Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

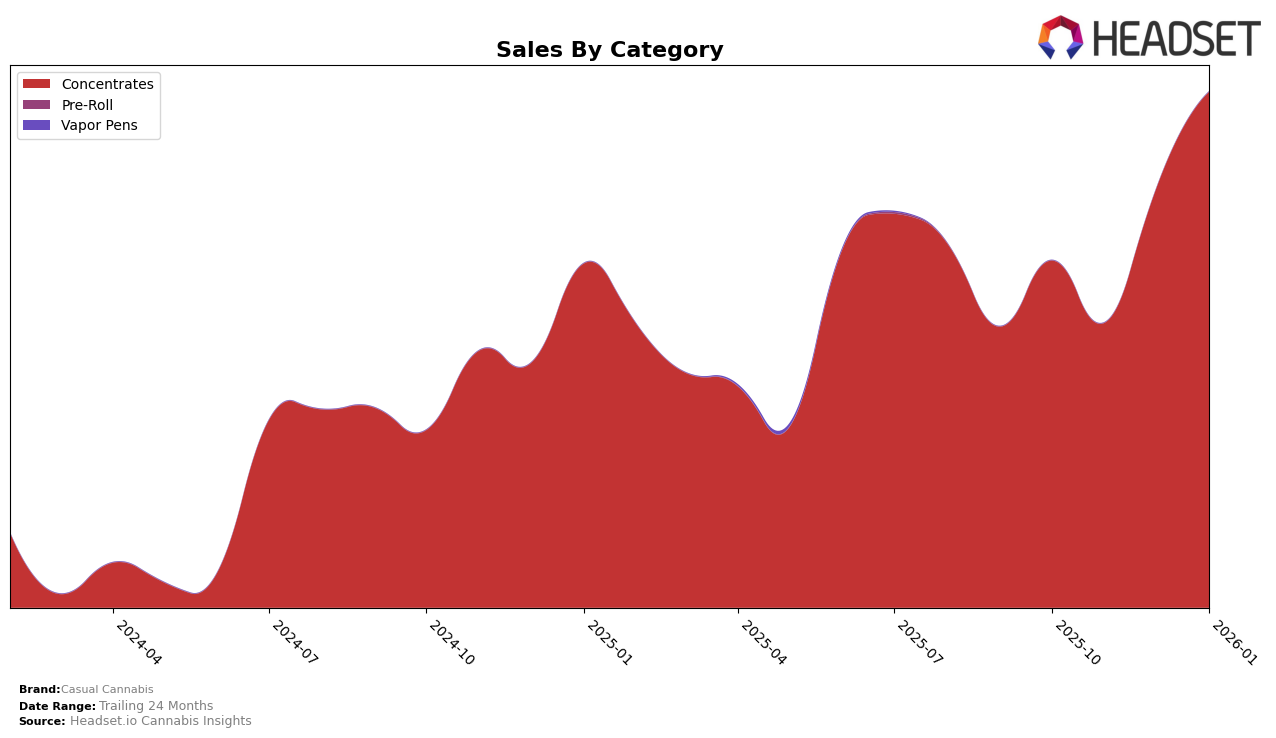

Casual Cannabis has shown notable performance in the Concentrates category within the state of California. Over the four-month period from October 2025 to January 2026, the brand improved its ranking from 26th to 20th, indicating a positive trend in market presence. This upward movement suggests a growing consumer preference or effective market strategies that have bolstered their position. The brand's sales in this category also reflect a strong upward trajectory, with a significant increase from October to January, culminating in a notable rise in January sales. However, it's important to note that while they made the top 30 in California, there are other states where Casual Cannabis might not have achieved similar visibility or success, as they did not appear in the top 30 rankings for those areas.

While California has been a stronghold for Casual Cannabis, their absence from the top 30 rankings in other states or provinces indicates potential areas for growth or challenges in penetrating those markets. This disparity could be due to a variety of factors such as regional market dynamics, consumer preferences, or competitive pressures. Understanding these factors could provide valuable insights for the brand's strategic planning. The performance in California, however, sets a benchmark and could serve as a case study for expansion strategies in other regions. As the brand continues to evolve, monitoring these trends will be crucial for stakeholders interested in the broader cannabis market landscape.

Competitive Landscape

In the California concentrates market, Casual Cannabis has shown a promising upward trend in its ranking, moving from 26th in October 2025 to 20th by January 2026. This improvement in rank is accompanied by a notable increase in sales, suggesting a positive reception of their products. However, Casual Cannabis faces stiff competition from brands like Cream Of The Crop (COTC), which consistently ranks higher, maintaining a position within the top 20 throughout the same period. Similarly, West Coast Trading Co. has shown strong sales, although experiencing a slight dip in January 2026. Meanwhile, Emerald Bay Extracts and Pistil Whip are also competitors to watch, as they closely trail Casual Cannabis in both rank and sales. The data indicates that while Casual Cannabis is gaining momentum, maintaining this trajectory will require strategic efforts to outpace these formidable competitors.

Notable Products

In January 2026, the top-performing product for Casual Cannabis was Canal St. Sweets Badder (1g) in the Concentrates category, rising to the number one spot with sales of 1397 units. Casual x Potwest - Thai Grapes Badder (1g) followed closely in second place, maintaining its position from the previous month. Monkey Headlights Badder (1g) entered the rankings at the third position, showing a strong debut. Casual x Potwest- Thin Mint Sherbet Badder (1g) and Jelly Cake Badder (1g) took the fourth and fifth spots, respectively, both appearing in the rankings for the first time. This shift indicates a growing trend in consumer preference for new concentrate products from Casual Cannabis.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.