Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

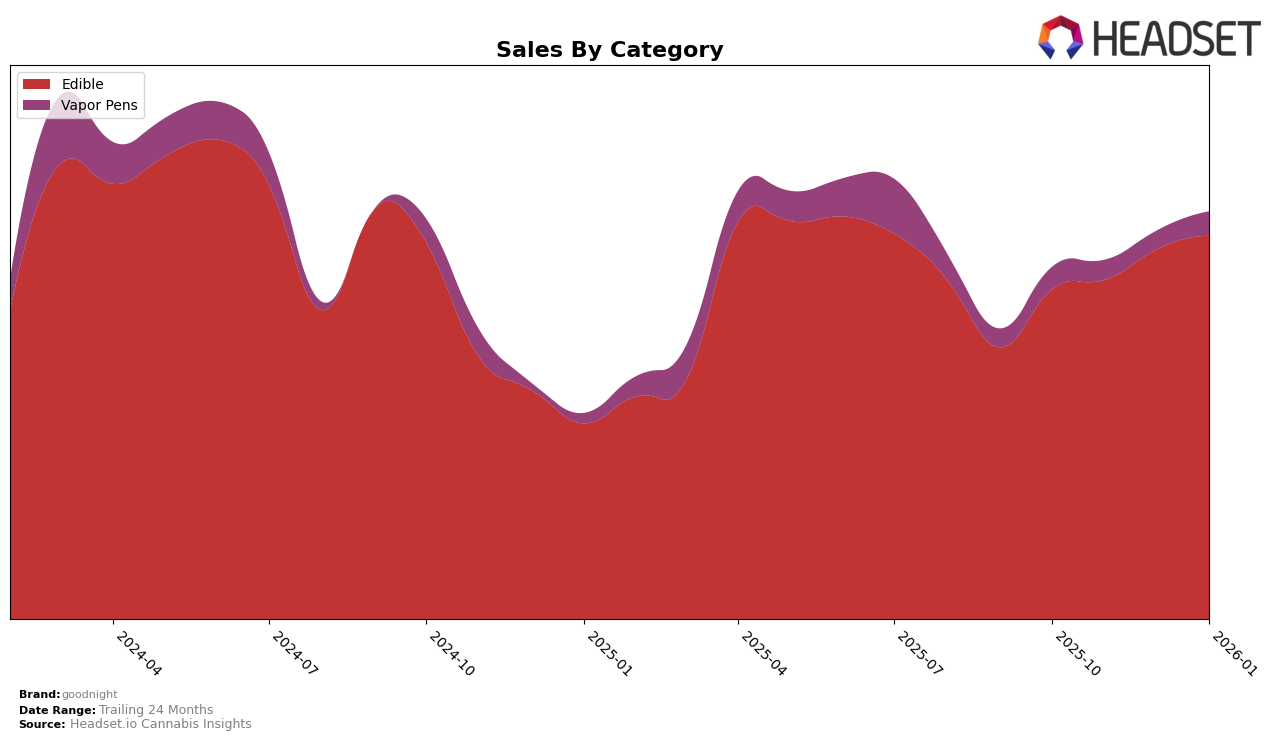

In the state of Missouri, goodnight has shown a steady improvement in the Edible category. Starting from a rank of 30 in October 2025, the brand climbed to 24 by January 2026. This upward movement indicates a growing consumer preference or effective brand strategies in this category. The sales figures also reflect this positive trend, with a noticeable increase from approximately $137,000 in October to nearly $158,000 by January. However, the brand's performance in the Vapor Pens category has not mirrored this success, as it remained outside the top 30 rankings, suggesting potential challenges or competitive pressures in this segment.

While goodnight has made commendable strides in the Edible category in Missouri, its position in the Vapor Pens category highlights an area for potential growth. Despite being ranked 80th in October 2025, the brand has improved slightly to 75th by January 2026. This modest progress could indicate initial efforts to capture a larger market share, though it remains a considerable distance from breaking into the top 30. The brand's performance across these categories in Missouri provides a nuanced view of its strengths and areas for development, offering a glimpse into market dynamics and consumer preferences.

Competitive Landscape

In the competitive landscape of the Edible category in Missouri, goodnight has shown a promising upward trajectory in its rankings, moving from 30th place in October 2025 to 24th by January 2026. This positive trend is reflected in its sales growth, which increased steadily over the same period. In contrast, Greenlight experienced fluctuations, with its rank improving slightly from 25th to 23rd, but its sales showing a decline in January 2026 compared to October 2025. Meanwhile, Yum-eez saw a significant spike in sales in December 2025, which temporarily boosted its rank to 22nd, although it fell back to 26th by January 2026. Hermit's Delight consistently improved its rank, ending at 22nd in January 2026, with a notable increase in sales. Plume Cannabis (MO) experienced volatility, dropping to 29th in November 2025 before recovering to 25th in January 2026. Overall, goodnight's consistent improvement in both rank and sales highlights its growing presence in the Missouri Edible market, setting it apart from competitors who faced more erratic performance trends.

Notable Products

In January 2026, the top-performing product for goodnight was the CBD/CBN/THC 1:1:1 Dreamberry Gummies 40-Pack (100mg CBD, 100mg THC, 100mg CBN), maintaining its first-place rank consistently from October to January, with sales increasing to 3,245 units. The CBD/THC/CBN 1:1:1 Dreamberry Gummies 40-Pack (300mg CBD, 300mg THC, 300mg CBN, 0.3oz) held steady at the second position, though sales dipped slightly to 1,055 units. The Good Night - CBD/THC/CBN 1:1:1 Sleep Full Spectrum Disposable (0.5g) remained in third place, experiencing a modest sales increase to 687 units. The CBD/CBN/THC 1:1:1 Dreamberry Gummies 20-Pack and 10-Pack also retained their fourth and fifth ranks, respectively, with the 10-Pack showing a notable uptick in sales. Overall, the rankings for goodnight products remained stable with slight fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.