Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

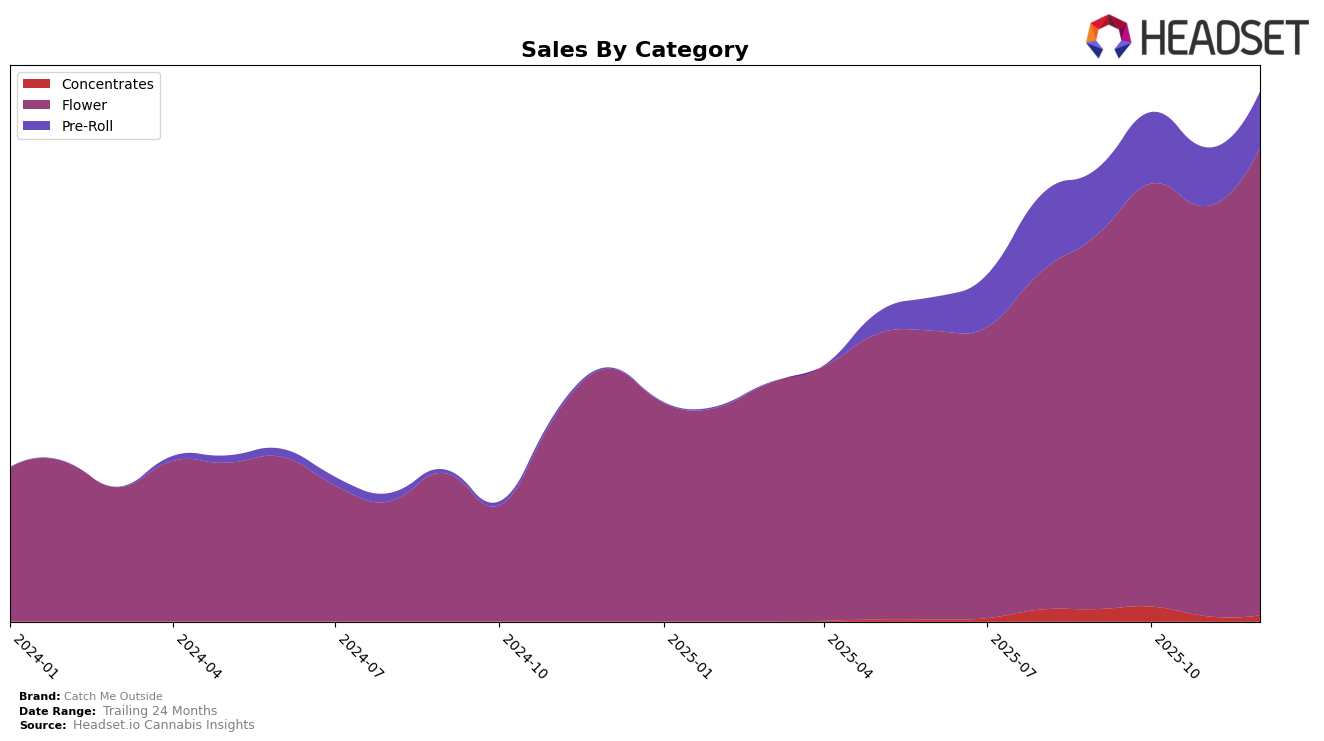

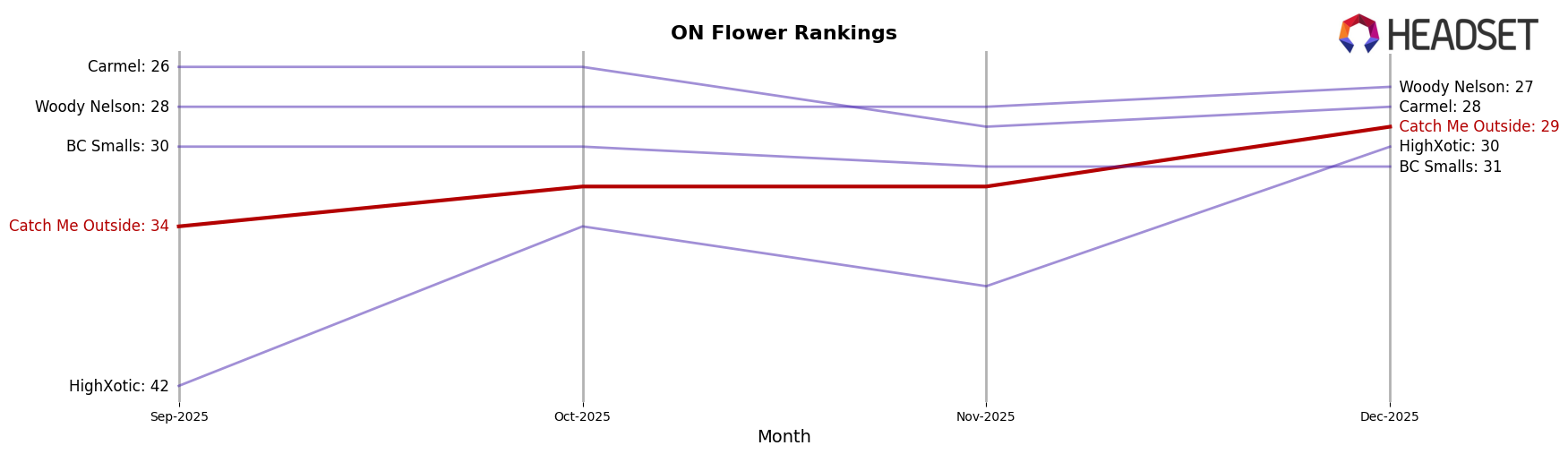

Catch Me Outside has shown varied performance across different categories and provinces. In the concentrates category in Alberta, the brand has not reached the top 30 rankings from September to December 2025, indicating a challenging market presence in this segment. However, in the flower category, Catch Me Outside has demonstrated a more consistent performance. Notably, in Ontario, the brand improved its position from 34th in September to 29th by December 2025, suggesting a positive trajectory in this competitive market. Meanwhile, in Saskatchewan, the brand maintained a steady rank in the flower category, fluctuating slightly but remaining within the top 40. This indicates stable consumer interest and market presence in the province.

In the pre-roll category in Alberta, Catch Me Outside struggled to break into the top 60, with rankings hovering in the mid-60s to low 70s throughout the last quarter of 2025. This could point to either a highly competitive market or a need for strategic adjustments to improve their standing. The Alberta flower market showed some resilience for the brand, with a slight dip in November but a recovery by December, ending the year with an improved rank compared to September. This suggests that while the brand faces challenges in certain categories, it continues to hold potential in others, particularly in flower sales across multiple provinces.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Catch Me Outside has shown a notable upward trajectory in rankings from September to December 2025. Initially ranked 34th in September, the brand climbed to 29th by December, indicating a positive trend in market presence. This improvement is particularly significant when compared to competitors like HighXotic, which also improved its rank but started from a lower position at 42nd in September and reached 30th by December. Meanwhile, Carmel and Woody Nelson maintained relatively stable positions, with Carmel not breaking into the top 20 throughout the period. Despite BC Smalls maintaining a consistent rank around 30th, Catch Me Outside's sales growth trajectory suggests a stronger momentum, potentially positioning it to surpass some of these competitors if the trend continues. This dynamic shift highlights Catch Me Outside's growing influence in the Ontario Flower market, making it a brand to watch in upcoming months.

Notable Products

In December 2025, the top-performing product for Catch Me Outside was Couch Potato (3.5g) in the Flower category, maintaining its first-place ranking from the previous months with a notable sales figure of 10,992. Rooster Call (3.5g) also continued to hold its consistent second-place position in the Flower category. Couch Potato Pre-Roll 4-Pack (4g) retained the third spot in the Pre-Roll category, showing steady performance over the months. Farmer's Market (28g) remained fourth in the Flower category, with a slight increase in sales compared to previous months. A new entry, Couch Potato (14g), debuted in fifth place, indicating potential growth in the Flower category for Catch Me Outside.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.