Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

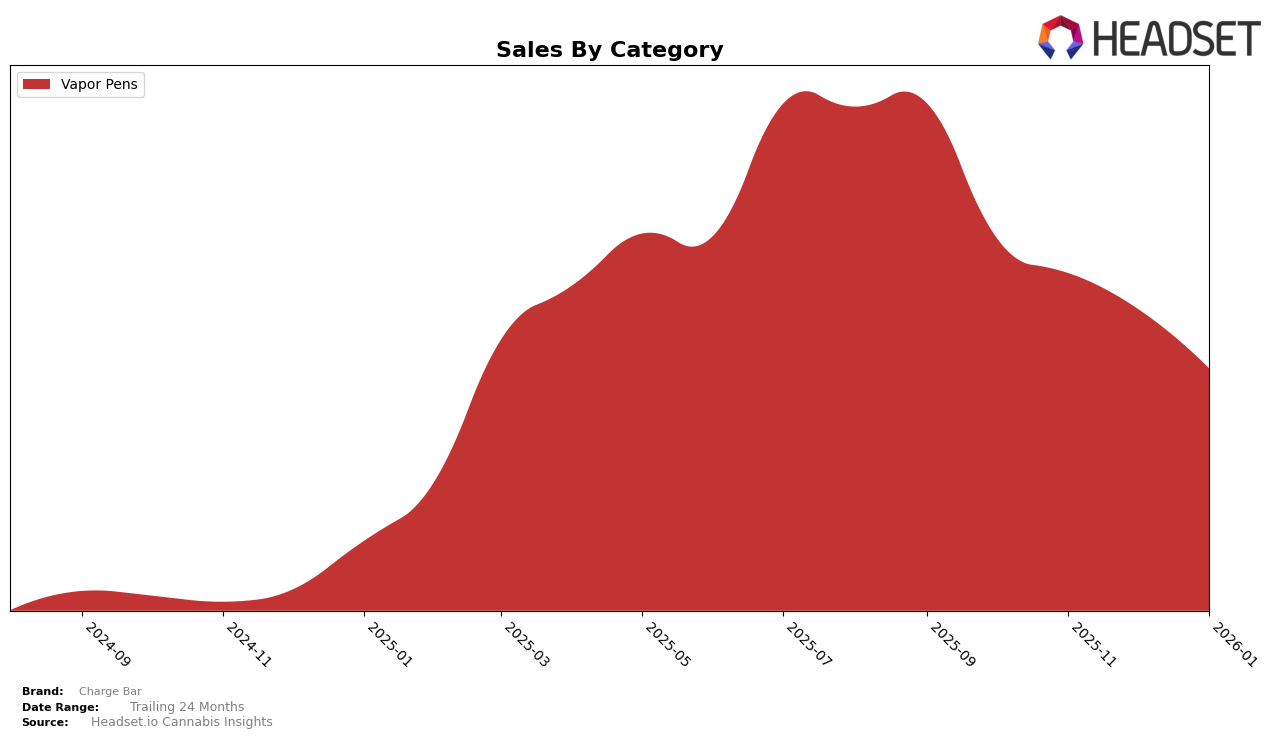

Charge Bar's performance in the Vapor Pens category in Massachusetts has shown a steady decline over the last few months. Starting at rank 14 in October 2025, the brand slipped to rank 18 by January 2026. This downward trend is reflected in their sales figures, which decreased from $562,247 in October to $365,843 in January. The consistent drop in both rankings and sales suggests that Charge Bar might be facing increased competition or changes in consumer preferences within the Massachusetts market. This movement out of the top 15 could be concerning for the brand, indicating a need to reassess their strategy in this state.

Despite the challenges in Massachusetts, Charge Bar's performance in other states or categories is not detailed here, which leaves room for speculation on whether this trend is isolated or part of a broader pattern. The absence of Charge Bar from the top 30 rankings in other states or categories during this period could imply either a lack of presence or competitive challenges in those markets. This gap in the rankings highlights an area for potential growth or strategic focus for Charge Bar if they aim to expand their influence beyond Massachusetts. Understanding these dynamics could provide valuable insights for stakeholders looking to optimize Charge Bar's market position.

```Competitive Landscape

In the Massachusetts vapor pens category, Charge Bar has experienced a notable decline in rank from October 2025 to January 2026, moving from 14th to 18th place. This downward trend is reflected in its sales, which have decreased over the same period. In contrast, Ozone has shown consistent performance, maintaining a stable rank around 16th and 17th place, with sales figures that are generally higher than Charge Bar's. Meanwhile, Good News and In House have fluctuated within the top 20 but have not surpassed Charge Bar's earlier high rank. Cali-Blaze, although not consistently in the top 20, has shown an upward trend, reaching 19th place by January 2026. These dynamics suggest that while Charge Bar faces stiff competition, particularly from Ozone, there is potential for recovery if strategic adjustments are made to regain market share.

Notable Products

In January 2026, Charge Bar's top-performing product was the Watermelon Splash x Georgia Pie Distillate Dual Chamber Disposable (2g) in the Vapor Pens category, which climbed to the number one spot with sales reaching 897 units. The Hawaiian Haze Distillate Cartridge (1g) secured the second position, marking its first appearance in the rankings. Rainbow Sherbet x Tangie Sunrise Distillate Dual Chamber Disposable (2g) followed closely in third place. Notably, the Vanilla Chai x Berry Blast Distillate Dual Chamber Disposable (2g) experienced a decline, dropping from second in December 2025 to fourth in January 2026. Meanwhile, the Strawberry Shortcake x Tropic Thunder Distillate Dual Disposable (2g) maintained a steady presence, rounding out the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.