Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

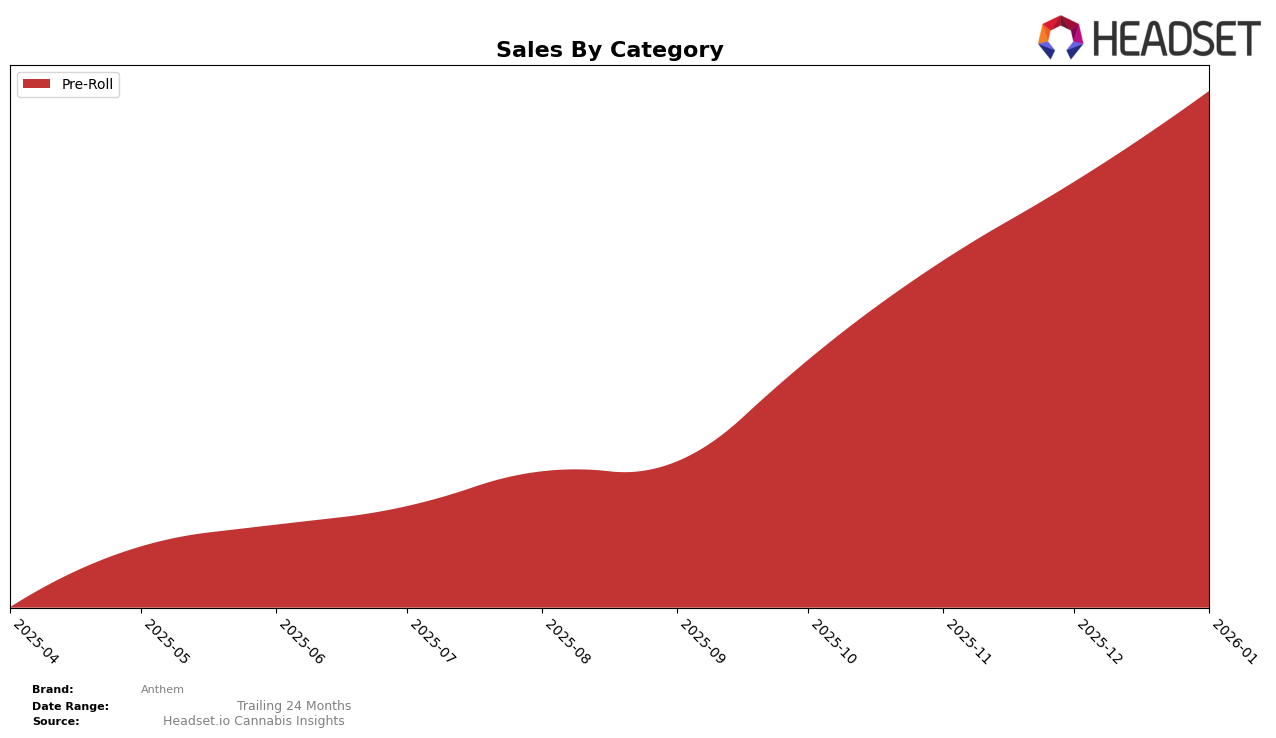

Anthem's performance in the Pre-Roll category has been noteworthy across several states, with marked improvements in ranking positions over the past few months. In Arizona, Anthem demonstrated a significant upward trajectory, moving from a rank of 34 in October 2025 to breaking into the top 10 by January 2026, securing the 8th position. This highlights a strong growth in sales and market presence in the state. Similarly, in Illinois, Anthem maintained a strong hold in the top 10, consistently improving to reach the 3rd position by December 2025 and maintaining it into January 2026. In contrast, Anthem's presence in Massachusetts was less prominent, as it did not break into the top 30 rankings, indicating potential challenges or opportunities for growth in this market.

In New Jersey, Anthem showed a steady presence within the top 30, maintaining a position around the 21st rank towards the end of the period, suggesting a stable but competitive landscape. Meanwhile, in New York, Anthem's performance was strong, climbing from the 12th position in October 2025 to reach the 6th position by January 2026, reflecting a robust increase in sales and brand recognition. This upward trend in New York is particularly notable given the competitive nature of the market. Overall, Anthem's performance across these states underscores its varying levels of market penetration and suggests areas where the brand could focus on strengthening its presence or leveraging its momentum.

Competitive Landscape

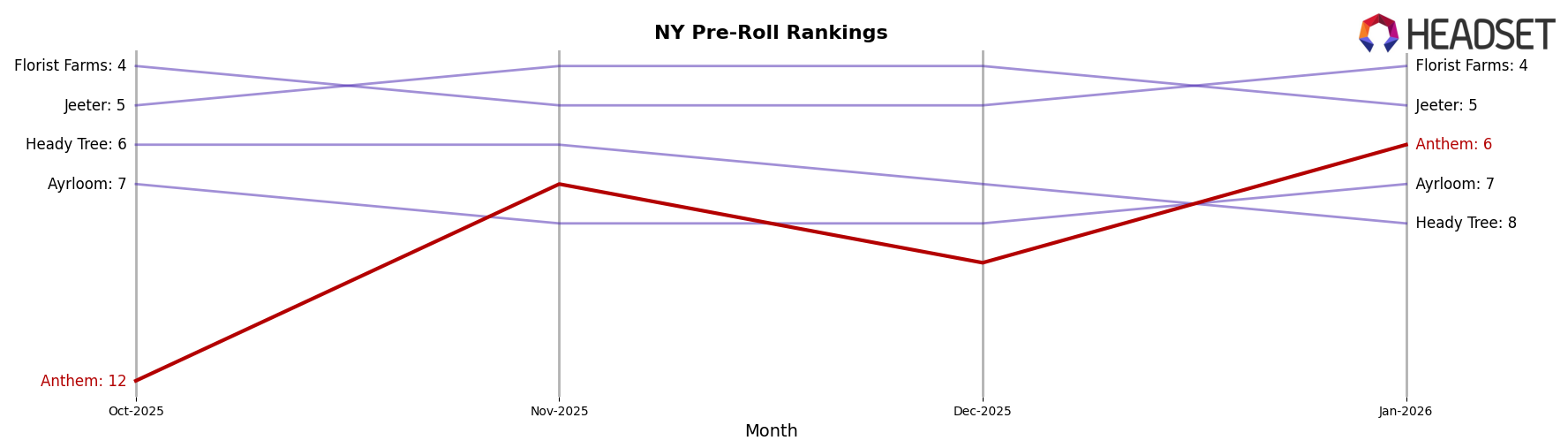

In the competitive landscape of the New York pre-roll category, Anthem has demonstrated a notable upward trajectory in recent months. Starting from a rank of 12 in October 2025, Anthem climbed to 7th place by November, briefly dipped to 9th in December, and then surged to 6th in January 2026. This upward movement is indicative of a significant increase in sales, especially in January, where Anthem's sales figures approached those of top competitors. Despite this progress, Anthem still trails behind brands like Jeeter and Florist Farms, which consistently held ranks within the top 5. However, Anthem's ability to surpass Ayrloom and Heady Tree in January highlights its potential to further climb the ranks if the current sales momentum is maintained. This competitive analysis underscores Anthem's growing presence in the market, suggesting a promising future if it continues to capitalize on its recent gains.

Notable Products

In January 2026, Anthem's Hybrid Blend Pre-Roll 10-Pack (3.5g) emerged as the top-performing product, maintaining its leading position from December 2025 with sales reaching 12,458 units. The Sativa Blend Pre-Roll 10-Pack (3.5g) followed closely, ranking second after briefly holding the top spot in November 2025. The Indica Blend Pre-Roll 10-Pack (3.5g) consistently held the third position over the past four months, indicating steady performance. Notably, the Blue Raspberry Kush Infused Pre-Roll (1g) debuted at fourth place, while the Pineapple Haze Infused Pre-Roll 5-Pack (2.5g) climbed to fifth, showing significant growth from its absence in December rankings. The data highlights Anthem's strength in the Pre-Roll category, with consistent top rankings and notable new entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.