Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

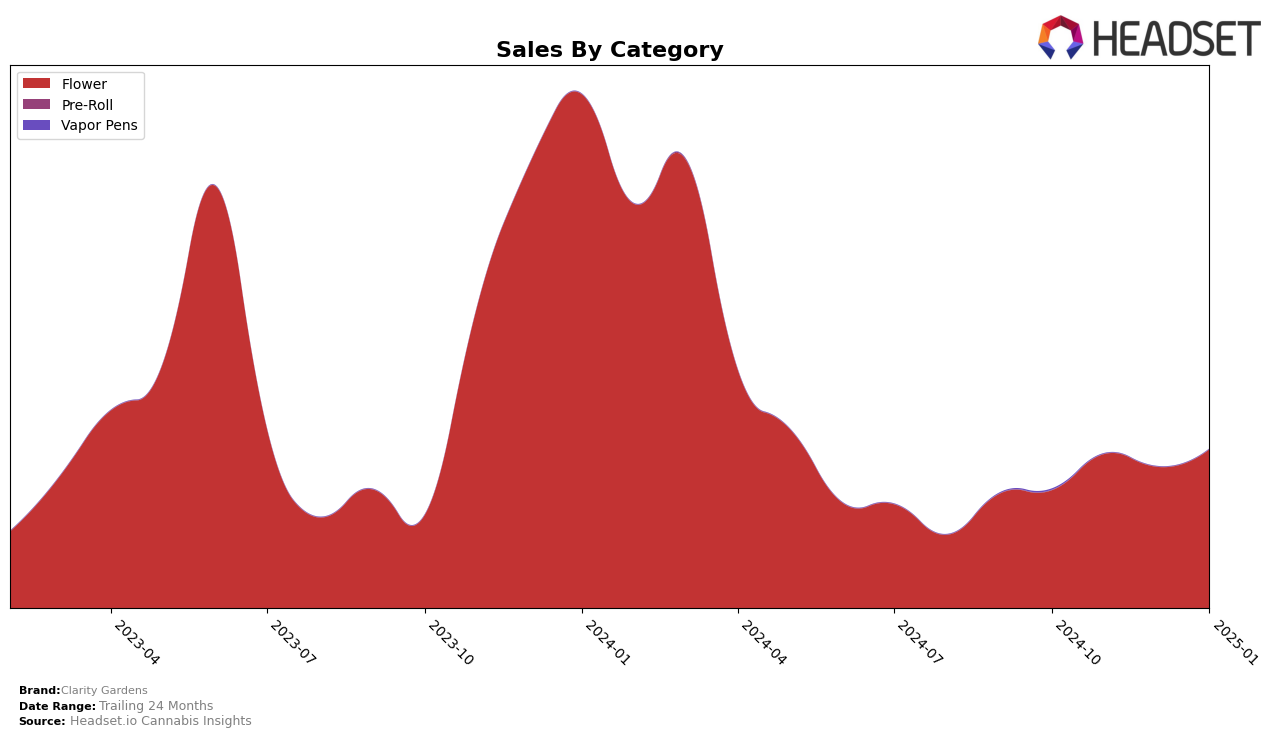

Clarity Gardens has shown a notable upward trend in the Flower category within Colorado. Starting from October 2024, where they were ranked 43rd, the brand made significant strides, breaking into the top 30 by January 2025 with a rank of 28th. This movement indicates a positive reception and growing popularity of their products in this competitive category. The increase in sales from October to January further underscores their improving market presence, suggesting effective strategies or product offerings that resonate well with consumers.

While Clarity Gardens has made impressive gains in Colorado, their absence from the top 30 rankings in other states or provinces suggests either a limited market presence or challenges in gaining traction outside of Colorado. This could imply potential areas for growth or the need for strategic adjustments to replicate their success in Colorado elsewhere. The absence of rankings in other regions may also indicate that Clarity Gardens is focusing its efforts more narrowly, which could be a deliberate strategy to consolidate their position in a key market before expanding further.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Clarity Gardens has demonstrated a notable upward trajectory in rankings from October 2024 to January 2025. Starting at rank 43 in October, Clarity Gardens climbed to rank 28 by January, indicating a positive trend in market positioning. This improvement is particularly significant when compared to competitors such as The Colorado Cannabis Co., which fluctuated in the lower ranks, and Boulder Built, which experienced a decline in November before stabilizing. Meanwhile, Nuhi showed a remarkable rise from rank 56 to 27, suggesting increased competition. Despite the competitive pressure, Clarity Gardens' consistent sales growth, peaking in January, positions it favorably against these brands. This upward movement in rank and sales indicates Clarity Gardens' strengthening market presence and potential for continued growth in the Colorado Flower market.

Notable Products

In January 2025, Clarity Gardens' top-performing product was Monkey Bite Popcorn (Bulk) in the Flower category, which climbed to the number one rank with sales of 6488. Moon Arc Smalls (Bulk) followed closely, securing the second position for the month. Frost Nova (Bulk) entered the rankings at third place, showing a strong performance. Frost Nova (3.5g) improved its rank from fifth in December 2024 to fourth in January 2025, indicating a positive trend. Meanwhile, Monkey Bite (3.5g) saw a decline, dropping from third in October 2024 to fifth in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.