Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

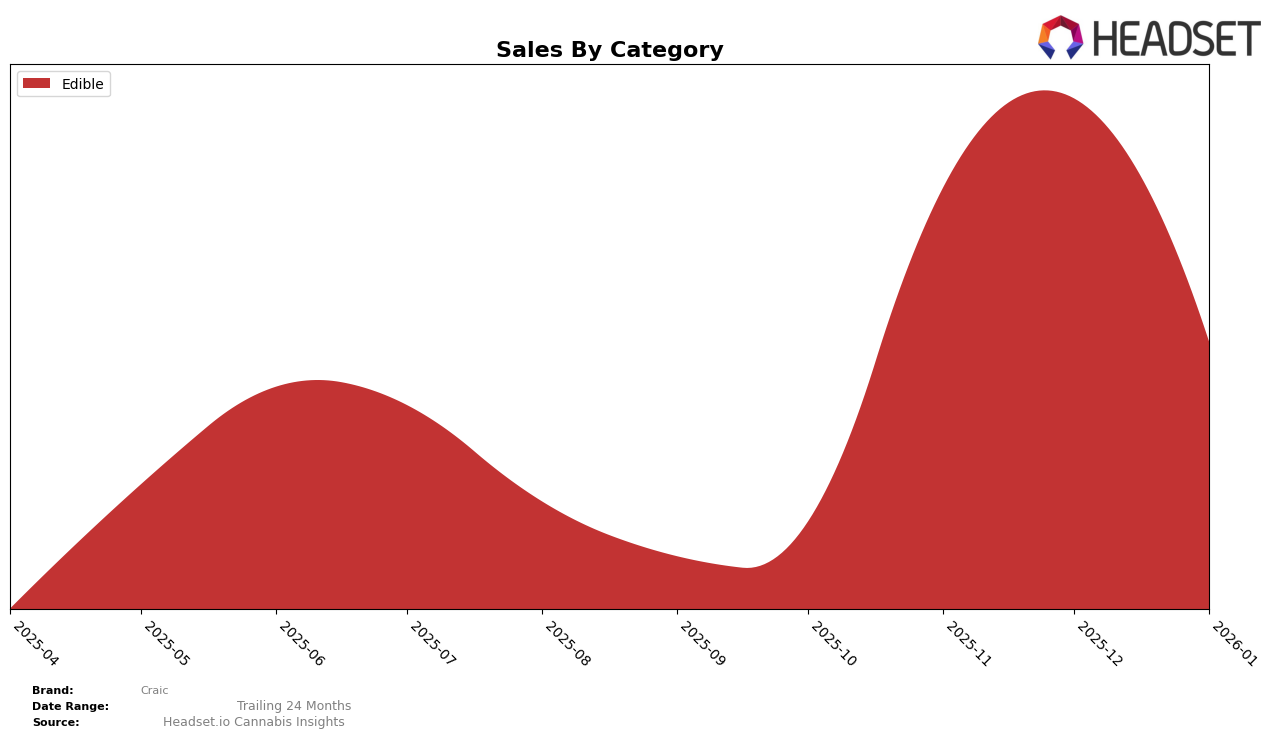

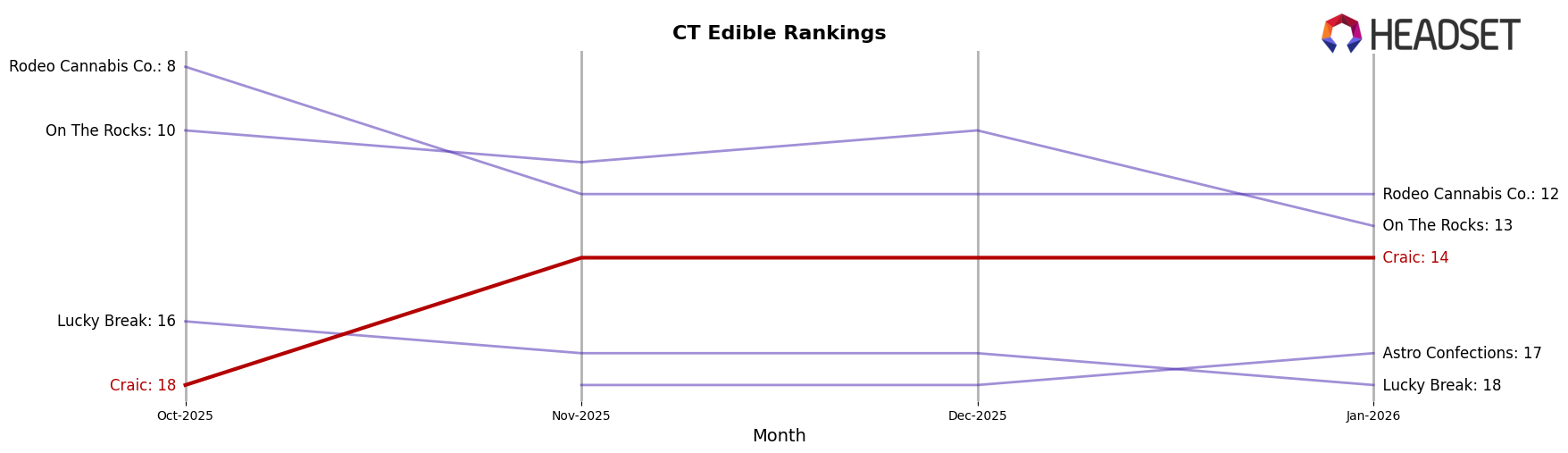

Craic has shown a consistent performance in the Edible category in Connecticut over the past few months. Starting in October 2025, Craic was ranked 18th in this category and improved to 14th by November, maintaining this position through December and January 2026. This stable ranking in the top 15 indicates a strong foothold in the Connecticut edible market. The notable increase in sales from October to November, followed by a slight decline in January, suggests potential seasonality or promotional activities that could have influenced consumer purchasing behaviors during this period.

Despite Craic's strong presence in the Connecticut edibles market, their absence from the top 30 rankings in other states or categories suggests that their influence is currently more localized. This could point to either a strategic focus on specific markets or a need for expansion efforts to enhance their presence in other regions. While the data provides a glimpse into their performance in Connecticut, further insights into other states and categories could reveal opportunities or challenges that Craic might face in broadening their market reach.

Competitive Landscape

In the Connecticut edible market, Craic has demonstrated a notable upward trajectory in brand ranking over the last few months, moving from 18th place in October 2025 to a consistent 14th place from November 2025 through January 2026. This improvement in rank is indicative of a significant boost in sales, particularly from November to December 2025, where Craic's sales increased substantially. In comparison, Rodeo Cannabis Co. experienced a decline in rank from 8th to 12th place by November 2025, though they maintained their position through January 2026. Meanwhile, On The Rocks saw a slight fluctuation, dropping from 10th to 13th place by January 2026. Astro Confections and Lucky Break remained relatively stable, with Astro Confections consistently ranking 17th by January 2026, and Lucky Break slipping slightly to 18th place. Craic's ability to climb the ranks amidst these shifts highlights its growing presence and potential in the Connecticut edible market.

Notable Products

In January 2026, the top-performing product for Craic was Milk Chocolate 20-Pack (100mg) in the Edible category, maintaining its leading position from the previous month with sales of 3446 units. Dark Chocolate 20-Pack (100mg), another Edible product, held the second position, consistent with its ranking in December 2025, despite a significant drop in sales to 40 units. Notably, Milk Chocolate 20-Pack (100mg) has consistently been a strong performer, holding the top rank since November 2025. Dark Chocolate 20-Pack (100mg) experienced a decline in its ranking from October to November 2025, where it slipped from first to second place. This shift highlights Milk Chocolate 20-Pack (100mg)'s growing dominance in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.