Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

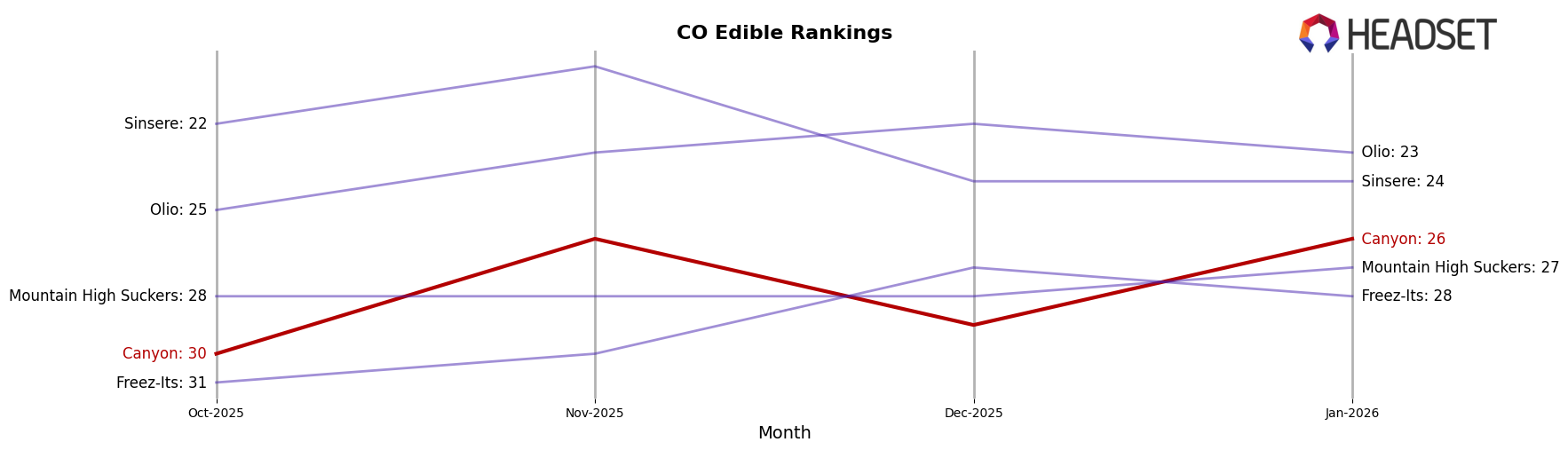

In the state of Colorado, Canyon has shown a consistent presence in the Edible category, with rankings fluctuating within the top 30 brands over the past few months. Starting in October 2025, Canyon was ranked 30th, and by November, it had climbed to 26th place. Although there was a slight dip to 29th in December, the brand quickly rebounded to 26th in January 2026. This pattern of movement suggests a resilience in maintaining a competitive position within the market, even amidst fluctuations in monthly sales figures.

While Canyon's performance in Colorado's Edible category demonstrates some volatility, the brand has managed to remain within the top 30, which is a positive sign of its market presence. It is noteworthy that despite a drop in sales from November to December, Canyon was able to improve its ranking by January, indicating a potential recovery or strategic adjustments that may have been made. This ability to stay relevant in a competitive landscape, especially in a mature market like Colorado, underscores the brand's capacity to adapt and maintain its standing among consumers.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Canyon has shown a consistent presence, with its rank fluctuating between 26th and 30th from October 2025 to January 2026. Notably, Canyon improved its position from 30th in October to 26th in November and maintained this rank in January, indicating a positive trend in market presence. Despite this improvement, Canyon faces stiff competition from brands like Olio, which consistently ranks higher, holding the 23rd position in January 2026, and Sinsere, which also maintains a competitive edge with a rank of 24th in the same month. Meanwhile, Mountain High Suckers and Freez-Its are close competitors, with ranks of 27th and 28th in January, respectively. This competitive environment suggests that while Canyon is making strides in improving its market position, it must continue to innovate and differentiate to climb higher in the rankings and increase its sales relative to these formidable competitors.

Notable Products

In January 2026, Canyon's top-performing product was the Chew It - CBD/THC 1:1 Sour Lemonade Gummies 40-Pack (100mg CBD, 100mg THC), maintaining its first-place ranking with a notable sales figure of 601 units. The Chew It - Sativa Sour Cherry Limeade Gummies 40-Pack (100mg) improved to second place, up from third in the previous two months. The Chew It - Indica Watermelon Lemonade Gummies 40-Pack (100mg) held steady in third place, despite a slight decline in sales. The Chew It - Blueberry Pomegranate Rosin Gummies 10-Pack (100mg) rose to fourth place, showing an increase from its fifth-place debut in December 2025. Finally, the Chew It - Blue Raspberry Rosin Gummies 20-Pack (100mg) re-entered the rankings in fifth place, having last appeared in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.