Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

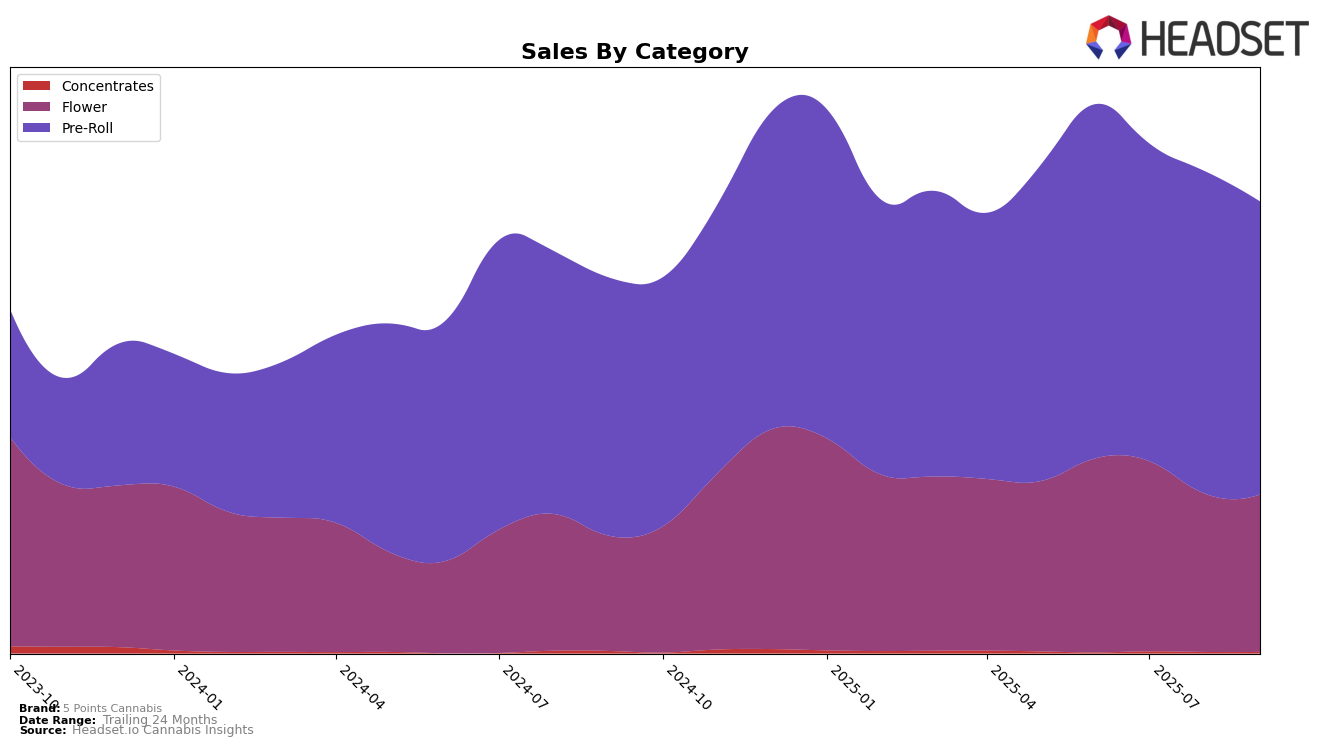

5 Points Cannabis has experienced varying performance across different provinces and product categories. In British Columbia, the brand's ranking in the Flower category has remained relatively stable, hovering around the 47th position over the past few months, with a slight dip in August before returning to its original rank by September. This consistency indicates a steady presence in the market, although the sales figures have shown a downward trend from June to September, suggesting a need for strategic adjustments. Meanwhile, in Ontario, 5 Points Cannabis has shown a more dynamic performance. While their Flower category ranking fluctuated slightly, they maintained a presence just outside the top 50, which highlights opportunities for growth in this competitive market.

In the Pre-Roll category, 5 Points Cannabis has made notable strides in Ontario. Despite a minor dip in July, the brand managed to climb back up, reflecting resilience and adaptability in a rapidly changing market. The sales figures in this category have remained robust, indicating a strong consumer preference for their products. However, the brand's performance in Saskatchewan tells a different story. After appearing in the rankings in June and July, the brand fell out of the top 30 for subsequent months, pointing to challenges in maintaining market share in this region. This absence from the rankings could be a signal for the brand to reassess its strategy in the province to regain its footing.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, 5 Points Cannabis has experienced fluctuating rankings over the past few months, indicating a dynamic and competitive environment. From June to September 2025, 5 Points Cannabis saw its rank shift from 27th to 29th, with a notable dip to 33rd in July. This suggests that while the brand maintains a strong presence, it faces stiff competition from brands like Rizzlers, which consistently held higher ranks, peaking at 26th in June. Additionally, CountrySide Cannabis and 3Saints have shown upward trends, with CountrySide Cannabis improving from 35th to 28th and 3Saints climbing from 51st to 30th by September. These movements highlight the competitive pressure on 5 Points Cannabis to innovate and capture more market share to improve its ranking and sales performance in the Ontario pre-roll category.

Notable Products

In September 2025, Blueberry Yum Yum Pre-Roll 10-Pack (3g) maintained its position as the top-performing product for 5 Points Cannabis, continuing its streak at rank 1 with sales of 7409 units. Strawberry Kush Pre-Roll 10-Pack (3g) climbed to the second position, improving from its consistent third place in previous months, with notable sales of 5950 units. Zsweet Pre-Roll 10-Pack (3g) dropped to third place, marking a decline from its previous second-place standing. Strawberry Kush (3.5g) remained steady in fourth place, maintaining its rank from earlier months. The newly introduced Blueberry Yum Yum (3.5g) entered the rankings at fifth place, adding diversity to the top products lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.