Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

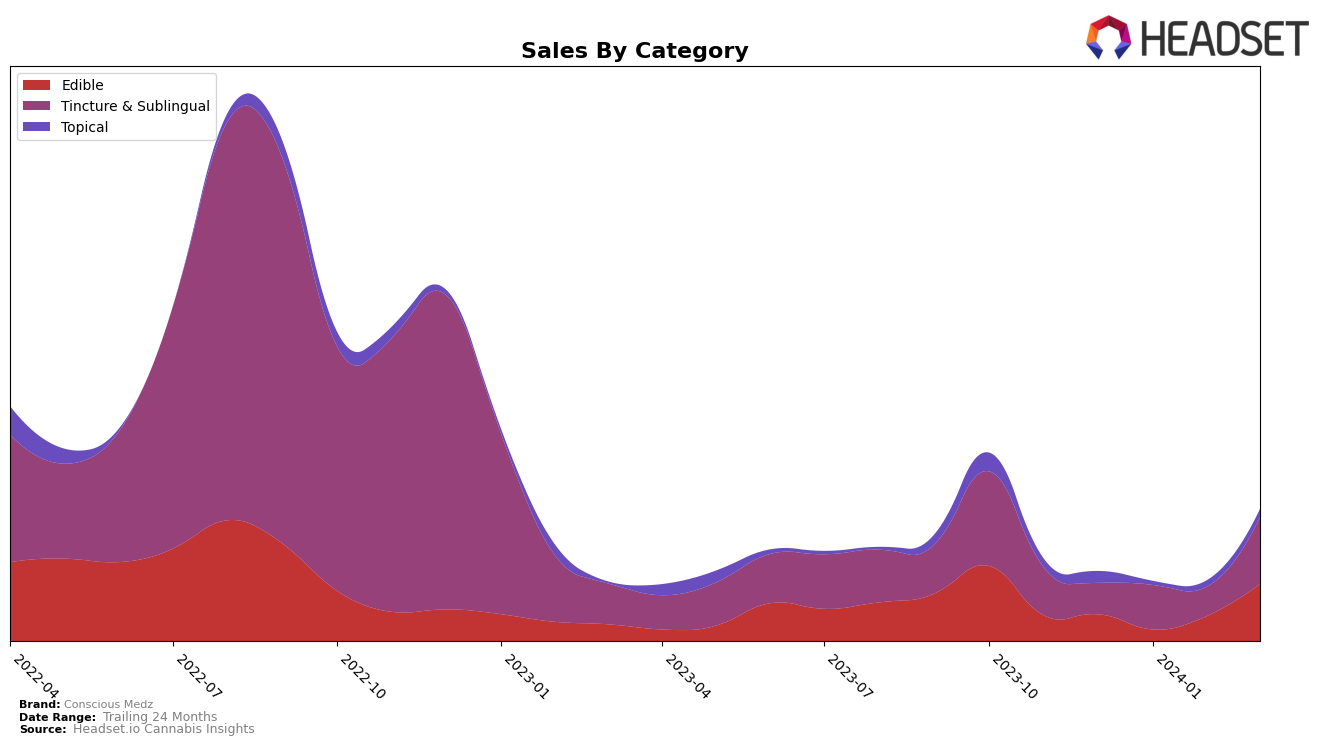

In the competitive cannabis market of Colorado, Conscious Medz has shown varied performance across different product categories. Notably, in the Tincture & Sublingual category, the brand has maintained a strong position within the top 10, with rankings fluctuating slightly between 9th and 8th place from December 2023 to March 2024. This consistency is a testament to the brand's solid foothold in this category, especially considering the increase in sales from 3,661 units in December 2023 to 7,190 units in March 2024. On the other hand, their Edible category rankings have seen a slight improvement, moving up from 54th to 49th place, despite a significant drop in sales in January 2024 before recovering in the following months. This recovery indicates a potential resilience and adaptability of Conscious Medz in the Edibles market.

The Topical category tells a different story for Conscious Medz, with rankings hovering around the 17th to 19th positions from December 2023 to March 2024. Although this shows the brand has maintained a steady presence in the top 20, the slight decline in sales from December 2023 to January 2024, followed by a gradual recovery, suggests challenges in maintaining their market share in this segment. The brand's performance in the Topical category, while stable, highlights the competitive nature of the cannabis industry in Colorado and the need for continuous innovation and marketing efforts to improve or maintain market standings. Overall, Conscious Medz's performance across these categories illustrates a mixed but intriguing picture of its market dynamics, with notable strengths in Tinctures & Sublinguals and areas for growth in Edibles and Topicals.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category within Colorado, Conscious Medz has shown notable fluctuations in its market positioning from December 2023 through March 2024. Initially ranked 9th in December, Conscious Medz improved to 8th in January, dipped back to 9th in February, and then climbed to 8th again in March. This indicates a volatile yet slightly positive trajectory in terms of rank amidst its competitors. Noteworthy competitors include Care Division, consistently holding the 6th position with a remarkable sales increase over the months, suggesting a strong and growing presence in the market. Mary's Medicinals maintained a steady 7th rank, experiencing a significant sales jump in March, which could indicate a resurgence in popularity. Meanwhile, marQaha and Sweet Mary Jane have also shown fluctuations in their rankings but with an overall upward trend in sales, particularly Sweet Mary Jane, which saw a substantial increase in March. These dynamics suggest a competitive but opportunity-rich environment for Conscious Medz, where strategic marketing and product quality improvements could significantly impact its market share and ranking.

Notable Products

In Mar-2024, Conscious Medz saw the Indica Peanut Butter Fudge Chocolate Bar (100mg) leading the sales with a remarkable figure of 234 units, maintaining its top position from the previous month. Following closely, the THC/CBG 9:1 Purple OG Kush Tincture (100mg THC, 12mg CBG) secured the second rank, showing consistent high performance but unable to surpass the leading edible. The Salted Caramel Chocolate Bar (100mg) experienced a notable rise, moving up to the third rank, indicating a growing preference for edibles within the product lineup. The Original Glue Tincture made an impressive entry into the fourth rank, despite not being ranked in the previous two months, highlighting a significant demand for tincture products. Lastly, the Spicy Muscle Rub (100mg) ranked fifth, demonstrating a steady demand for topical products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.