Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

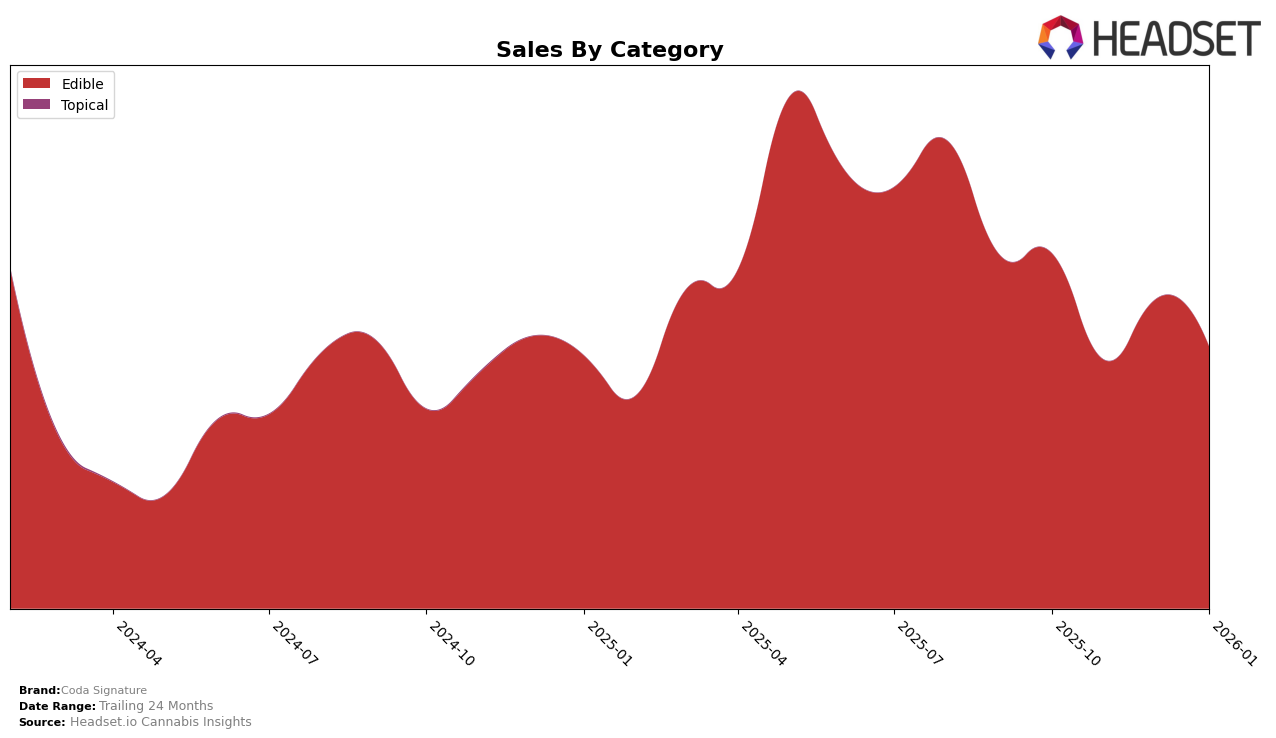

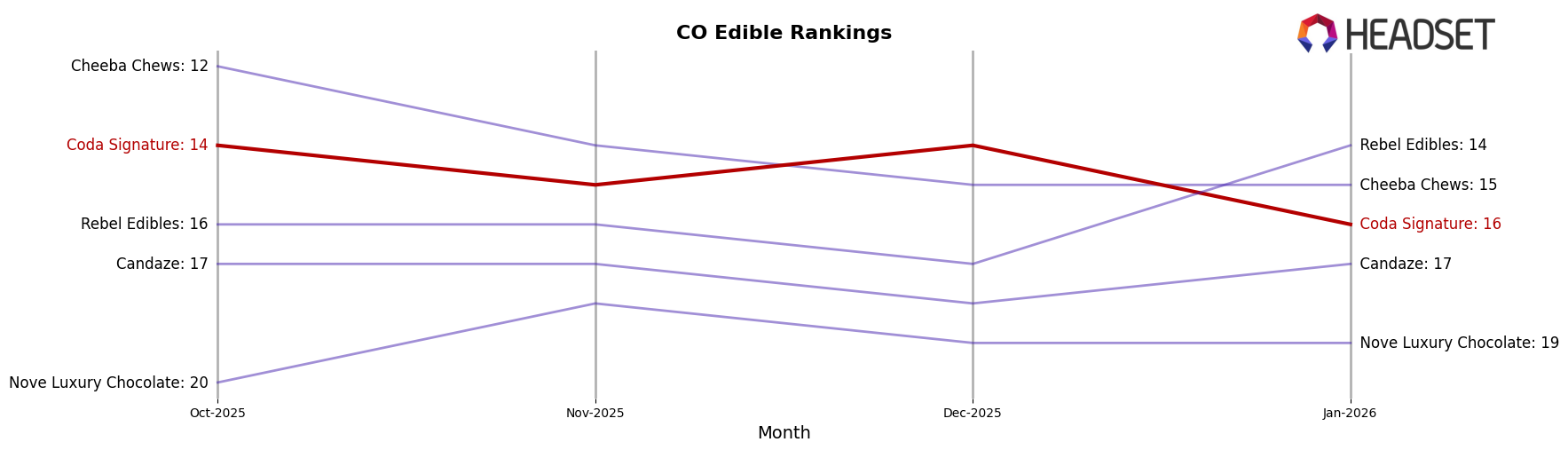

Coda Signature has shown a consistent presence in the Colorado edibles market, maintaining a position within the top 20 brands. From October 2025 to January 2026, their rankings fluctuated slightly, moving from 14th to 16th. This indicates a steady but slightly declining performance in the competitive edibles category. The sales figures reflect a similar trend, with a peak in October 2025 followed by some variability in the subsequent months. The brand's ability to stay within the top 20 suggests a solid consumer base, though the slight downward trend may warrant a closer look at competitive dynamics or seasonal factors impacting sales.

It is noteworthy that Coda Signature did not appear in the top 30 rankings for any other states or categories during this period. This absence highlights a potential area for growth or a strategic focus on consolidating their market share specifically within Colorado. While being consistently ranked in the top 20 in one state is commendable, expanding presence to other states or categories could offer new revenue streams and mitigate risks associated with market concentration. The data suggests a strong foothold in their existing market, but diversification could be key to sustaining long-term growth.

```Competitive Landscape

In the competitive landscape of the Colorado edible market, Coda Signature has experienced fluctuations in its rank and sales over recent months. Notably, Coda Signature's rank shifted from 14th in October 2025 to 16th by January 2026, indicating a slight decline in its competitive positioning. During this period, Coda Signature's sales saw a dip in November 2025 but rebounded in December, only to decrease again in January 2026. In contrast, Cheeba Chews maintained a relatively stable rank, albeit slightly declining from 12th to 15th, with a consistent downward trend in sales. Meanwhile, Rebel Edibles showed a positive trajectory, climbing from 16th to 14th by January 2026, with sales peaking in the same month. Nove Luxury Chocolate and Candaze remained outside the top 15, with Nove Luxury Chocolate showing a slight improvement in rank and Candaze maintaining a steady position. These dynamics suggest that while Coda Signature remains a key player, it faces increasing competition, particularly from brands like Rebel Edibles, which are gaining traction in the market.

Notable Products

In January 2026, Coda Signature's Coffee & Doughnuts Milk Chocolate Bar 20-Pack maintained its top position as the best-selling product, despite a decrease in sales to 1115 units. The Kiwi & Watermelon Fruit Notes 20-Pack climbed to second place, showing a remarkable improvement from its fourth position in December 2025. Cream & Crumble White Chocolate Bar held steady in third place, consistent with its ranking from the previous month. Toffee & Sea Salt Chocolate Bar dropped from second to fourth place, indicating a decline in popularity. The CBD/THC 1:1 Strawberry & Rhubarb Fruit Notes experienced a notable drop to fifth place, reflecting a continuous downward trend since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.