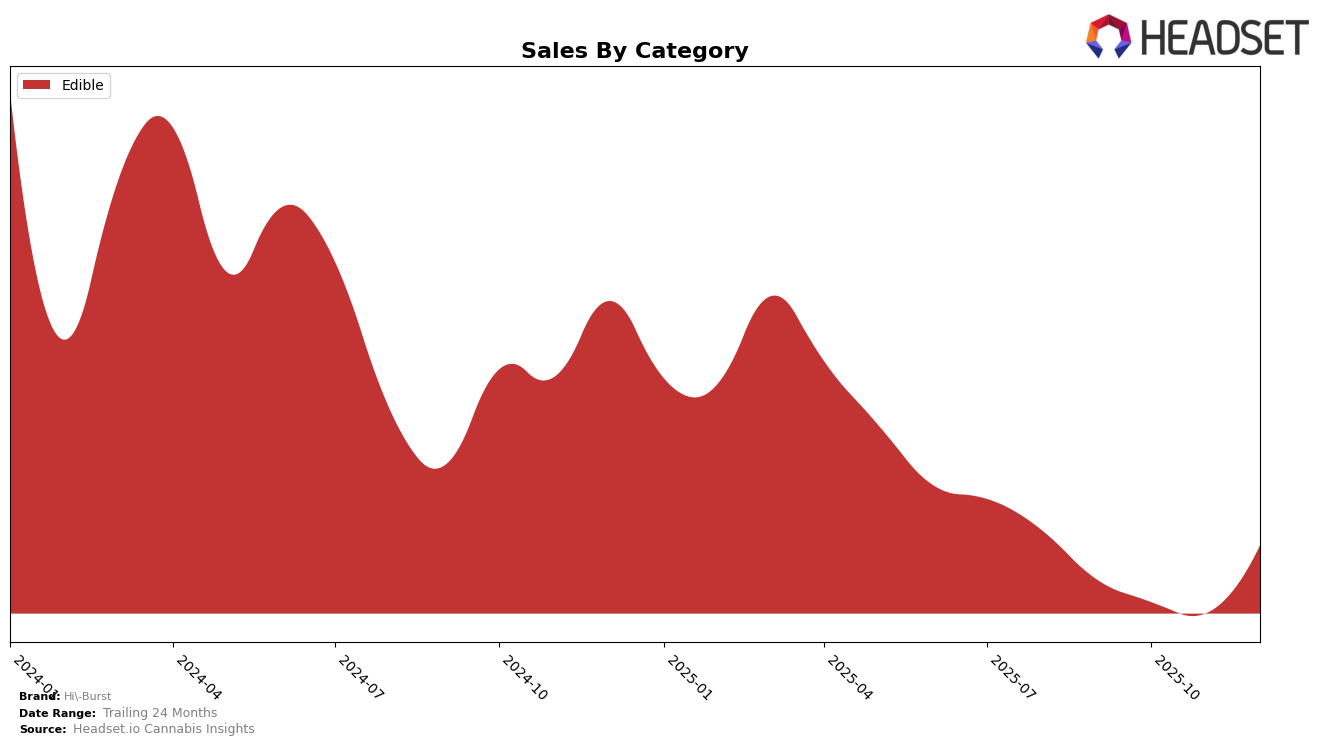

Hi-Burst has shown a consistent presence in the Edible category within Washington, maintaining a position within the top 30 brands throughout the last quarter of 2025. Despite a dip in October, where the brand fell to 30th place, Hi-Burst managed to recover slightly, climbing back to 28th by December. This fluctuation indicates a volatile but resilient performance in the state, suggesting that while competition is fierce, Hi-Burst has managed to sustain its market presence.

Interestingly, the sales figures for Hi-Burst in Washington reflect a notable increase from November to December, hinting at a potential seasonal boost or successful promotional efforts during the holiday season. However, the brand's ranking outside the top 30 in other states or provinces is a point of concern, as it suggests that Hi-Burst's market reach is currently limited geographically. This could indicate either a strategic focus on Washington or challenges in expanding their footprint beyond this market.

Competitive Landscape

In the Washington edibles market, Hi-Burst has experienced fluctuating rankings over the last few months, with a notable improvement in December 2025, moving up to 28th place from 30th in October. This positive shift in rank aligns with a significant increase in sales, suggesting a successful strategy or product launch. However, competition remains fierce, particularly from SnacMe, which consistently holds a higher rank, maintaining the 25th position through October and November before slightly dropping to 26th in December, yet still achieving substantial sales growth. Meanwhile, Koko Gemz and Agro Couture have also shown upward trends in sales, with Koko Gemz surpassing Hi-Burst in sales by December, despite a similar rank trajectory. These dynamics highlight the competitive pressure Hi-Burst faces in maintaining and improving its market position amidst a landscape of brands that are also scaling their operations and enhancing their market appeal.

Notable Products

In December 2025, the top-performing product from Hi-Burst was the Sativa Sour Raspberry Lemonade Fruit Chew 10-Pack (100mg), maintaining its number one rank for four consecutive months and achieving a notable sales figure of 465 units. The Sativa Sour Blue Raspberry Fruit Chews 10-Pack (100mg THC, 1.88oz) rose from third place in November to second place in December, reflecting an upward trend in sales. Indica Chill Sour Blue Raspberry Fruit Chew 10-Pack (100mg) returned to third place after a temporary absence in November, indicating a strong rebound. Hybrid Strawberry Kiwi Fruit Chews 10-Pack (100mg) saw a slight drop from second to fourth place, despite consistent sales. Sativa Orange n' Cream Fruit Chews 10-Pack (100mg) maintained its fifth-place ranking, showing a steady performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.