Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

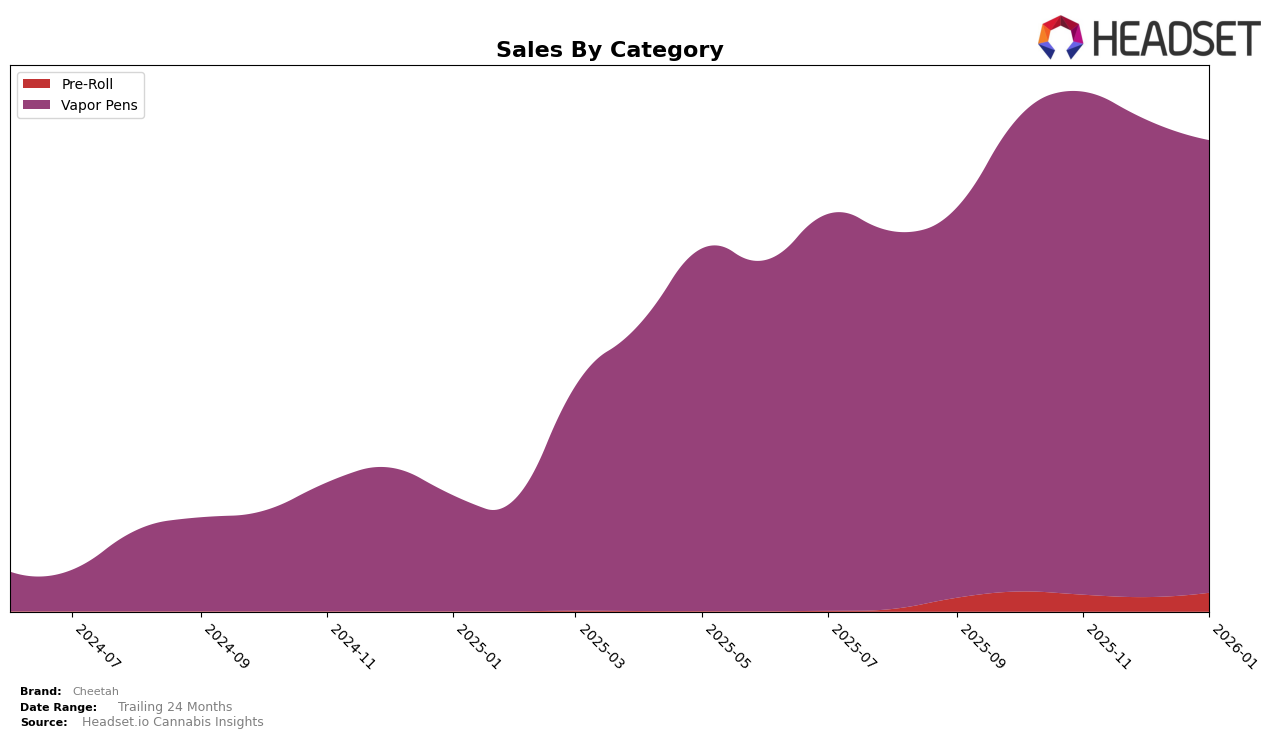

The performance of Cheetah in the vapor pens category shows varied trends across different states. In Illinois, Cheetah's ranking has been on a downward trajectory, moving from 44th in October 2025 to 53rd by January 2026, indicating a decline in its market presence. This contrasts sharply with its performance in Massachusetts, where Cheetah improved its position from 49th to 40th over the same period, demonstrating a positive trend. In Maryland, the brand maintained a strong presence, although it slipped to 30th in January 2026 after consistently being in the top 22 for the previous months. Meanwhile, in New Jersey, Cheetah maintained a robust ranking in the vapor pens category, consistently staying within the top 15 brands, which signifies a strong foothold in this market.

In the pre-roll category, Cheetah's performance in New Jersey has been less consistent. The brand's ranking fluctuated, reaching as low as 72nd in December 2025 before improving slightly to 64th in January 2026. This indicates challenges in maintaining a stable market position in this category. The overall sales figures for vapor pens in New Jersey were notably high, reflecting a strong consumer preference for this category over pre-rolls, where sales were considerably lower. These movements suggest that while Cheetah has a solid presence in the vapor pens market, particularly in New Jersey, it faces significant competition and challenges in the pre-roll segment, underscoring the need for strategic adjustments to strengthen its market position across different categories and states.

Competitive Landscape

In the competitive landscape of Vapor Pens in New Jersey, Cheetah has shown a promising upward trajectory in recent months. Despite starting at a rank of 15 in October 2025, Cheetah improved its position to 12 by January 2026, indicating a positive shift in market presence. This improvement is notable when compared to competitors like Bloom, which experienced a decline from rank 9 to 14 over the same period. Similarly, AiroPro maintained a relatively stable position, moving from rank 8 to 10, while &Shine showed a slight improvement from rank 10 to 11. Cheetah's sales figures also reflect this positive trend, with a notable increase in January 2026, surpassing its December 2025 sales, which suggests a growing consumer preference and potential for further market penetration. This upward trend positions Cheetah as a rising contender in the New Jersey Vapor Pens market.

Notable Products

In January 2026, Blue Runtz Live Resin Disposable (1g) maintained its top position as the leading product for Cheetah, recording sales of 1039 units. Super Boof Live Rosin Disposable (1g) followed closely, holding steady at the second spot with sales of 796 units. Kashmir Kush Rosin Disposable (1g) entered the rankings at third place, indicating a strong debut for this product. Tush Push Live Resin Disposable (1g) also made its first appearance in the rankings, securing the fourth position. Cream 47 Rosin Cartridge (0.5g) rounded out the top five, marking its initial entry into the rankings as well, suggesting a reshuffling of consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.