Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

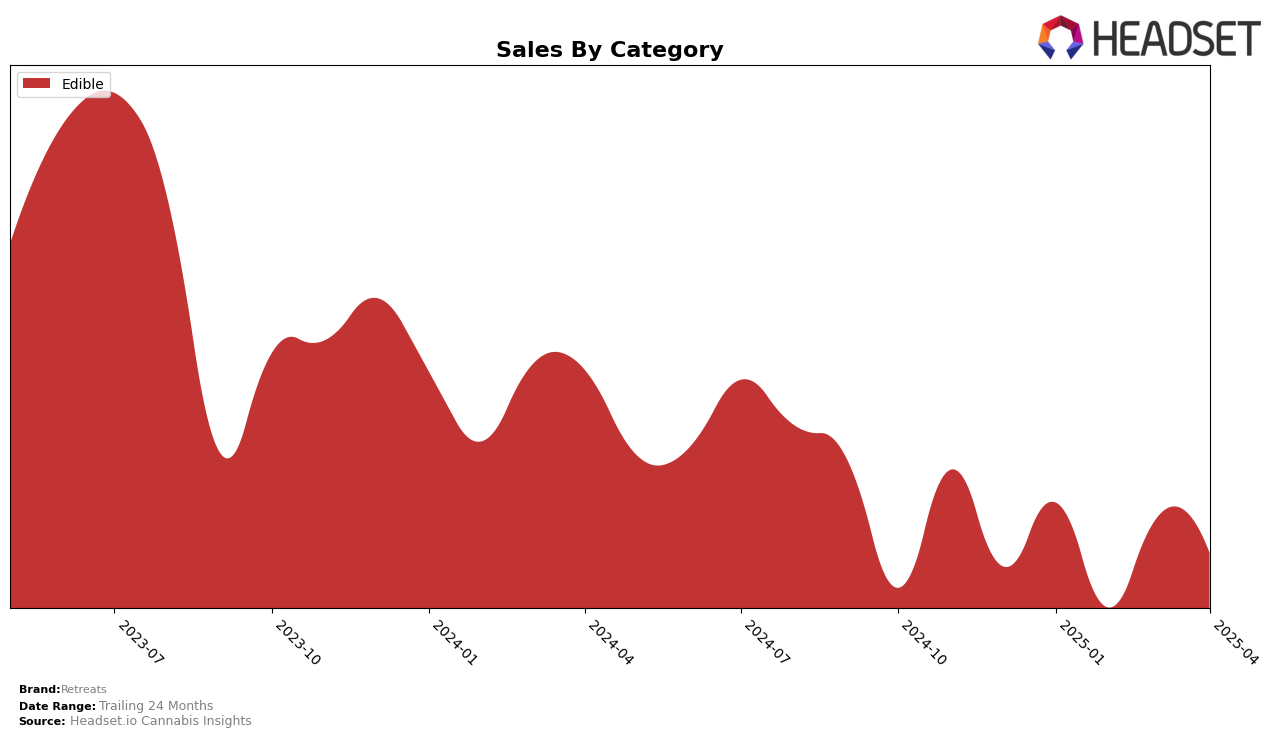

In the state of Oregon, Retreats has shown a consistent presence within the top 30 rankings for the Edible category throughout early 2025. The brand maintained its position at 28th in January and March, with a slight dip to 30th in February and April. Despite these fluctuations, the brand's performance indicates a steady demand in the market. This persistence in the rankings, despite not breaking into higher positions, suggests a stable consumer base. The sales figures for January and March also reflect a recovery from a dip in February, indicating potential resilience in their market strategy or product appeal.

However, it is worth noting that Retreats did not manage to break into the top 27, which might be a point of concern if they aim to increase market share in the Edible category in Oregon. The absence of the brand from higher ranks could suggest stronger competition or a need for strategic adjustments to climb higher. This performance presents an opportunity for Retreats to analyze their competitive landscape and identify areas for improvement or innovation to enhance their ranking and sales in the future.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Oregon, Retreats has maintained a relatively stable position, with its rank fluctuating between 28th and 30th from January to April 2025. This consistency is noteworthy given the dynamic shifts observed among competitors. For instance, Crop Circle Co showed significant improvement, climbing from 36th to 28th, which could pose a competitive threat to Retreats if this upward trend continues. Meanwhile, Concrete Jungle remained stable at 29th, closely trailing Retreats. In contrast, Willamette Valley Alchemy and Crown B Alchemy experienced more volatility, with Willamette Valley Alchemy not ranking in February, indicating potential market instability. Retreats' sales figures reflect a slight decline from January to February, followed by a recovery in March, suggesting that while the brand is holding its ground, there is room for strategic adjustments to capitalize on market opportunities and fend off rising competitors.

Notable Products

In April 2025, Hybrid Gummies 10-Pack (100mg) reclaimed the top position in Retreats' product lineup, showing a notable increase from its third-place ranking in March, with sales reaching 643 units. Sativa Gummies 10-Pack (100mg) maintained a strong presence, securing the second spot after leading in February, though its sales slightly dipped to 541 units. Indica Gummies 10-Pack (100mg), which was the bestseller in March, fell to third place, indicating a shift in consumer preference. The CBD/THC 1:1 Island Punch Gummies 2-Pack (100mg CBD, 100mg THC) remained consistent at fourth place, showing a sales increase to 241 units. Meanwhile, CBD/THC 1:1 Passion Orange Guava Gummies 10-Pack (100mg CBD, 100mg THC) improved its standing from fifth to fourth, reflecting growing interest in balanced CBD/THC offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.