Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

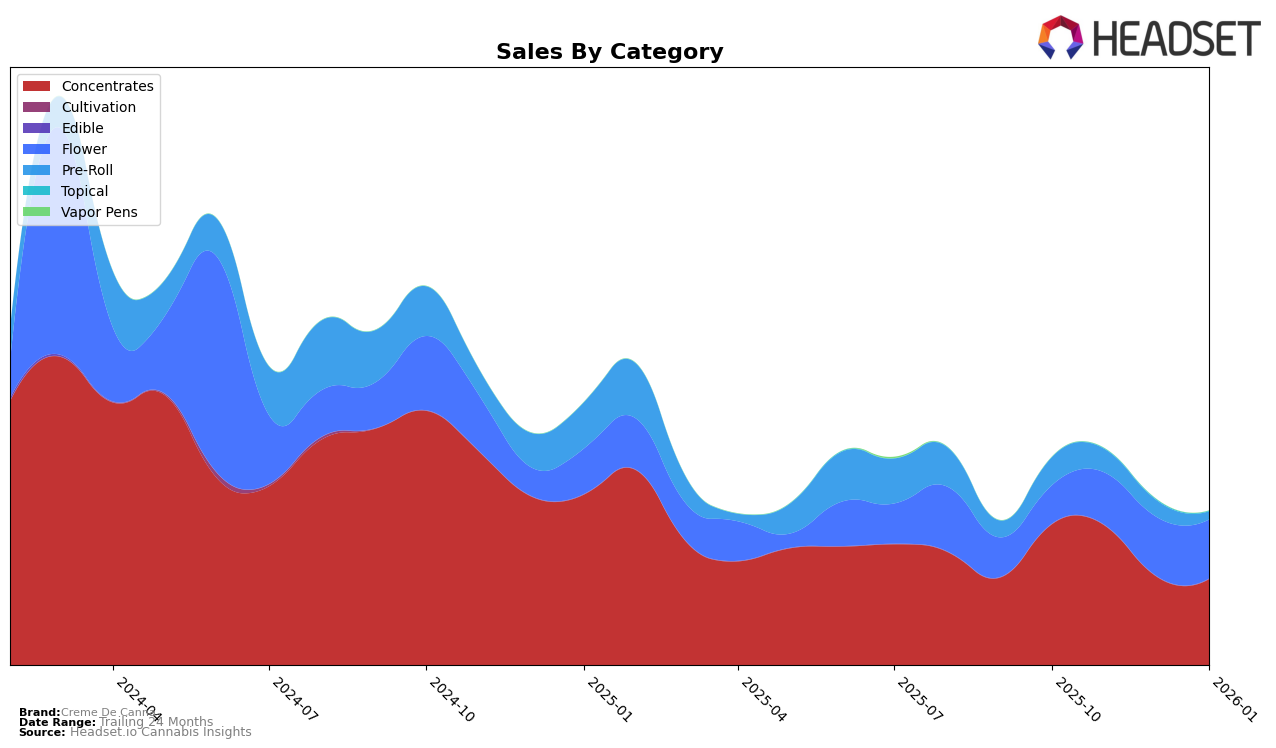

Creme De Canna has experienced fluctuating performance in the California market, particularly within the concentrates category. In October 2025, the brand held the 28th position, improving slightly to 25th in November. However, by December, they dropped out of the top 30, ranking 45th, and continued to struggle in January 2026 with a 40th place ranking. This indicates a notable decline in their market presence towards the end of the year. The brand's sales figures mirror this trend, with a significant drop from October to January, suggesting a need for strategic adjustments to regain their standing.

While Creme De Canna's performance in California shows some challenges, the data also provides insights into potential areas for growth. The initial improvement from October to November suggests that the brand has the capability to climb in rankings, although sustaining such momentum appears to be an issue. The absence from the top 30 in December and January is a critical point that highlights the competitive nature of the concentrates market in California. Understanding the factors that contributed to their brief rise in November could be key to developing a more consistent performance in the future.

Competitive Landscape

In the highly competitive California concentrates market, Creme De Canna has experienced notable fluctuations in its rankings over the past few months. Starting at 28th place in October 2025, it improved slightly to 25th in November, but then saw a decline to 45th in December and 40th in January 2026. This downward trend in rank coincides with a decrease in sales, suggesting challenges in maintaining market share. In comparison, Almora Farms showed a more stable performance, ranking 30th in October and ending at 34th in January, with a significant sales spike in December. Meanwhile, Sluggers Hit consistently improved its position, reaching 30th by January, indicating a positive reception in the market. Decibel Gardens and Heirbloom by CBX remained outside the top 20, with Decibel Gardens entering the rankings in December at 70th and improving slightly to 65th by January. These dynamics highlight the competitive pressures Creme De Canna faces, necessitating strategic adjustments to regain its footing in the California concentrates market.

Notable Products

In January 2026, Creme De Canna's Banjo Cold Cure Diamond Badder emerged as the top-performing product, securing the number one rank in the Concentrates category with sales of 447 units. Following closely, Magic Melon Diamond Sugar achieved the second position, reflecting strong consumer demand for concentrates. Orange Creamsicle Infused Flower ranked third, indicating a notable presence in the Flower category. THCA Isolate Diamond Powder experienced a drop in ranking, moving from first place in October and November 2025 to fourth in January 2026, with sales declining to 313 units. Strawberry Daiquiri Diamond & Crumble Infused Flower maintained a steady performance, slipping slightly from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.