Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

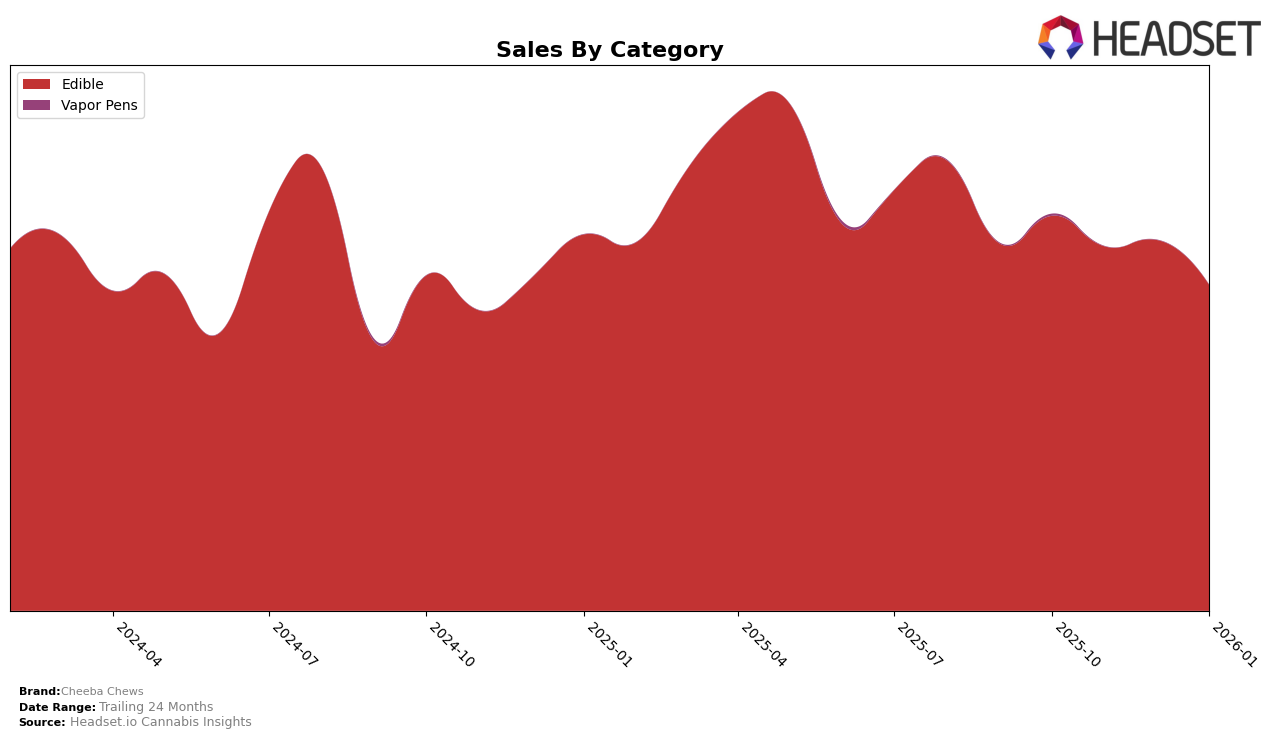

Cheeba Chews has demonstrated varied performance across several states in the Edible category. In Colorado, the brand has consistently maintained a presence within the top 15 rankings from October 2025 to January 2026, although there is a noticeable downward trend in sales, decreasing from $140,777 to $96,743 over the same period. This decline suggests a potential challenge in maintaining market share in a competitive environment. Conversely, in Missouri, Cheeba Chews has seen a stable ranking at 32, but the sales figures have shown fluctuations, peaking in December 2025. This indicates a potential seasonal influence or a successful promotional strategy during that month.

In New Jersey, Cheeba Chews experienced a drop in rankings, falling out of the top 30 in December 2025 before climbing back to 31 in January 2026. The sales trajectory in this state also reflects a significant decline, highlighting a challenging market environment. Meanwhile, in Nevada, the brand saw a brief improvement in December 2025, moving to 22nd place, before slipping back to 30th. This volatility suggests a highly competitive landscape. In New York, Cheeba Chews has not broken into the top 30 rankings, indicating a need for strategic adjustments to enhance their market presence in this state.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Cheeba Chews has maintained a consistent rank of 32 from November 2025 through January 2026, showing a slight improvement from its October 2025 rank of 33. Despite this stability, Cheeba Chews faces stiff competition from brands like Flav and ROBHOTS, which have consistently ranked higher, although both have seen a decline in their rankings over the same period. Notably, Flav dropped from 26 to 31, and ROBHOTS fell from 24 to 29, indicating potential vulnerabilities that Cheeba Chews could capitalize on. Meanwhile, Elevate entered the top 35 in November 2025 and has maintained a position just below Cheeba Chews, suggesting emerging competition. Cheeba Chews' sales peaked in December 2025, reflecting a positive trend that could be leveraged to improve its market position further.

Notable Products

In January 2026, the top-performing product from Cheeba Chews was the CBN/THC 1:2 Sleepy Time Chocolate Taffy Chew 20-Pack, maintaining its lead from previous months with a sales figure of 2396. The CBD/CBC/THC 6:10:5 Joint Relief Salted Caramel Taffy 20-Pack climbed to the second position, showing a significant improvement from its fifth position in December 2025. The Indica OG Chocolate Taffy 10-Pack remained stable in third place across the analyzed months. The Hybrid Caramel Sea Salt Caramel Taffy 10-Pack fell to fourth place after topping the ranks in December 2025. Notably, the THC/THCV 2:1 Charged Energy Mocha Chocolate Taffy 20-Pack debuted at fifth place, marking its entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.