Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

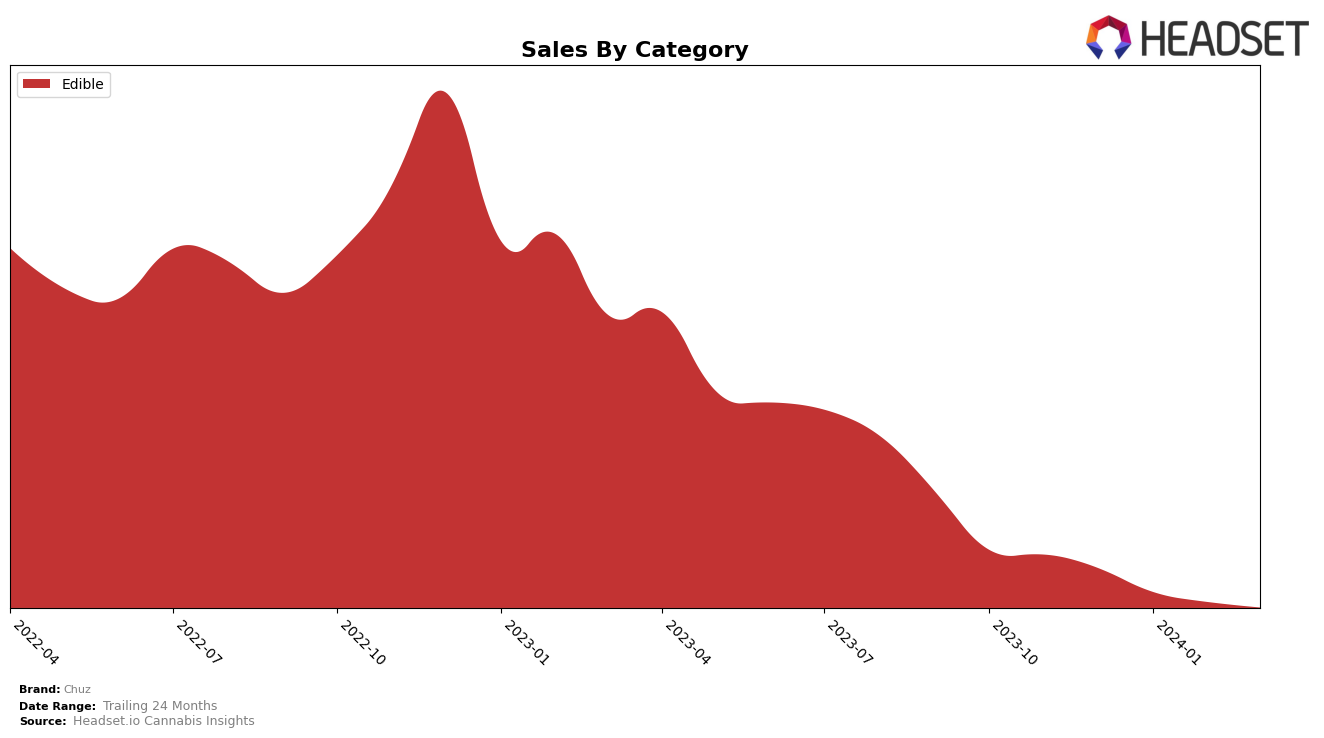

In the edible category, Chuz's performance has shown significant variance across different provinces in Canada, indicating a fluctuating market presence. In Alberta, Chuz experienced a notable decline, falling from a rank of 33 in December 2023 to 59 by March 2024, with sales plummeting from 5460 to 275 units in the same period. This stark decrease highlights a potential challenge in maintaining market share within the province. Conversely, in British Columbia, Chuz maintained a more stable position, hovering around the 30th rank from December 2023 to March 2024, suggesting a steadier demand for their edibles. However, the slight drop in sales from 957 to 542 units over the months indicates a need for strategies to boost consumer interest and sales.

Looking at Ontario and Saskatchewan, the brand's performance presents a mixed bag. In Ontario, Chuz's ranking slipped slightly from 40th in December 2023 to 51st by March 2024, with sales decreasing significantly from 10146 to 2538 units. This downturn suggests that Chuz is facing challenges in one of Canada's largest markets, which could impact its overall performance. On the other hand, Saskatchewan showed an initial decline in ranks from 21st to 31st between December 2023 and February 2024, with no rank available for March, indicating they were not in the top 30 brands. The absence in March's ranking could be seen as a negative trend, although it's important to note that sales data for March is missing, leaving some uncertainty about the brand's current standing in the province.

Competitive Landscape

In the competitive landscape of the edible category in Ontario, Chuz has experienced fluctuations in its market position, indicating a dynamic and challenging environment. From December 2023 to March 2024, Chuz's rank among top edible brands saw a decline from 40th to 51st. This shift suggests a relative decrease in its market presence compared to competitors such as Color Cannabis, which maintained a more stable position, moving from 42nd to 50th in the same period. Interestingly, Kiss, another competitor, showed a notable improvement, jumping from 64th to 49th rank, surpassing Chuz by March 2024. This leap indicates a significant gain in market share and consumer preference for Kiss. On the other hand, Pure Sunfarms and Palmetto also experienced rank declines, suggesting a competitive shuffle among brands within this category. These movements highlight the importance of innovation and marketing strategies in maintaining or improving market position. Chuz's recent rank and sales trajectory underscore the need for strategic adjustments to reclaim and enhance its standing in Ontario's edible cannabis market.

Notable Products

In March 2024, Chuz saw Salted Caramels 2-Pack (10mg) from the Edible category maintain its top position with 431 sales, continuing its streak as the number one product since December 2023. Following closely, Super Sours - CBD:THC 1:1 Peach Mango Madness Gummies 4-Pack (10mg CBD, 10mg THC) secured the second rank, showing a consistent performance in the top tiers over the past months. Classic Soda Blendz Gummies 5-Pack (10mg) made a notable jump to the third rank in March, despite not being ranked in January and February, indicating a significant increase in popularity or availability. Super Sours - CBD:THC 1:1 Kiwi Kaboom Gummies 4-Pack (10mg CBD, 10mg THC) also climbed the ranks to secure the fourth position in March, showing a gradual increase in its ranking. Lastly, Super Sours - CBD/THC 1:1 Blue Blastberry Gummies 4-Pack (10mg CBD, 10mg THC) entered the top five in March, highlighting the growing interest in CBD/THC combination products within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.