Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

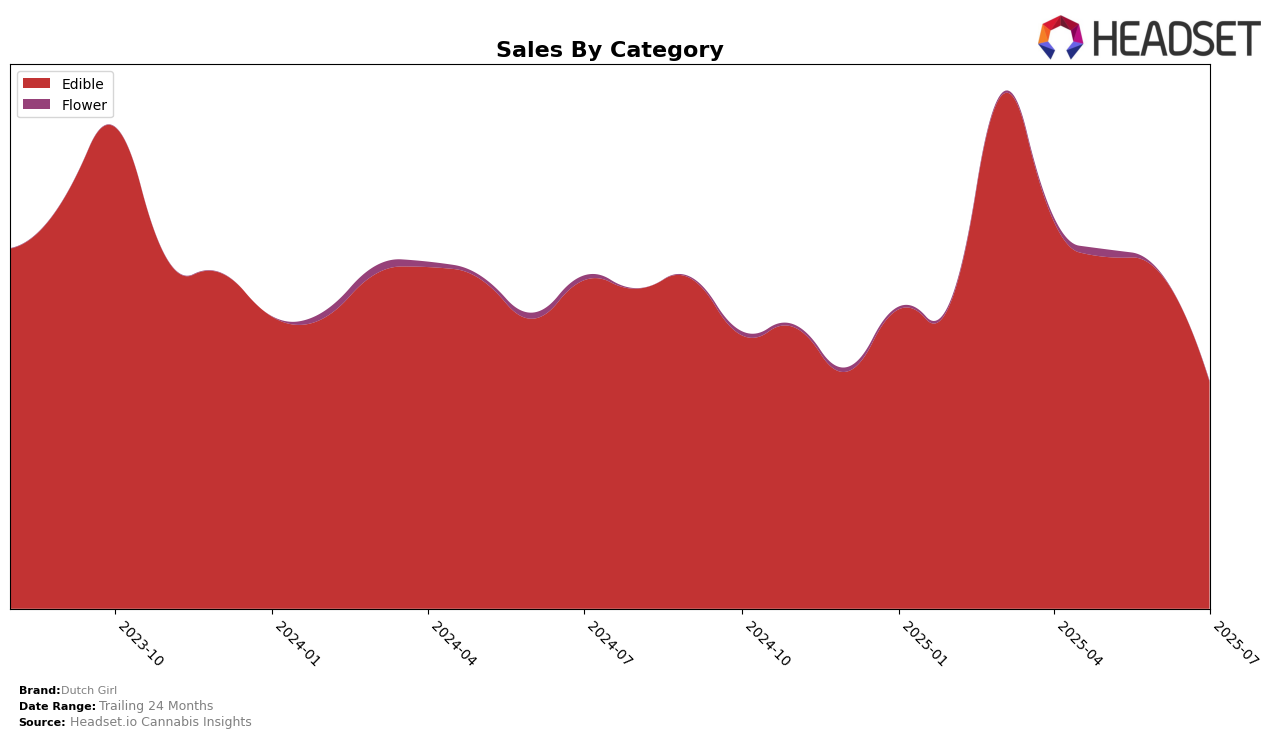

In the state of Colorado, Dutch Girl's performance in the Edible category has shown a notable downward trend over the past few months. Starting from a rank of 27 in April 2025, the brand maintained its position through June, but by July, it had slipped to the 30th position. This indicates a challenging market environment or possibly increased competition within the state. The sales figures reflect this trend, with a steady decline from $45,604 in April to $26,670 in July. The consistent presence in the top 30, however, suggests that Dutch Girl still holds a significant market share, albeit diminishing over the months.

Despite the challenges in Colorado, it's important to note that Dutch Girl's presence in the top 30 brands in the Edible category, even at the 30th rank in July, is an indicator of resilience. Not being ranked higher could be seen as a missed opportunity to capitalize on the growing Edible market. However, the brand's ability to stay within the top 30 suggests potential for recovery and growth if strategic adjustments are made. The lack of data from other states or provinces could imply that Dutch Girl has a more localized focus or faces stiffer competition elsewhere, which could be an area of interest for deeper analysis.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Dutch Girl has faced significant challenges in maintaining its rank and sales performance. Over the months from April to July 2025, Dutch Girl consistently held the 27th rank until July, when it slipped to 30th. This decline in rank coincides with a notable decrease in sales, dropping from $45,604 in April to $26,670 in July. Competitors such as Mountain High Suckers and ROBHOTS have shown upward momentum, with Mountain High Suckers improving its rank from 37th to 28th and ROBHOTS maintaining a steady position at 29th in June and July. Meanwhile, Dixie Elixirs experienced a decline, falling out of the top 20 by July, which could indicate shifting consumer preferences. The competitive dynamics suggest that while Dutch Girl is struggling to maintain its market position, other brands are capitalizing on opportunities to enhance their visibility and sales, highlighting the need for strategic adjustments to regain competitive advantage.

Notable Products

In July 2025, the top-performing product for Dutch Girl was the CBD/CBN/THC/CBG 1:1:1:1 Moonberry Stroopwafel Cookie 10-Pack, maintaining its number one rank despite a decrease in sales to 492 units. The Strawberry Stroopwafel 10-Pack secured the second position, showing a significant climb from its fifth place in June. The Strawberry Stroop Waffle Cookie improved to third place from fourth in June. Indica Caramel Stroopwafels remained steady at fourth place, while the Carmel Waffles Stroopwafel made its debut at fifth place. These shifts indicate a dynamic change in consumer preferences, particularly favoring strawberry-flavored products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.