Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

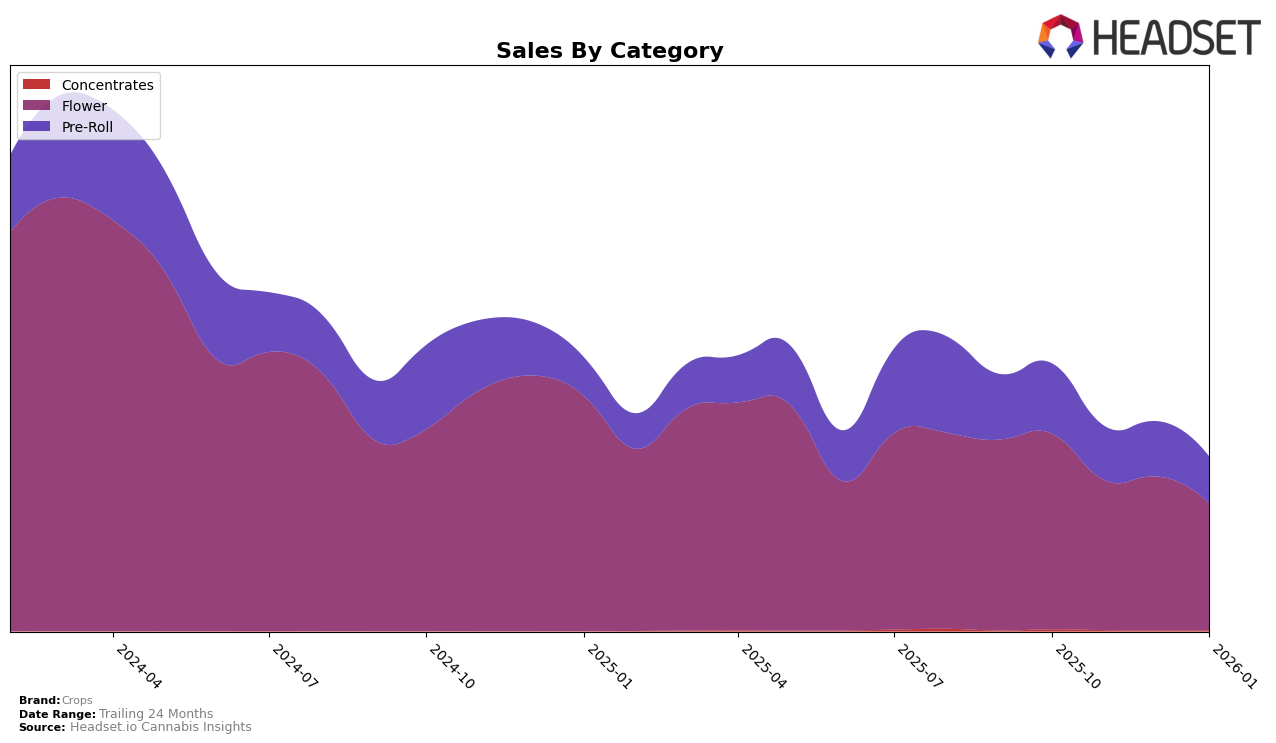

Crops has shown varied performance across different states and categories, with notable differences in market presence. In Illinois, the brand's ranking in the Flower category has consistently remained outside the top 30, indicating a challenging competitive landscape. Despite being ranked 38th in October 2025, Crops saw a gradual decline, reaching 56th by January 2026. This downward trend suggests potential issues in maintaining market share or adapting to consumer preferences in Illinois. Conversely, in the Pre-Roll category, Crops managed to stay within the top 50, though its ranking slipped from 22nd in October to 50th by January. Such fluctuations highlight the competitive dynamics and potential challenges Crops faces in Illinois.

In contrast, Crops has performed significantly better in New Jersey, particularly in the Flower category, where it consistently held a position within the top 11 brands. Starting at 6th place in October 2025, Crops experienced a slight dip to 11th by January 2026. This consistent presence in the top tier suggests a strong brand recognition and consumer loyalty in New Jersey's Flower market. Similarly, in the Pre-Roll category, Crops maintained a stable ranking, remaining in the 9th to 11th range throughout the observed period. This stability in New Jersey contrasts with the performance in Illinois and underscores Crops' stronger foothold in the New Jersey market.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Crops has demonstrated a dynamic shift in its market position over the past few months. Starting from a strong 6th place in October 2025, Crops experienced a slight decline, settling at 11th place by January 2026. This change in rank is notable when compared to competitors such as Seed & Strain Cannabis Co., which maintained a relatively stable position, and The Lid, which saw a significant rise from 20th to 9th place in the same period. Despite the rank fluctuations, Crops' sales figures remained robust, although they saw a decrease in January 2026. This suggests that while Crops is facing stiff competition, particularly from brands like Kind Tree Cannabis and Yeti, which also showed notable rank improvements, there is still a strong consumer demand for Crops' products. Understanding these trends can provide valuable insights for strategic positioning and market share growth in the competitive New Jersey Flower market.

Notable Products

In January 2026, the top-performing product from Crops was the Road Trip Pre-Roll 7-Pack (3.5g) in the Pre-Roll category, achieving the number one rank with sales of 3170 units. The Secret Meetings Pre-Roll (1g) climbed to the second position from its fifth rank in December 2025, showing a significant increase in popularity with sales reaching 1941 units. Super Lemon G Pre-Roll (1g) also made an impressive entry at rank three, moving up from a previous absence in December 2025 rankings, with sales of 1815 units. Secret Meetings (3.5g) and Super Lemon G (7g) secured the fourth and fifth spots respectively, both appearing for the first time in the rankings. This shift indicates a growing consumer preference for pre-rolls and larger flower packs from Crops at the start of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.