Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

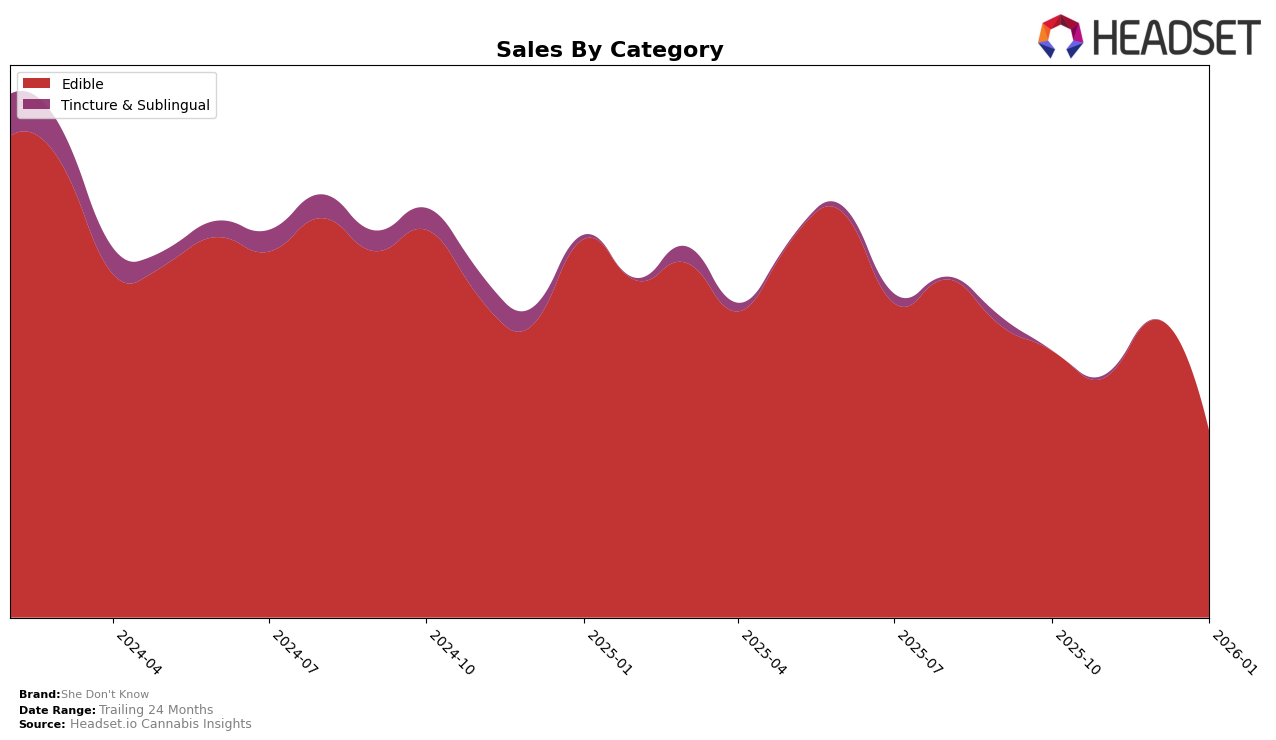

She Don't Know has demonstrated a fluctuating performance in the Oregon edible category over the past few months. The brand's rankings have seen minor shifts, moving from 27th place in October 2025 to 28th in November, then improving to 26th in December before dropping back to 28th in January 2026. This suggests a level of volatility in their market presence, potentially influenced by seasonal demand or competitive pressure. Despite these ranking changes, the brand's sales figures reveal an interesting trend: a peak in December followed by a significant drop in January. This could indicate a strong holiday season performance, which is common in the cannabis industry, but also highlights the challenge of maintaining momentum post-holiday.

Examining their position within the broader landscape, She Don't Know's absence from the top 30 rankings in other states or provinces suggests a limited geographical reach or varying levels of market penetration. This lack of presence in other regions could be seen as a strategic focus on the Oregon market, or it may reflect challenges in scaling operations beyond their current base. For industry observers, this data underscores the importance of understanding regional dynamics and the competitive landscape, as it can significantly impact a brand's performance and growth strategy. The insights from Oregon's performance could serve as a valuable benchmark for She Don't Know as they evaluate potential expansion opportunities or adjustments to their existing strategies.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, She Don't Know has experienced some fluctuations in its ranking over the past few months, which could impact its sales trajectory. As of January 2026, She Don't Know holds the 28th position, a slight decline from its peak at 26th in December 2025. This drop in rank is notable, especially when compared to competitors like Tasty's (OR), which improved its position to 26th in the same month, and beaucoup, which saw a significant drop from 21st in November 2025 to 30th in January 2026. Meanwhile, Crop Circle Co and Canna Crispy have also shown varying performance, with ranks fluctuating but generally staying within the top 30. These shifts suggest a dynamic market where She Don't Know must strategize to maintain or improve its position amidst strong competition, particularly as sales figures show a downward trend from December to January.

Notable Products

In January 2026, Key Lime Rosin Cookie (100mg) emerged as the top-performing product for She Don't Know, climbing from the fifth rank in October 2025 to first place with sales reaching 477 units. Blueberry Fruit Crunchers Gummy (100mg) maintained a strong presence, securing the second spot with 371 units sold, despite fluctuating ranks over previous months. Cherry Fruit Crunchers Gummy (100mg) continued its strong performance, securing third place, though its sales dropped from December 2025. Raspberry Fruit Crunchers Gummy (100mg) experienced a decline in rank, moving from first in November 2025 to fourth in January 2026. Strawberry Fruit Crunchers Gummy (100mg) saw a significant drop to fifth place, highlighting a notable decrease in sales compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.