Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

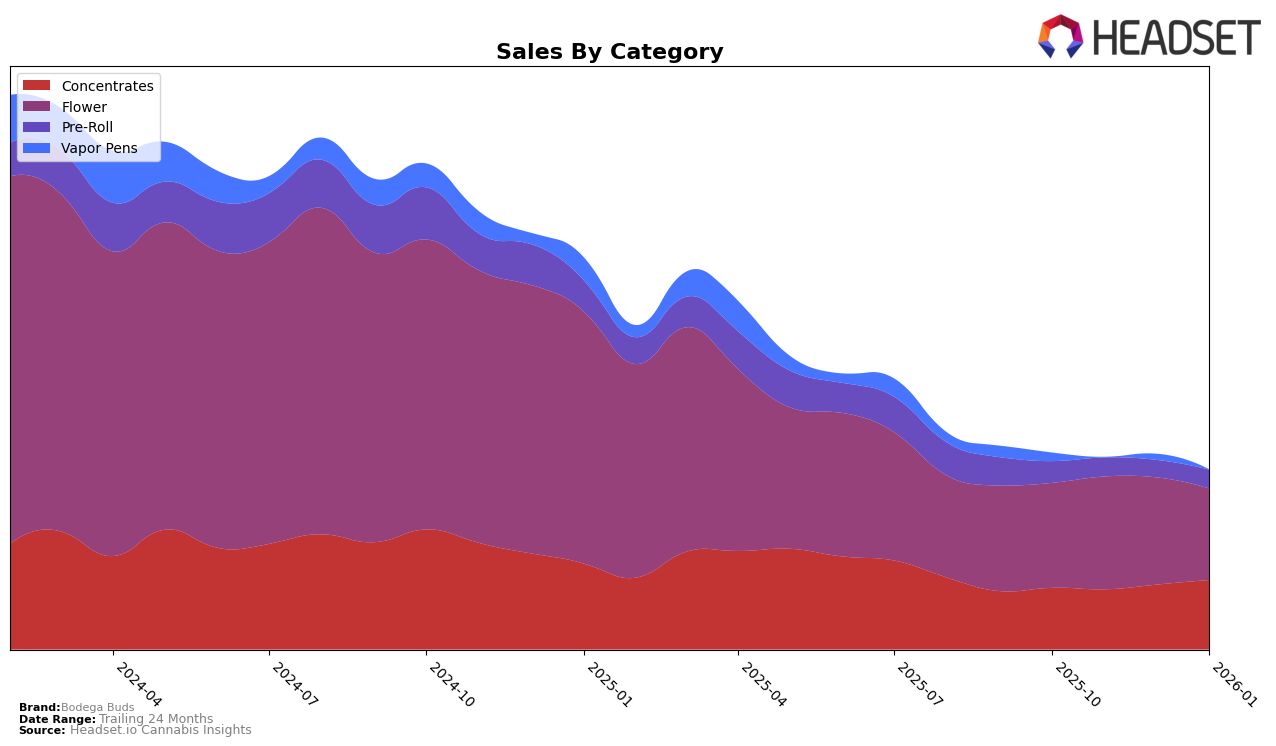

In the Washington market, Bodega Buds has shown a notable upward trend in the Concentrates category. Starting from the 29th position in October 2025, the brand managed to climb to the 24th position by January 2026, indicating a positive reception and growing consumer interest in their concentrate products. This improvement is underscored by a steady increase in sales, reflecting a robust demand. However, in the Flower category, Bodega Buds experienced fluctuations, moving from 61st in October to 66th by January, suggesting potential challenges or increased competition in this segment. Interestingly, the brand made its debut in the Pre-Roll category in January 2026, ranking 99th, which could either indicate a new entry or a lack of significant market presence previously.

The mixed performance across categories highlights both opportunities and challenges for Bodega Buds in the Washington cannabis market. The rise in Concentrates suggests that Bodega Buds is effectively capturing consumer interest in this category, which could be attributed to product innovation or competitive pricing strategies. On the other hand, the decline in the Flower category rankings, despite being outside the top 30, signals a need for strategic adjustments, possibly in marketing or product offerings, to regain market share. The entry into the Pre-Roll category, albeit at a lower rank, represents a potential growth area, provided the brand can leverage its strengths to improve its standing in subsequent months.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Bodega Buds has experienced notable fluctuations in its rankings and sales over the past few months. From October 2025 to January 2026, Bodega Buds' rank shifted from 61st to 66th, indicating a slight decline in its market position. Despite this, Bodega Buds maintained relatively stable sales, peaking in November 2025. In comparison, Trichome Extracts / Canna Pacific saw a more significant drop in rank from 51st to 68th by January 2026, with sales also decreasing notably. Meanwhile, Dog House improved its rank from 82nd to 67th, showing a positive trend in both rank and sales. Zen Cannabis and O'Geez (WA) have shown mixed results, with Zen Cannabis fluctuating in rank but ending higher in January, while O'Geez (WA) improved its rank from 68th to 63rd. These dynamics suggest that while Bodega Buds faces challenges in maintaining its rank, its sales performance remains competitive, highlighting the importance of strategic marketing to bolster its market position.

Notable Products

In January 2026, Sour Cough Pre-Roll (1g) maintained its top position among Bodega Buds products, repeating its performance from October and December 2025 with sales reaching 1280 units. White Widow Wax (1g) held steady at the second spot, showing a consistent presence in the top ranks with a notable increase in sales from December to January. Peach Soda Pre-Roll (1g) emerged as a new entrant in the rankings, securing the third position with impressive sales figures. Dolato Pre-Roll (1g) climbed back into the rankings at fourth place after not being ranked in December. Slurricane Sugar Wax (1g) rounded out the top five, marking its first appearance in the rankings with a solid performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.