Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

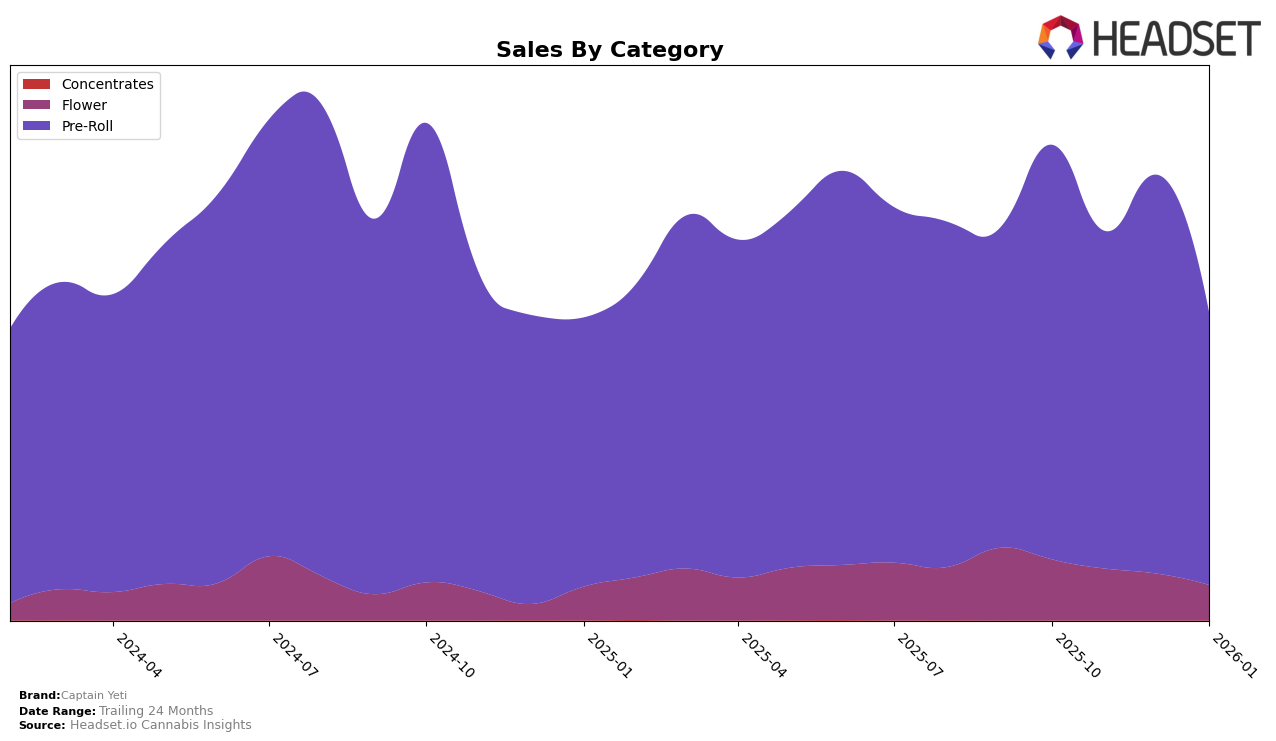

Captain Yeti's performance in the Pre-Roll category within the state of Washington has shown some fluctuations over the four months from October 2025 to January 2026. Initially holding the 13th position in October, the brand experienced a gradual decline, slipping to the 16th spot by January. This downward trend coincides with a noticeable decrease in sales, dropping from approximately $302,446 in October to $197,979 in January. Such a trend suggests that while Captain Yeti has maintained a presence in the top 30, its hold on consumer interest may be waning, potentially due to increased competition or shifts in consumer preferences.

It's noteworthy that Captain Yeti consistently remained in the top 30 brands in the Pre-Roll category in Washington throughout the observed period, which is a positive indicator of its market presence despite the ranking decline. However, the absence of Captain Yeti in the top 30 rankings in other states or categories during this timeframe could be seen as a limitation in its market reach or diversification strategy. This could imply that Captain Yeti's brand strength is currently concentrated in Washington, and there might be opportunities for expansion or improvement in other regions and product categories. Such insights could be valuable for stakeholders looking to understand market dynamics and potential growth areas for Captain Yeti.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Captain Yeti has experienced notable fluctuations in its ranking and sales performance. Starting in October 2025, Captain Yeti held the 13th position but saw a decline to 16th by January 2026. This downward trend in rank is mirrored in its sales, which peaked in October 2025 and then decreased significantly by January 2026. In comparison, From the Soil consistently maintained a higher rank, fluctuating between 12th and 15th, while Forbidden Farms and Agro Couture hovered around the mid to lower teens, with 1988 consistently ranking at 17th. Captain Yeti's sales were initially higher than these competitors but saw a sharper decline, indicating potential challenges in maintaining market share amidst a competitive environment. This suggests that while Captain Yeti started strong, it may need strategic adjustments to regain its footing and improve its market position.

Notable Products

In January 2026, Captain Yeti's top-performing product was Fuck Around and Find Out Infused Pre-Roll (1g), which climbed to the number one rank with sales of $1,087. This product showed a notable improvement from its second-place position in November 2025. The Fuck Around and Find Out Hash Infused Pre-Roll 3-Pack (1.5g) also performed well, securing the second rank, a slight improvement from its third position in November. Fucking Incredible Infused Pre-Roll (1g) slipped to third place, having previously held the top spot in November. Bitch Don't Kill My Vibe Hash Infused Pre-Roll (1g) maintained a steady presence, moving up to fourth place from fifth, while Pure Fucking Magic Hash Infused Pre-Roll (1g) made its debut in the rankings at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.