Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

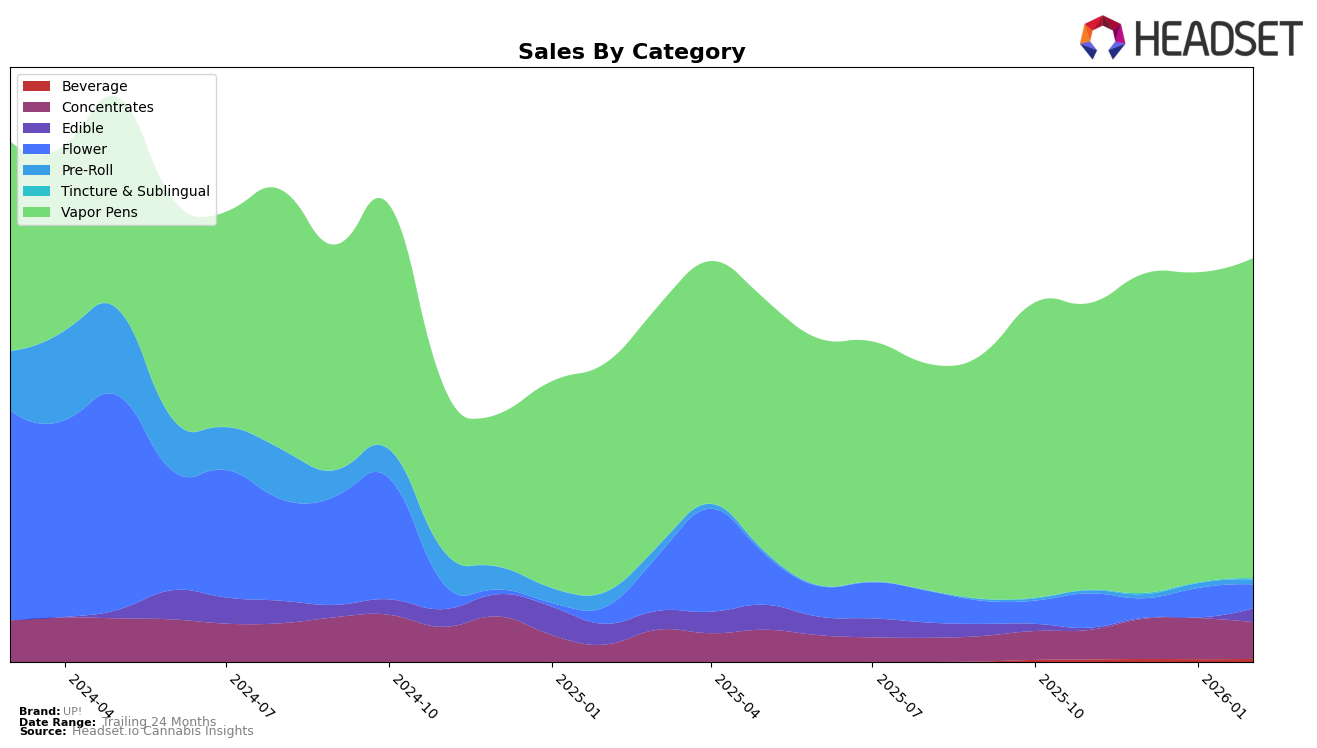

In the competitive landscape of cannabis brands, UP! has shown noteworthy movements across different categories and regions. In the California market, UP! has demonstrated a consistent presence in the concentrates category, maintaining a position within the top 30 brands. Specifically, it improved its rank from 31st in November 2025 to 24th by February 2026. This upward trend is indicative of a strengthening foothold in this category, although there remains room for improvement. On the other hand, UP!'s performance in the edibles category in California is less prominent, as it did not rank within the top 30 brands until February 2026, where it emerged at 42nd place. This suggests potential growth opportunities that UP! could capitalize on to enhance its market presence.

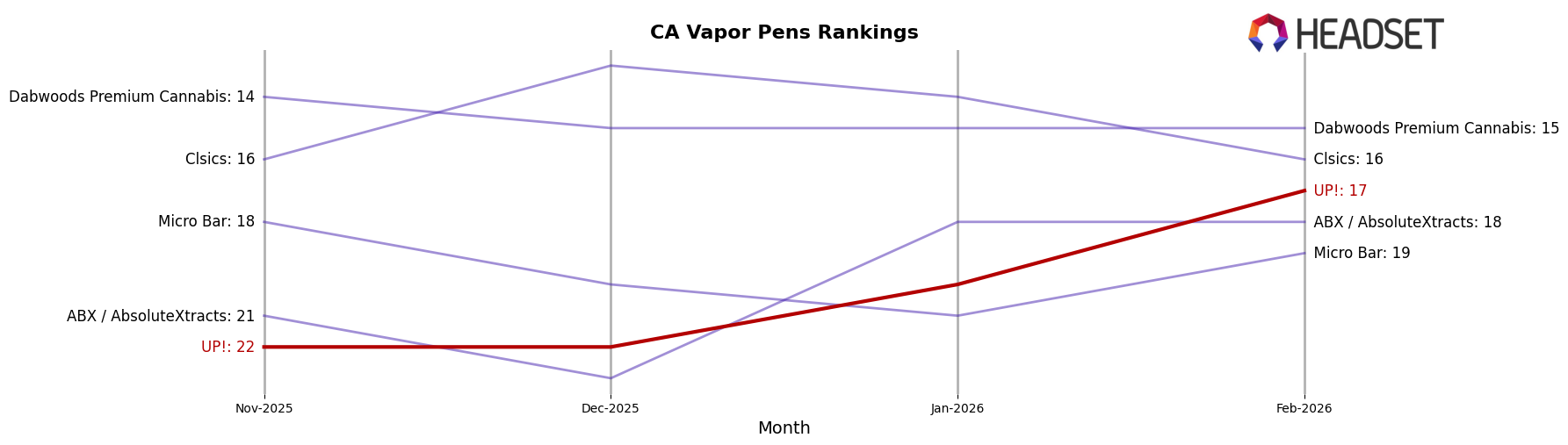

In the vapor pens category, UP! has made significant strides in California, beginning with a rank of 22 in November 2025 and climbing to 17th by February 2026. This positive trajectory highlights UP!'s strong performance and growing consumer preference in this category. The brand's ability to improve its ranking amidst a competitive market underscores its potential for further success. However, the lack of top 30 rankings in other states or provinces indicates that UP! might be focusing its efforts primarily within California, leaving room for expansion and increased competition in other regions. The brand's strategic decisions in the coming months could determine its broader market impact and category growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, UP! has shown a promising upward trajectory in brand rank over recent months. Starting from a rank of 22 in November 2025, UP! climbed to 17 by February 2026, indicating a positive shift in market presence. This improvement is particularly notable when compared to competitors like ABX / AbsoluteXtracts, which remained outside the top 20 in November and December 2025 but managed to secure the 18th position by January 2026. Meanwhile, Clsics and Dabwoods Premium Cannabis experienced fluctuations, with Clsics dropping from 13th to 16th and Dabwoods maintaining a steady 15th position. UP!'s consistent increase in sales from December 2025 to February 2026, even as some competitors saw declines, suggests a growing consumer preference and effective market strategies that could further enhance its competitive edge in the California vapor pen market.

Notable Products

In February 2026, UP!'s top-performing product remained the Mango Kush Live Resin Cartridge (1g) in the Vapor Pens category, holding its consistent first-place ranking despite a slight decrease in sales to 7882. The Blue Dream Live Resin Cartridge (1g) also maintained its steady second-place position, with sales rising to 6533. SFV OG Live Resin Cartridge (1g) improved its ranking from fifth in December to third in February, showing a positive sales trend. Skywalker OG Live Resin Cartridge (1g) held its fourth-place ranking, remaining stable over the past two months. Notably, the Pineapple Express Distillate Disposable (1g) dropped to fifth place in February, after being unranked in January, indicating a fluctuation in demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.