Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

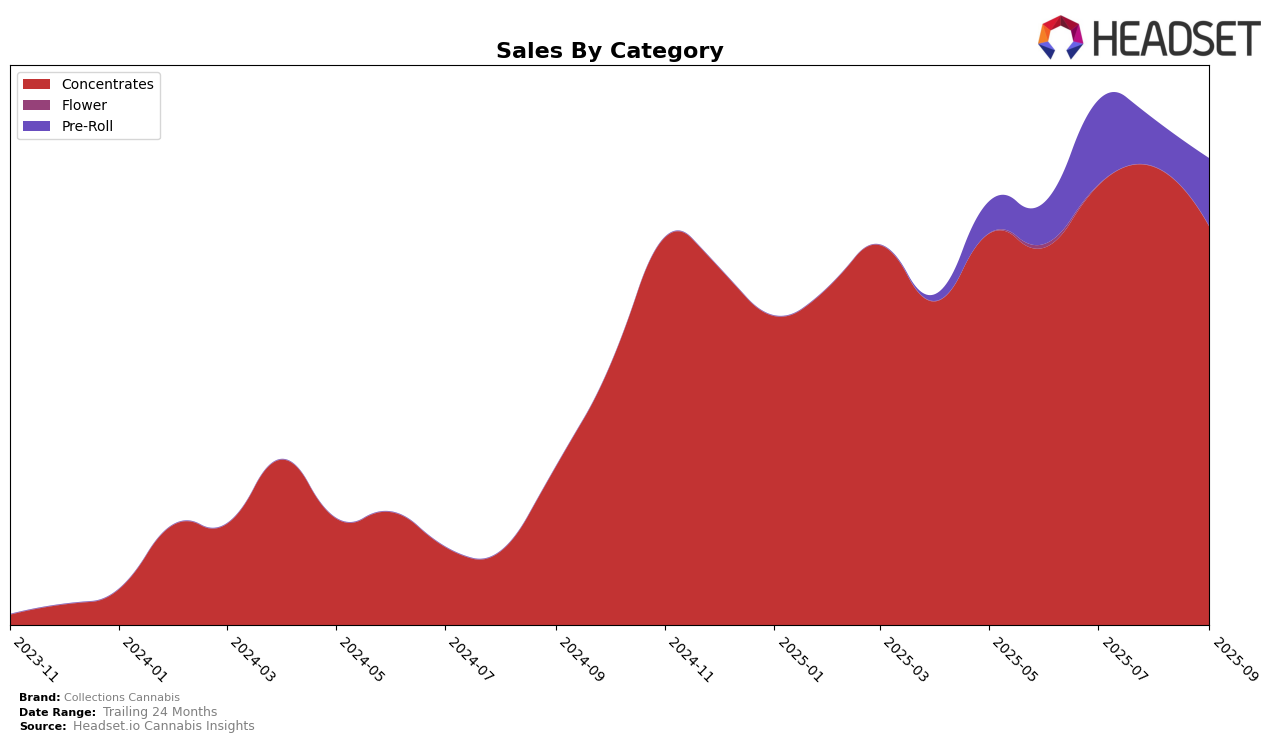

Collections Cannabis has demonstrated some notable fluctuations in its performance across different categories and regions. In the Washington market, the brand has shown a consistent presence in the Concentrates category, maintaining a position within the top 30 brands. Starting at rank 30 in June 2025, Collections Cannabis improved its standing to rank 26 by July and further to rank 24 by August. However, September saw a slight dip back to rank 29. This fluctuation indicates a competitive landscape in Washington's Concentrates category, where maintaining a stable rank can be challenging.

While Collections Cannabis has been able to sustain its visibility in the Washington market, the absence of rankings in other states or provinces suggests areas of potential growth or market entry challenges. The brand's ability to climb within the top 30 in Washington's Concentrates category reflects its adaptability and market strategy effectiveness. However, the lack of ranking in other regions might imply either a strategic focus on Washington or potential barriers to entry in other markets. This mixed performance highlights the importance of regional strategies and the dynamic nature of the cannabis market across different states and categories.

Competitive Landscape

In the competitive landscape of the Washington concentrates market, Collections Cannabis has experienced fluctuating rankings from June to September 2025, indicating a dynamic market presence. Notably, Collections Cannabis improved its rank from 30th in June to 24th in August, before slipping to 29th in September. This trend suggests a competitive edge, particularly against brands like Slab Mechanix, which consistently ranked lower, dropping from 21st in June to 30th by September. Despite this, Bodega Buds maintained a stronger presence, albeit with a declining trend, starting at 14th in June and falling to 27th in September. Collections Cannabis' sales trajectory, peaking in August, reflects a potential for growth amidst competitors like Method, which showed a positive sales trend but remained lower ranked. These insights highlight Collections Cannabis' resilience and potential for upward mobility in a highly competitive market.

Notable Products

In September 2025, the top-performing product from Collections Cannabis was Sherbanger Hash Rosin (1g) in the Concentrates category, reclaiming its number one spot from June after a brief dip to fourth in July. Notably, its sales increased to 310 units, showcasing a strong recovery. Alpine Guava Full Spectrum Rosin (1g) made a significant debut, securing the second position in its first recorded month. Rainbow Push Pop Hash Rosin (1g) followed closely, ranking third without previous data for comparison. Meanwhile, Superboof Full Spectrum Hash Rosin (1g), which held the top rank in August, experienced a drop to fourth place in September, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.