Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

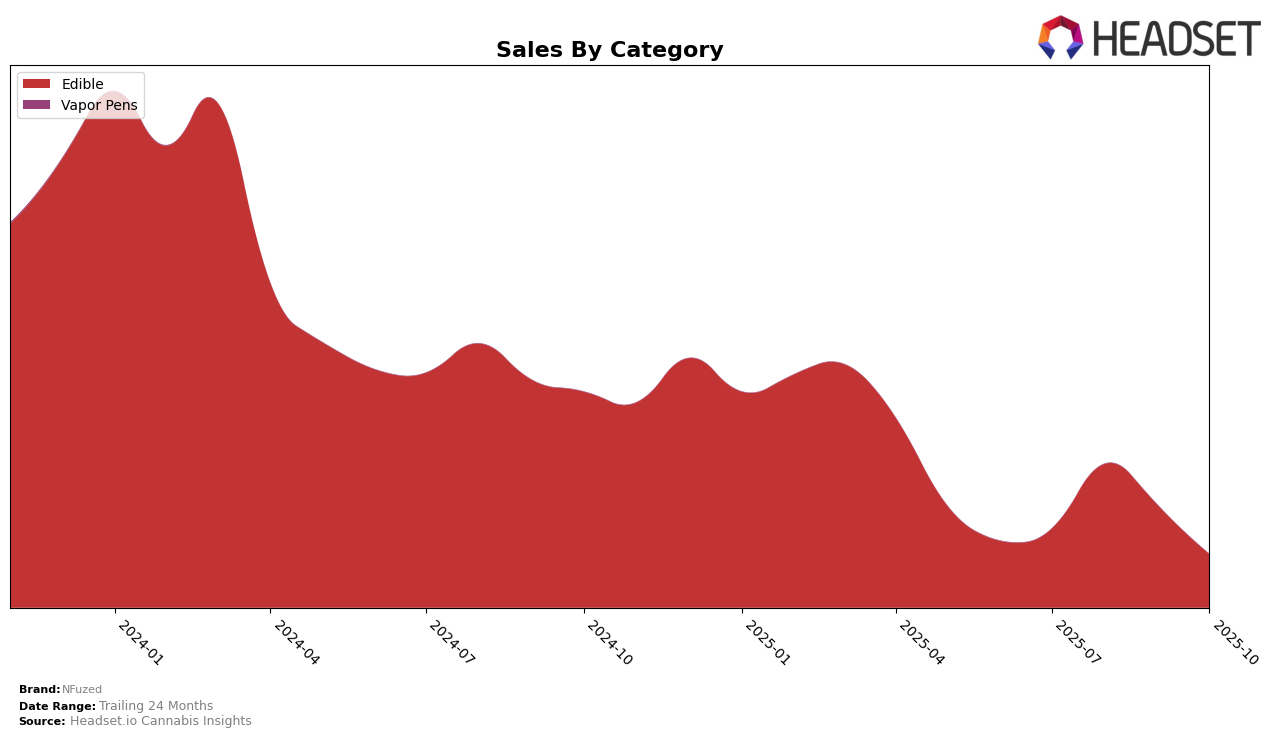

NFuzed has shown varied performance across different states and categories over the past few months. In Colorado, the brand has been active in the Edible category, experiencing fluctuations in its ranking from July to October 2025. Starting at the 25th position in July, NFuzed improved its standing to 18th in August, before slipping to 19th in September and further down to 23rd in October. This movement indicates a volatile presence in the market, with a notable peak in sales during August. Despite this peak, the subsequent decline in both ranking and sales suggests challenges in maintaining consistent performance.

Interestingly, the absence of NFuzed from the top 30 rankings in other states and categories reveals an area for potential growth or a strategic focus on its performance in Colorado. The brand's concentrated effort in the Edible category there might be a deliberate approach to capture a specific market segment. However, the lack of presence in other regions or categories could also point to missed opportunities or competitive pressures. Observing how NFuzed adapts its strategy in the coming months, either by expanding its footprint or solidifying its current market share, will be crucial for understanding its long-term trajectory.

Competitive Landscape

In the competitive landscape of the Edible category in Colorado, NFuzed has experienced notable fluctuations in its market position from July to October 2025. Initially ranked 25th in July, NFuzed climbed to 18th in August, demonstrating a significant improvement in its competitive standing. However, the brand's rank slipped to 19th in September and further to 23rd in October, indicating a volatile market presence. During this period, NFuzed faced stiff competition from brands like Zoobies, which, despite a dip in September, managed to secure the 21st position by October, and Sinsere, which showed a consistent upward trend, reaching 22nd place in October. Meanwhile, Olio and Flower Union maintained relatively stable rankings, with Olio ending at 25th and Flower Union at 26th in October. These dynamics suggest that while NFuzed has the potential for rapid rank improvements, sustaining such gains amidst strong competition remains a challenge.

Notable Products

In October 2025, the top-performing product from NFuzed was the Sour Raspberry Fast-Acting Gummies 10-Pack (100mg), which maintained its number one ranking from September, despite a notable decrease in sales to 907 units. The Juicy Fruit Fast Acting Gummies 10-Pack (100mg) made a significant impact by securing the second position, marking its first appearance in the top rankings. Sour Classic Variety Gummies 10-Pack (100mg) improved its position to third place, up from fifth in September, although its sales figures dropped to 564 units. Sour Blueberry Bubba Kush Rosin Gummies 10-Pack (100mg) ranked fourth, slipping one position from September, with sales reducing to 409 units. Lastly, the CBD/CBN/THC 1:2:4 Indica Sleep Variety Fast Acting Sour Gummies 10-Pack (25mg CBD, 50mg CBN, 100mg THC) re-entered the rankings at fifth place, despite a modest sales figure of 355 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.