Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

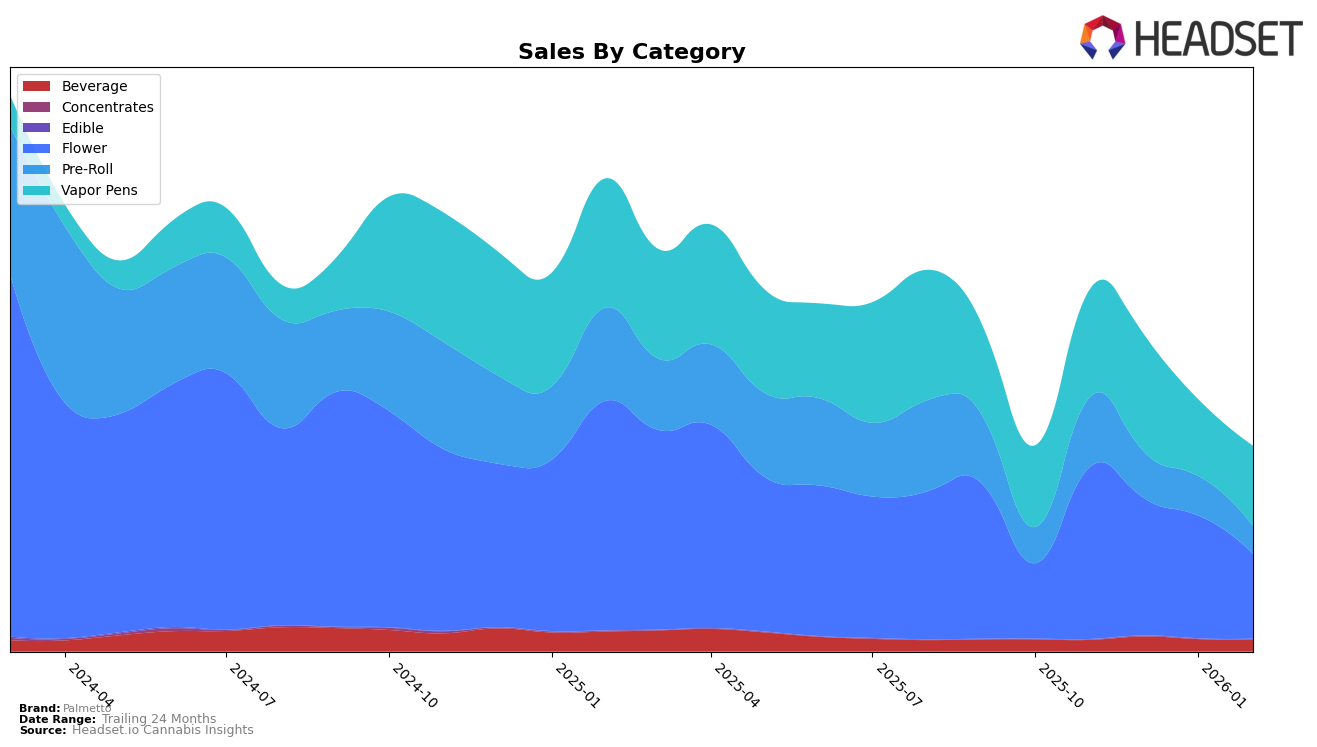

Palmetto's performance across various categories and provinces in Canada shows a mix of strengths and challenges. In Alberta, the brand has shown resilience in the Flower category, maintaining a stable presence with a rank of 76 in February 2026, despite dipping to 87 in January. However, in the Beverage category, Palmetto entered the top 30 in December 2025 and January 2026, ranking 12th and 13th respectively, which indicates a positive reception. In the Vapor Pens category, Palmetto made a notable entry at rank 46 in February 2026, suggesting a growing interest in this segment. Conversely, the absence of Palmetto from the top 30 in November 2025 in the Beverage and Vapor Pens categories highlights areas for potential growth and improvement.

In British Columbia, Palmetto's Flower category ranking dipped from 22 in November 2025 to 27 in February 2026, indicating a slight decline in market position. However, the brand maintained a consistent presence in the Pre-Roll category, fluctuating between ranks 73 and 78. The Vapor Pens category saw Palmetto improve its rank from 37 in November 2025 to 34 in February 2026, despite a drop to 36 in January. Meanwhile, in Ontario, Palmetto's Beverage category held a steady rank around 21, demonstrating consistent consumer demand. However, the brand's absence from the top 30 in the Flower category after November 2025 suggests a need for strategic adjustments to regain market share. In Saskatchewan, Palmetto showed volatility in the Flower and Pre-Roll categories, where it did not rank in February 2026, indicating challenges in maintaining market traction.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Palmetto has experienced a notable shift in its market position from November 2025 to February 2026. Initially ranked 22nd in November 2025, Palmetto saw a slight improvement to 21st in December, but then experienced a decline, falling to 27th by February 2026. This downward trend in rank is mirrored by a decrease in sales, with February's figures significantly lower than those in November. In contrast, competitors like Good Buds and AMANI CRAFT have shown impressive upward mobility, with Good Buds climbing from 87th to 29th and AMANI CRAFT from 84th to 25th over the same period. Meanwhile, Happy Hour, despite a drop from 15th to 26th, still maintains higher sales than Palmetto. These dynamics suggest that while Palmetto remains a significant player, it faces increasing competition from brands that are rapidly gaining traction, necessitating strategic adjustments to maintain its market share.

Notable Products

In February 2026, Palmetto's top-performing product was Orange Vanilla Cream Soda (10mg THC, 355ml) in the Beverage category, maintaining its consistent first-place rank from previous months with sales of 6444 units. The Strawberry & Kiwi 3-in-1 Distillate Disposable (1g) in the Vapor Pens category climbed to the second position, improving from its fifth-place rank in January 2026. The Banana & Pineapple Coco Distillate 3 in 1 Disposable (1g) also showed an upward trend, moving to third place from fourth in January. Meanwhile, Pals - Apple Jack Pre-Roll 10-Pack (4g) dropped to fourth place from its second-place rank, indicating a decline in sales momentum. Notably, the Peach & Lemonade Distillate 3-in-1 Disposable (1g) entered the rankings for the first time in February, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.