Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

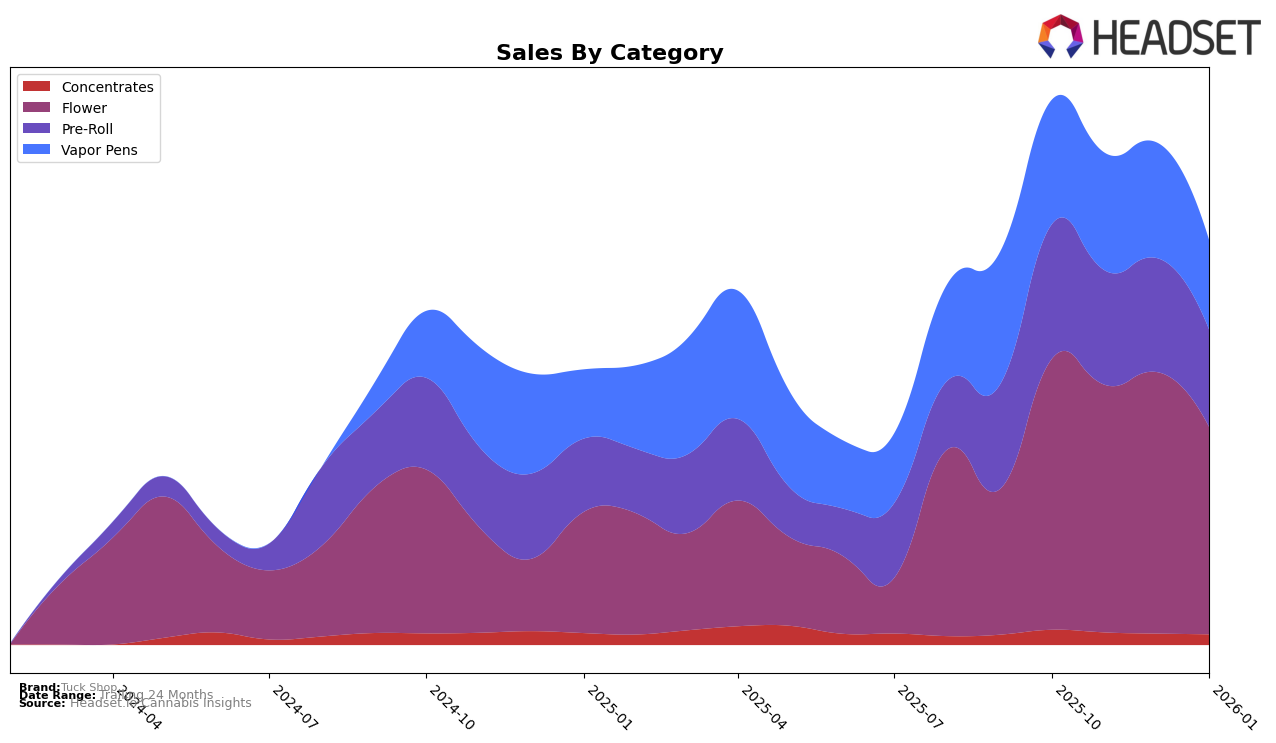

In Alberta, Tuck Shop's performance across various categories has shown both resilience and challenges. Within the Flower category, Tuck Shop maintained a presence in the top 30, albeit with fluctuations, moving from rank 22 in October 2025 to 28 by January 2026. This indicates a slight decline in their positioning over the months. Their Pre-Roll category, however, did not make it into the top 30 rankings, which could be seen as a significant area for potential improvement. Meanwhile, in the Vapor Pens category, Tuck Shop's rank hovered around the lower 30s, suggesting a stable yet modest presence in this segment. These movements highlight the brand's varying degrees of success and challenges in maintaining a competitive edge across different product categories in Alberta.

Looking at British Columbia and Ontario, Tuck Shop's performance presents a mixed picture. In British Columbia, the brand's Flower category did not appear in the top 30 until November 2025, where it peaked at rank 73 in December before slipping to 81 by January 2026. Notably, their Vapor Pens category only made it into the rankings by January 2026, securing the 51st position, which marks a new entry in this segment. Meanwhile, in Ontario, Tuck Shop consistently held positions in the top 40 for Concentrates and Flower categories, although there was a slight downward trend in rankings over the months. The Pre-Roll category, similar to Alberta, did not make it into the top 30, indicating a potential area for growth. These insights reflect Tuck Shop's strategic strengths and areas of opportunity within these provinces, highlighting the dynamic nature of their market presence.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Tuck Shop has experienced fluctuations in its ranking, moving from 31st in October 2025 to 34th by January 2026. Despite this slight decline, Tuck Shop remains a strong contender in the market, consistently outperforming brands like Catch Me Outside and HighXotic, which have not broken into the top 30 consistently. Notably, HighXotic saw a significant improvement in December 2025, reaching the 30th position, but could not maintain this momentum. Meanwhile, PIFF has shown a more stable performance, hovering around the mid-30s rank, while Dime Bag (Canada) has been climbing steadily, moving from 49th in October to 38th by January. These dynamics suggest that while Tuck Shop faces pressure from emerging competitors, it continues to hold a competitive edge in sales, indicating a robust brand presence in the Ontario market.

Notable Products

In January 2026, Tuck Shop's top-performing product was Hawaiian Marker Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with sales of 8,537 units. Valley Girl Pre-Roll (1g) held steady at the second position since November 2025, showing consistent popularity. Hawaiian Marker Pure Cured Resin Disposable (1g) in the Vapor Pens category remained in the third spot, indicating stable demand. Hawaiian Marker (7g) in the Flower category improved its rank from fifth to fourth since December 2025. Notably, Ghost OG Pre-Roll (1g) entered the rankings at fifth place in January 2026, marking its debut in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.