Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

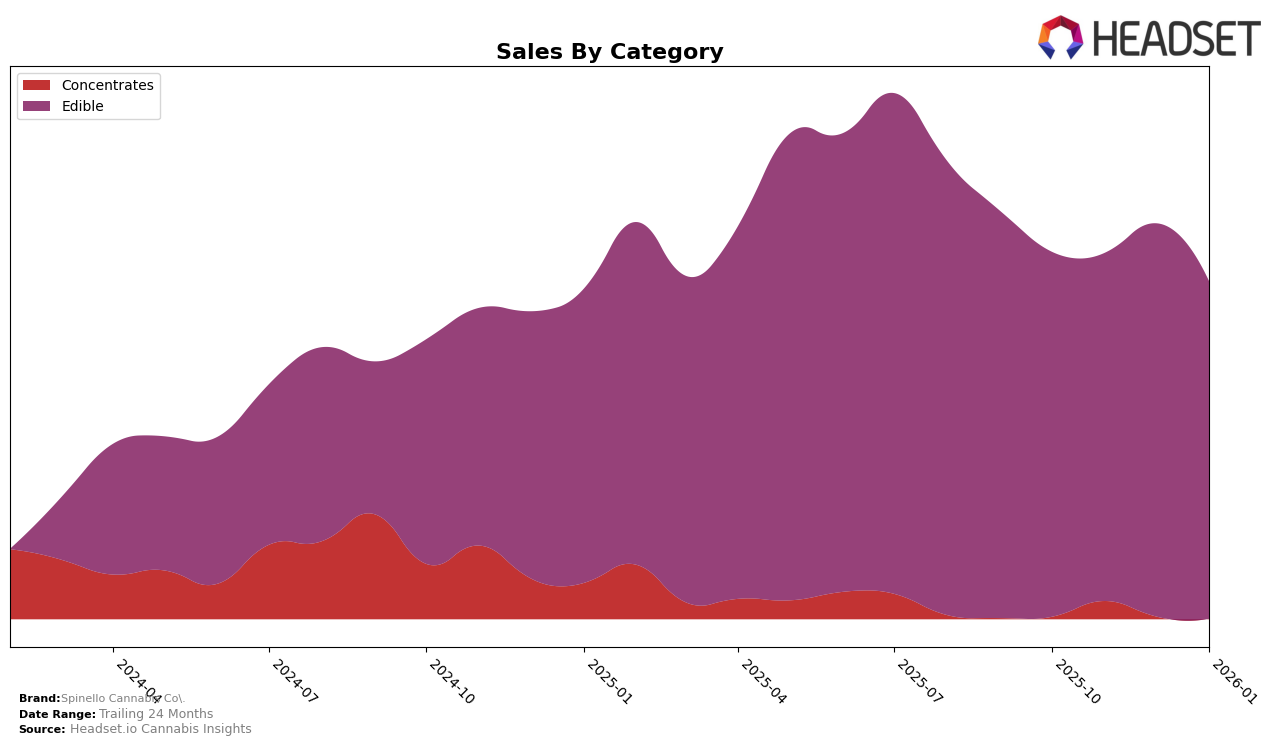

Spinello Cannabis Co. has shown varied performance across different states and categories, with notable trends in the edible category. In California, Spinello Cannabis Co. has not managed to break into the top 30 rankings for edibles, hovering around the 60s and 70s over the past few months. Despite this, there was a slight improvement from October to November 2025, moving from 64th to 61st position, although it slipped back to 67th by January 2026. This indicates a fluctuating presence in the California market, suggesting potential challenges in gaining a stronger foothold in this competitive state.

In contrast, Spinello Cannabis Co. has maintained a more stable position in Colorado, consistently ranking within the top 30 for edibles. The brand exhibited a slight dip in November 2025, moving from 21st to 22nd, but quickly bounced back to 20th in December, before settling at 21st in January 2026. This consistency highlights a solid market presence in Colorado, suggesting a well-received product line in this state. Meanwhile, in Missouri, the brand's rankings have remained in the low 50s, indicating a moderate level of competition and potential for growth. The steady performance across these states underscores the brand's varying market strategies and consumer reception, offering valuable insights into regional market dynamics.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Colorado, Spinello Cannabis Co. has experienced fluctuating rankings, indicating a dynamic market presence. As of January 2026, Spinello Cannabis Co. holds the 21st rank, a slight dip from its peak at 20th in December 2025. This fluctuation is notable when compared to competitors like Nove Luxury Chocolate, which consistently maintained a higher rank, stabilizing at 19th from November 2025 through January 2026. Meanwhile, Billo has shown a significant upward trend, climbing from 26th in October 2025 to 20th by January 2026, surpassing Spinello Cannabis Co. in both rank and sales momentum. Olio and Zoobies also present competitive pressures, with Olio maintaining a steady rank around the 22nd to 23rd positions, and Zoobies showing volatility but ending January 2026 just ahead of Spinello Cannabis Co. at 22nd. These shifts highlight the competitive challenges Spinello Cannabis Co. faces in maintaining and improving its market position amidst aggressive competitors.

Notable Products

In January 2026, Spinello Cannabis Co.'s top-performing product was Blueberry Rosin Gummies 10-Pack (100mg), reclaiming the number one spot after being ranked second in the previous two months, with sales reaching 1571 units. Peach Rosin Gummies 10-Pack (100mg) moved up to second place, maintaining a strong performance with a slight increase in sales compared to December 2025. Mango Rosin Gummies 10-Pack (100mg), which had been the top seller in November and December 2025, dropped to third place, experiencing a significant decrease in sales. Sativa Mango Rosin Chews 10-Pack (100mg) remained consistent in its performance, moving up one rank to fourth place. Indica Blueberry Rosin Chews 10-Pack (100mg) saw a slight decrease in sales, resulting in a drop to fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.