Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

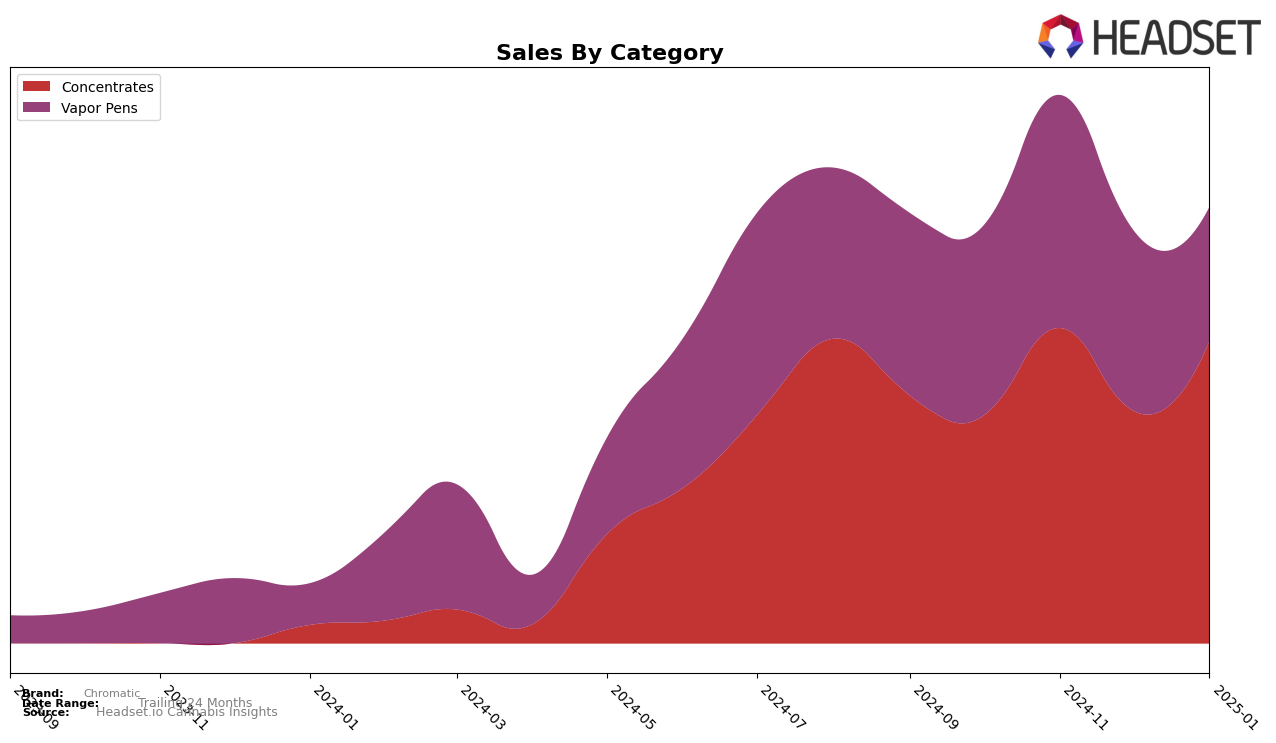

Chromatic's performance in Oregon reveals a dynamic presence in the Concentrates category. Over the span from October 2024 to January 2025, Chromatic experienced fluctuations in its rankings, peaking at 23rd in November before dropping out of the top 30 in December and then rebounding to 27th in January. This suggests a volatile but resilient positioning within the market, potentially indicating strategic adjustments or market responses to competitor actions. The sales figures corroborate this narrative, with a notable increase in November, hinting at successful promotional activities or product launches during that period.

In contrast, Chromatic's performance in the Vapor Pens category in Oregon has been more stable, albeit outside the top 30 rankings consistently. Starting at a rank of 56th in October, the brand saw a slight improvement in November before gradually falling to 61st by January. This downward trend in rankings, coupled with declining sales, suggests challenges in capturing market share or possibly increased competition from other brands. The absence from the top 30 could also reflect a strategic focus on other categories or a need for innovation to boost presence in this segment.

Competitive Landscape

In the Oregon concentrates market, Chromatic has shown a dynamic performance over the past few months, with its rank fluctuating between 23rd and 33rd place. Notably, in November 2024, Chromatic achieved its highest rank at 23rd, coinciding with a significant increase in sales. However, it faced a dip in December, dropping to 33rd, before recovering slightly to 27th in January 2025. This volatility is contrasted by Farmers First, which consistently improved its position, peaking at 26th in both December and January. Meanwhile, Farmer's Friend Extracts maintained a relatively stable presence, although it never broke into the top 20, indicating a competitive but steady market environment. Grape God experienced a notable surge in December, reaching 24th place, which suggests potential seasonal demand shifts that Chromatic could capitalize on. Overall, Chromatic's fluctuating rank highlights the competitive nature of the Oregon concentrates market, where strategic adjustments could enhance its market position.

```

Notable Products

In January 2025, Gorilla Breath Honeycomb (2g) from the Concentrates category emerged as the top-performing product for Chromatic, achieving the number one rank with sales of 578 units. Grape Sherbanger Sugar Sauce (2g) maintained its consistent performance, holding steady at the second rank with 531 units sold. Wild Cherry Punch Cured Resin Cartridge (1g) dropped from its previous top position in December to third place, indicating a slight decline in its dominance. Wild Cherry Punch Sugar Sauce (1g) and Strawberry Pave Shatter (2g) rounded out the top five, with the latter making a notable entry at fifth rank. This ranking shift highlights a dynamic market where new products can quickly rise to prominence, reflecting changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.