Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

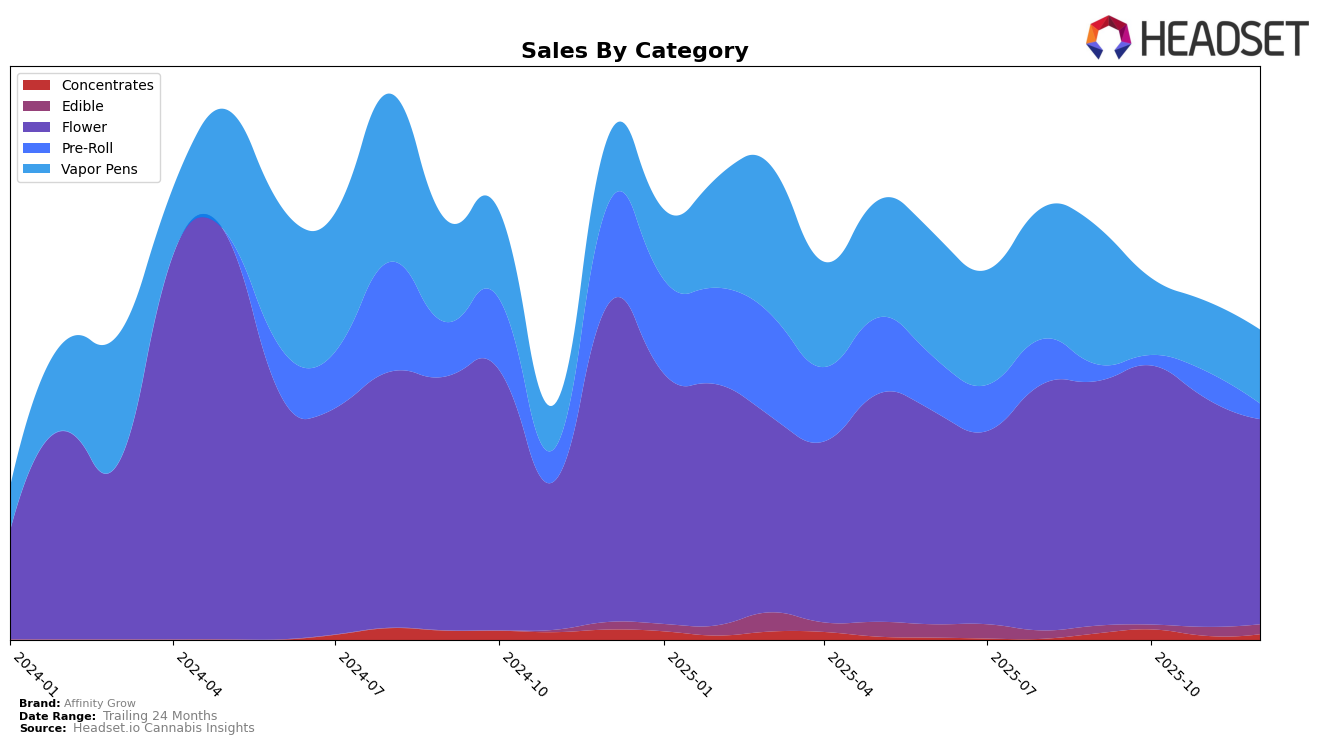

Affinity Grow has shown a mixed performance across different product categories in Connecticut over the last few months of 2025. In the concentrates category, the brand made a notable appearance in October, ranking 3rd, but it did not maintain a top 30 position in other months, indicating a potential area for growth or inconsistency in market presence. In contrast, their flower products have consistently ranked within the top 10, although there was a slight decline from 4th to 6th place from October to December. This suggests a strong but slightly slipping hold in the flower market, which could be due to increasing competition or changing consumer preferences.

The edible category has seen Affinity Grow maintain a steady 14th position in both November and December, after missing out on the top 30 in October. This stability might reflect a loyal customer base or effective marketing strategies for their edibles. The vapor pens category shows a positive trend, with a slight improvement from 9th in November to 8th in December, hinting at a growing acceptance or preference for their products. However, the pre-roll category exhibited some volatility, with rankings fluctuating between 10th and 14th over the months. This inconsistency could suggest challenges in maintaining supply or varying consumer interest. Overall, Affinity Grow's performance in Connecticut highlights both strengths and areas for potential improvement across different product lines.

Competitive Landscape

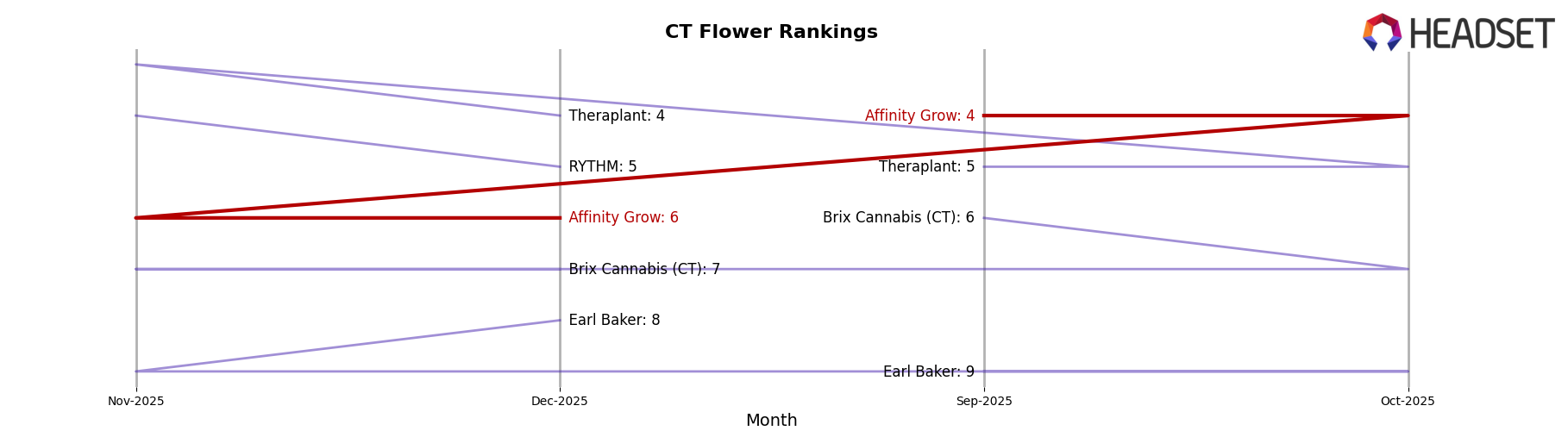

In the competitive landscape of the Flower category in Connecticut, Affinity Grow has experienced fluctuations in its market position, notably dropping from 4th place in September and October 2025 to 6th place by November and December 2025. This shift in rank is primarily influenced by the performance of competitors like Theraplant, which climbed from 5th to 3rd place in November before settling at 4th in December, suggesting a strong upward trend in sales during this period. Meanwhile, RYTHM maintained a steady presence, securing the 4th position in December, which may have contributed to Affinity Grow's decline in rank. Despite these challenges, Affinity Grow's sales figures indicate a need for strategic adjustments to regain its competitive edge, particularly as Earl Baker showed a notable increase in sales, moving from 9th to 8th place by December 2025. Understanding these dynamics is crucial for Affinity Grow to enhance its market strategy and improve its standings in the Connecticut Flower market.

Notable Products

In December 2025, Capy (3.5g) continued its dominance as the top-performing product for Affinity Grow, maintaining its first-place ranking from previous months despite a decrease in sales to 2,753 units. Sunshine Daydream (3.5g) climbed to the second position, showing improvement from its fourth-place ranking in November. Lemon Delight (3.5g) emerged as a new contender, debuting in third place, while Lemon Skunk (3.5g) and Star Killer x CDLC (3.5g) secured the fourth and fifth positions, respectively. This month marks a notable reshuffling in the rankings, with new entries making significant impacts. The Flower category continues to dominate the sales landscape for Affinity Grow.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.