Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

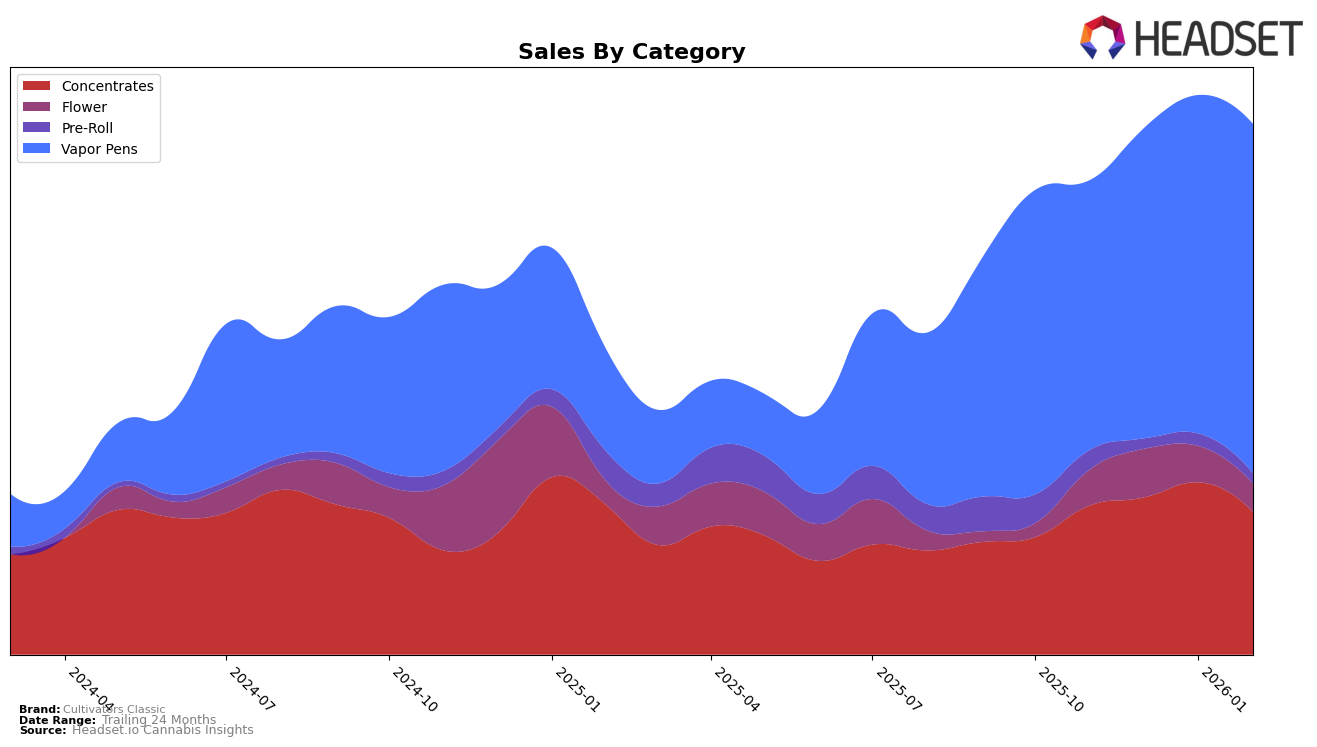

The cannabis brand Cultivators Classic has demonstrated a consistent performance in the Massachusetts market, particularly in the Concentrates category where it has maintained a steady 4th place ranking from November 2025 through February 2026. This stability indicates a strong foothold in the concentrates segment, though there was a slight dip in sales from January to February 2026. Such consistency in rankings suggests that Cultivators Classic has successfully captured a loyal customer base in this category, even as it navigates minor fluctuations in monthly sales figures.

In contrast, the brand has shown a notable upward trajectory in the Vapor Pens category within Massachusetts. Starting from a 16th place ranking in November 2025, Cultivators Classic improved to 10th place by February 2026. This upward movement is indicative of a growing presence and acceptance among consumers, potentially due to product innovation or effective market strategies. The increase in sales over these months aligns with the improved rankings, highlighting a positive trend for the brand in this competitive category. However, it's worth noting that outside of these two categories in Massachusetts, Cultivators Classic did not rank in the top 30, suggesting potential areas for growth or a more targeted focus in their market strategy.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Cultivators Classic has shown a promising upward trajectory in rankings from November 2025 to February 2026. Starting at rank 16 in November 2025, Cultivators Classic climbed to the 10th position by February 2026, indicating a significant improvement in market presence. This upward movement is noteworthy, especially when compared to competitors like Hellavated, which fluctuated between ranks 14 and 12, and Strane, which saw a dip in January before recovering slightly in February. Meanwhile, Jeeter maintained a steady position around the 7th and 8th ranks, and Freshly Baked consistently held the 9th position. Cultivators Classic's consistent sales growth, reflected in their improved ranking, suggests a strengthening brand presence and increasing consumer preference, positioning them as a rising competitor in the Massachusetts vapor pen market.

Notable Products

In February 2026, Baja Burst Distillate Cartridge (1g) from Cultivators Classic emerged as the top-performing product, reclaiming its number one position with a notable sales figure of 5311 units. Orange Sherbert Distillate Cartridge (1g) climbed to the second spot, showing a significant improvement from its fifth position in January 2026. Peach Rush Distillate Cartridge (1g) maintained a steady performance, securing the third rank after debuting in the rankings in January. Grape Pop Distillate Cartridge (1g) re-entered the top five, capturing the fourth position after being absent in January. Watermelon Wave Distillate Cartridge (1g) experienced a drop, moving from second place in January to fifth in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.