Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

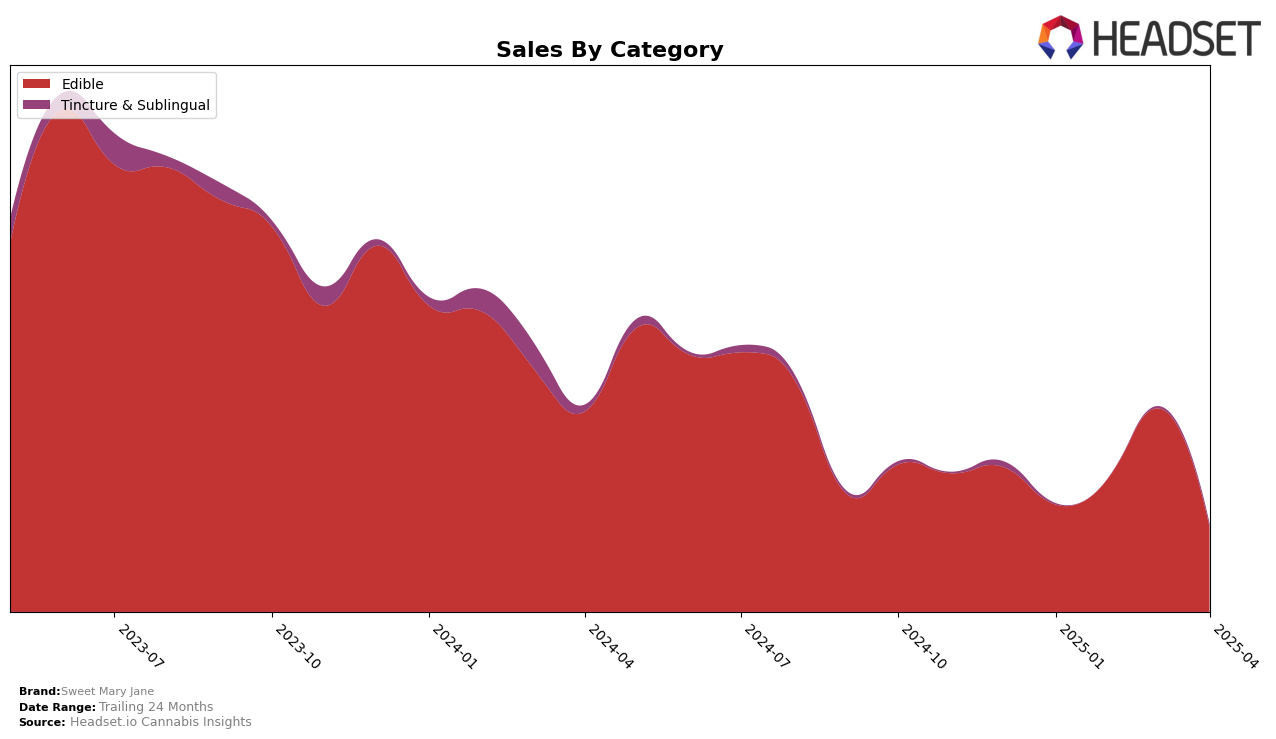

Sweet Mary Jane has shown fluctuating performance in the Edible category within the state of Colorado. Despite not breaking into the top 30 rankings over the past four months, the brand has experienced significant sales variations. Notably, March 2025 saw a peak in sales, reaching $42,174, before dropping to $17,638 in April. This inconsistency suggests a volatile market presence, which could be attributed to varying consumer preferences or competitive pressures within the state.

The brand's inability to consistently rank within the top 30 in Colorado’s Edible category could be seen as an area of concern, indicating potential challenges in brand visibility or market penetration. However, the spike in sales during March suggests there are opportunities for growth if Sweet Mary Jane can identify and capitalize on the factors contributing to this temporary surge. Understanding these dynamics could be key to achieving more stable and improved performance in the future.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Sweet Mary Jane has experienced some fluctuations in its ranking over the first four months of 2025. Despite a promising increase in sales from January to March, Sweet Mary Jane's rank remained outside the top 30, peaking at 31st in March before dropping back to 34th in April. This indicates a challenging environment where competitors like Billo consistently outperformed, maintaining a top 30 position and even reaching 22nd in March. Meanwhile, ROBHOTS showed a steady presence, slightly trailing Sweet Mary Jane but closing the gap by April. The market dynamics suggest that while Sweet Mary Jane has potential for growth, it faces stiff competition from brands like Billo, which have demonstrated stronger sales performance and higher rankings. Brands like Kush Masters (Kush Master LLC) and Lazercat Cannabis also highlight the volatility in rankings, with intermittent appearances in the top 40, emphasizing the competitive pressure in this market segment.

Notable Products

In April 2025, Sweet Mary Jane's top-performing product was the Hybrid Classic Pot Brownie (100mg) in the Edible category, maintaining its first-place rank for the fourth consecutive month despite a notable drop in sales to 437 units. The Cookie Dough Cookies (100mg) secured the second position, consistently rising from fourth in January to second in February, and maintaining that rank in April with sales reaching 170 units. The Hybrid Salted Caramel Cookies (100mg) climbed back to third place after slipping to fifth in March, showcasing a dynamic shift in its popularity. The Chocolate Chip Cookie Dough 10-Pack (100mg) made a notable entry into the rankings in April, securing the fourth spot with 82 units sold. Lastly, the CBD/THC 1:1 Classic Pot Brownie (100mg CBD, 100mg THC) entered the rankings for the first time in April, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.