Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

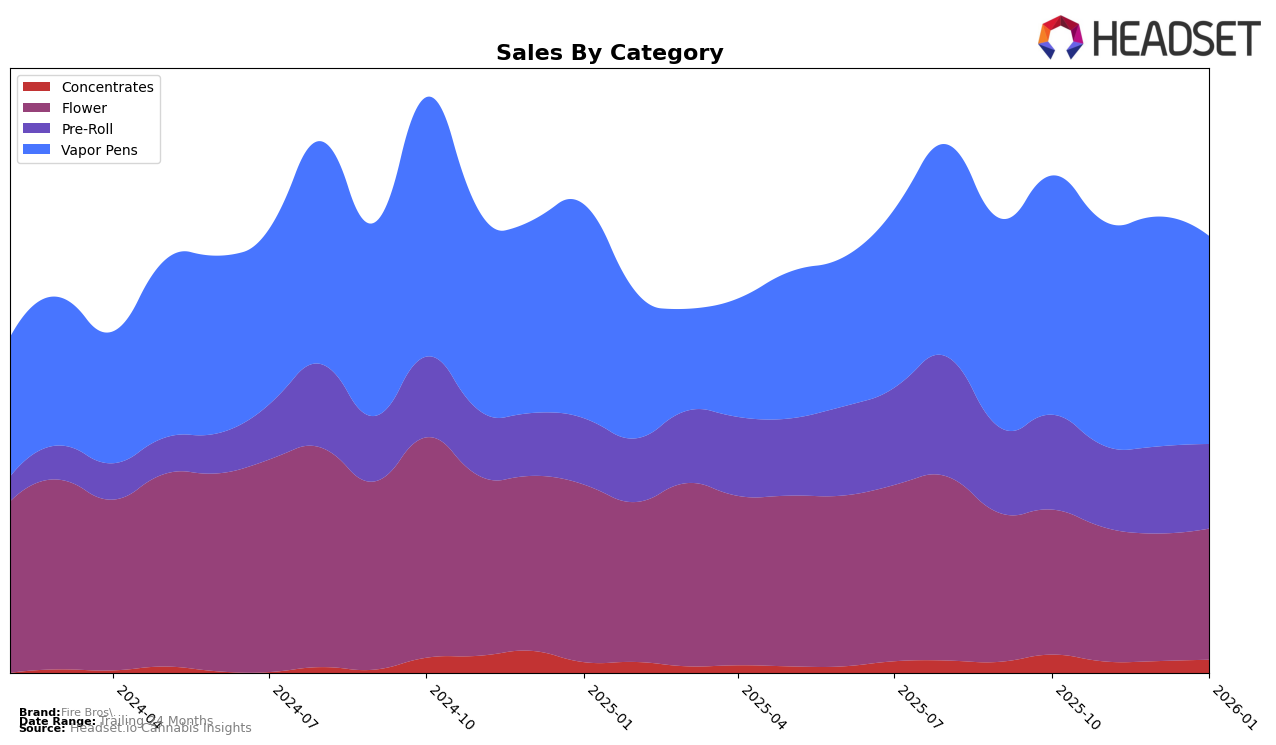

Fire Bros. has shown varied performance across different product categories in Washington. In the Concentrates category, the brand experienced a dip in rankings, dropping to 31st place in December 2025, but rebounded slightly to 25th by January 2026. This fluctuation suggests some volatility in their market position within this category. Conversely, their Flower products have maintained a relatively stable position, hovering around the top 10, although there was a slight decline in sales from October to January. Notably, Fire Bros. did not fall out of the top 30 in any category, which indicates a consistent presence in the market.

The Pre-Roll category for Fire Bros. has been stable with minimal rank changes, consistently staying around the 12th position from October 2025 through January 2026. This steadiness may suggest a loyal customer base or effective product offerings in this segment. In contrast, the Vapor Pens category saw a gradual decline in rank from 11th to 13th over the same period, accompanied by a decrease in sales. This trend could imply growing competition or shifting consumer preferences in the vapor pen market. Overall, Fire Bros. demonstrates resilience across categories, but the varying rankings and sales figures highlight areas where strategic adjustments could be beneficial.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Fire Bros. has experienced a gradual decline in rank, moving from 11th place in October 2025 to 13th by January 2026. This downward trend in rank coincides with a decrease in sales, suggesting a need for strategic adjustments to regain market share. Notably, EZ Vape maintained a consistent rank of 10th through most of the period, only dropping to 12th in January 2026, yet still outperforming Fire Bros. in sales. Meanwhile, Hustler's Ambition demonstrated a positive trajectory, climbing from 14th to 11th, with sales surpassing Fire Bros. by January 2026. Lifted Cannabis Co and Plume (WA) remained lower in rank, but Plume (WA) showed a notable improvement from 20th to 15th, indicating potential emerging competition. These dynamics highlight the competitive pressures Fire Bros. faces and underscore the importance of strategic innovation to enhance their market position.

Notable Products

In January 2026, the top-performing product for Fire Bros. was the Variety Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, maintaining its top rank from December 2025 with sales of 3265 units. The Crepe Ape Pre-Roll 2-Pack (1g) showed a strong performance, climbing to the second position from fourth in December 2025. The Mexican Flan Pre-Roll 2-Pack (1g) made its debut in the rankings at the third position. Cough Trop Pre-Roll 2-Pack (1g) fell to fourth place, having previously held the second position back in October 2025. Lastly, the Crepe Ape Live Resin Disposable (1g) entered the rankings at fifth place, marking its first appearance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.