Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

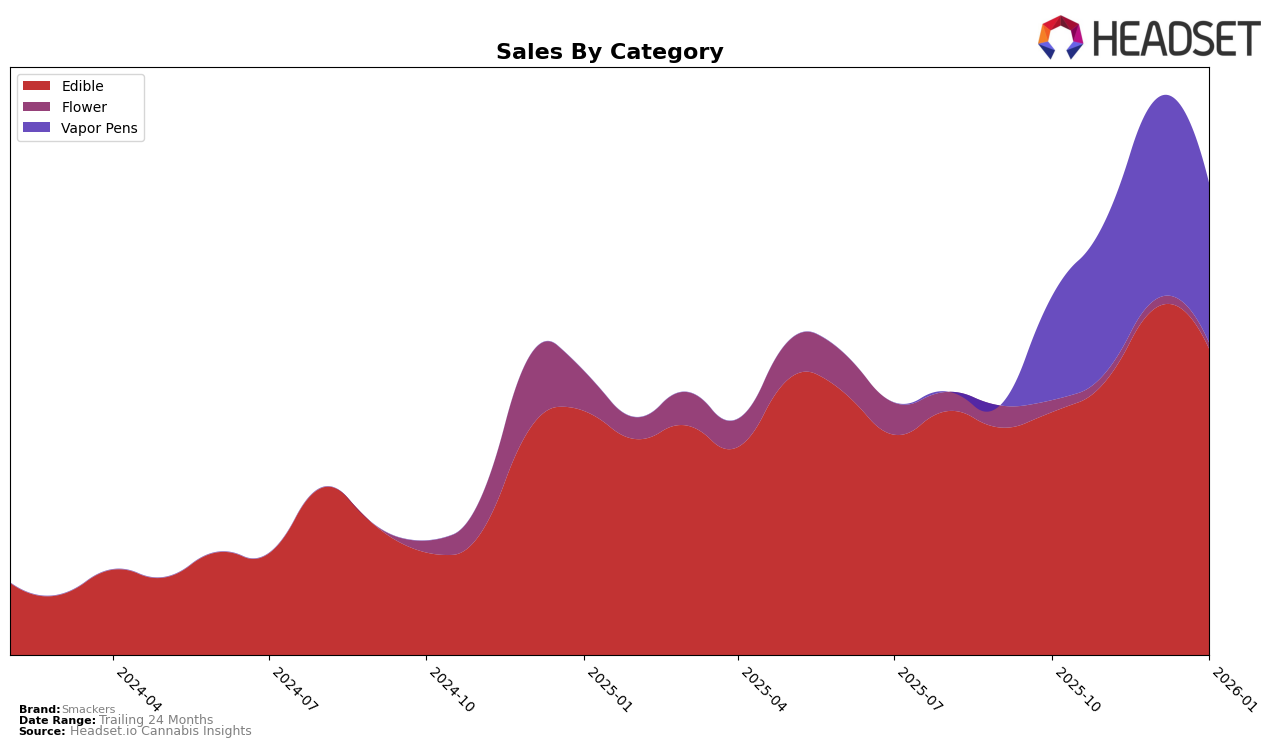

In the Missouri market, Smackers has shown a promising upward trajectory in the Edible category, moving from the 22nd position in October 2025 to the 16th position by January 2026. This steady climb indicates a growing consumer preference for their products in this segment, with sales peaking in December 2025. On the other hand, their performance in the Vapor Pens category has been less stellar, as they did not break into the top 30 rankings during this period. This suggests that while they have been improving, there is still significant room for growth in the Vapor Pens category in Missouri.

Overall, the data highlights a strategic opportunity for Smackers to strengthen their presence in the Vapor Pens category, potentially by leveraging their success in Edibles. The absence of a top 30 ranking in Vapor Pens could be seen as a gap in their market penetration, contrasting with their positive momentum in Edibles. With the right adjustments and focus on expanding their reach in the Vapor Pens market, Smackers could potentially replicate their success across different categories in Missouri.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Smackers has shown a promising upward trend in its rankings, moving from not being in the top 20 in October 2025 to securing the 16th position by January 2026. This positive trajectory indicates a growing consumer preference and effective market strategies. In comparison, Dixie Elixirs experienced fluctuations, dropping from 15th to 18th place, while Curio Wellness improved its rank from 20th to 17th. Meanwhile, Dialed In Gummies and Smokey River Cannabis maintained relatively stable positions, with Smokey River consistently holding the 14th spot. Smackers' sales growth, particularly in December 2025, suggests a successful holiday season, outperforming some competitors in sales momentum, although still trailing behind the top brands. This upward movement in rank and sales for Smackers highlights its potential to further capitalize on market opportunities and consumer trends in Missouri's edible category.

Notable Products

In January 2026, the top-performing product from Smackers was the Strawberry Lemonade Rosin Gummies 10-Pack (250mg), ranking first with notable sales of 1016 units. The Indica Cherry Gummies 10-Pack (250mg) climbed to the second spot, improving from its fourth position in December 2025 with sales of 992 units. The CBD/CBN/THC 1:1:1 Blackberry Nighttime Gummies 10-Pack (100mg CBD,100mg CBN,100mg THC) secured the third position, marking its entry into the rankings. The Strawberry Lemonade Rosin Gummies 10-Pack (100mg) fell to fourth place from its previous first position in December 2025. Lastly, the Hybrid Sour Apple Gummies 10-Pack (100mg) rounded out the top five, dropping from third to fifth place since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.