Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

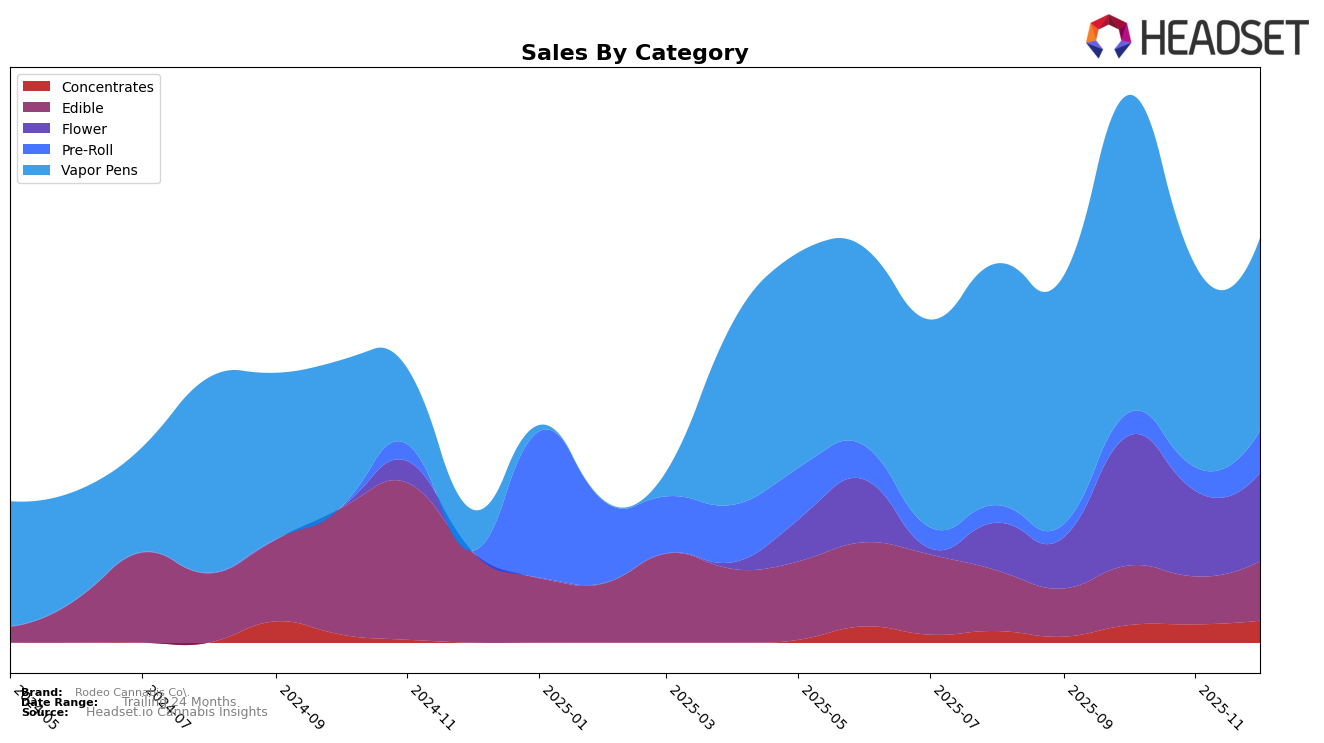

Rodeo Cannabis Co. has shown a promising performance in the Connecticut market across various categories. In the Concentrates category, the brand has made significant strides, improving its rank from being outside the top 30 to securing the 4th position in October 2025 and maintaining the 3rd position in both November and December 2025. This upward movement indicates a growing consumer preference for their concentrates. Meanwhile, in the Pre-Roll category, Rodeo Cannabis Co. demonstrated resilience by bouncing back to the 11th rank in December 2025 after a slight dip to the 14th position in November. This suggests a consistent demand for their pre-roll products within the state.

In the Edibles category, Rodeo Cannabis Co. experienced some fluctuations, moving from the 9th rank in September 2025 to the 12th in November but recovering to the 10th in December. Despite these shifts, the brand has maintained a strong presence within the top 15, reflecting a stable consumer base for their edibles. The Flower category also saw some interesting dynamics, with the brand peaking at the 11th rank in October before stabilizing at the 13th position for November and December. This indicates a competitive landscape in the flower market. The Vapor Pens category showcased consistent performance, with Rodeo Cannabis Co. fluctuating between the 6th and 7th positions, underscoring their steady hold in this segment despite a decrease in sales towards the end of the year.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Rodeo Cannabis Co. has demonstrated a consistent performance, maintaining a rank between 6th and 7th place from September to December 2025. This stability is notable given the fluctuations experienced by competitors such as Affinity Grow and Brix Cannabis (CT), which saw more significant rank changes during the same period. Despite a dip in sales from October to December, Rodeo Cannabis Co. managed to maintain its rank, suggesting a resilient market presence. Meanwhile, Lighthouse Cannabis Company consistently outperformed Rodeo Cannabis Co. in both rank and sales, indicating a strong market leadership. However, Rodeo's ability to hold its position amidst these dynamics points to a solid customer base and effective market strategy, which could be leveraged for future growth.

Notable Products

In December 2025, the top-performing product for Rodeo Cannabis Co. was Scorpion Bowl RSO Gummies 20-Pack (100mg) in the Edible category, which rose to the number one rank with notable sales of $2,123. Crystal Palace Liquid Diamonds Cartridge (0.5g) in the Vapor Pens category debuted impressively at the second rank. Rainbow Beltz Pre-Roll (1g), previously holding the top position for three consecutive months, dropped to third place. The product Z. (3.5g) in the Flower category saw a slight decline, moving from second to fourth place. Lastly, Crystal Palace Liquid Diamonds Cartridge (1g) entered the top five, securing the fifth rank after not being ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.