Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

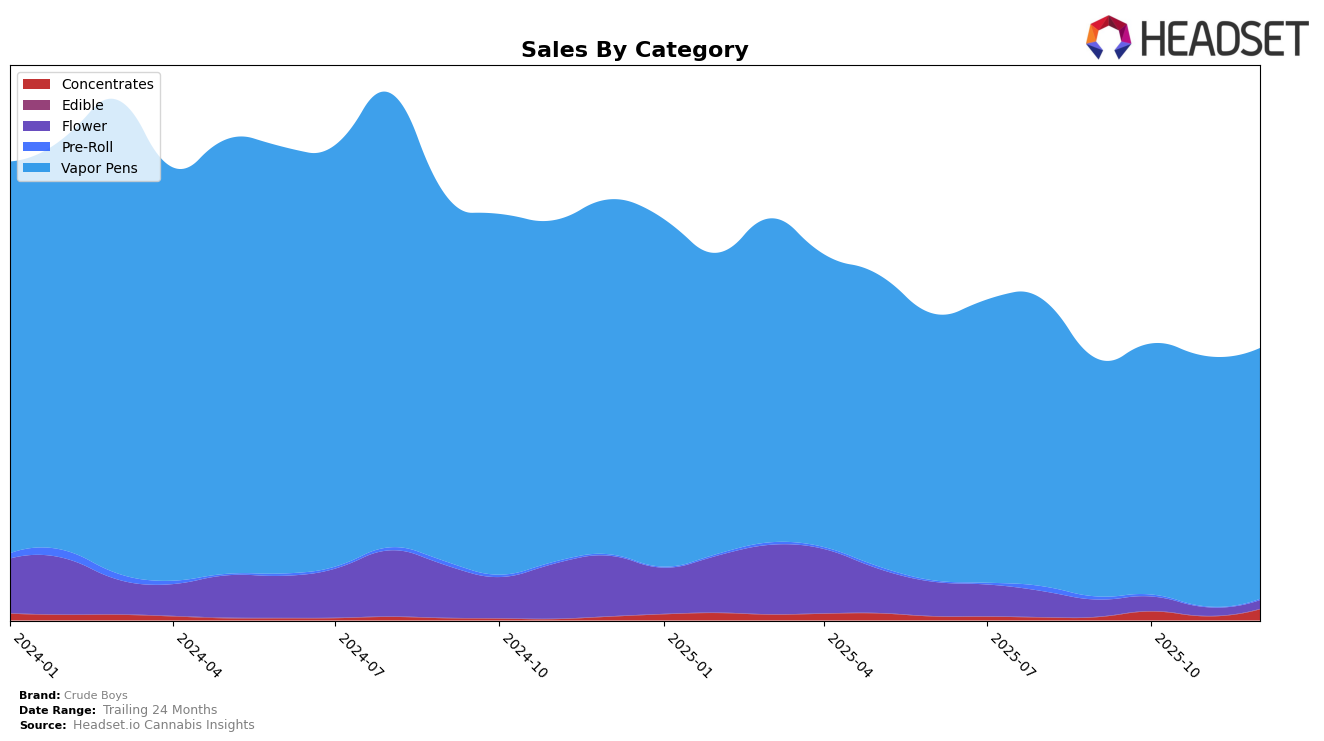

In the state of Massachusetts, Crude Boys has consistently maintained its position within the top five brands in the Vapor Pens category from September to December 2025. This stability indicates a strong market presence and consumer preference for their products. Despite a slight fluctuation in sales figures, with a peak in October, the brand has managed to hold its ground against competitors. Such consistency in ranking suggests a loyal customer base and effective market strategies, which are crucial for sustaining their position in a competitive market.

In contrast, the performance of Crude Boys in Michigan presents a mixed picture. While they have maintained a steady sixth position in the Vapor Pens category, their presence in the Concentrates category has been less stable. Notably, the brand did not make it into the top 30 in September and November, but it reappeared in December at rank 32. This inconsistency highlights potential challenges in this category, possibly due to stronger competition or market dynamics. Nevertheless, the re-entry into the rankings by the end of the year could indicate a positive shift or strategic adjustments by the brand.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Crude Boys consistently held the 6th rank from September to December 2025, showcasing a stable position amidst fluctuating market dynamics. While Platinum Vape maintained a stronghold at the 4th position, Crude Boys faced close competition from Drip (MI), which consistently ranked 5th. Notably, Jeeter showed an upward trend, climbing from the 10th to the 7th position, indicating a potential threat if the trend continues. Meanwhile, Play Cannabis also improved its rank from 11th to 8th, suggesting a competitive market environment. Despite these shifts, Crude Boys' consistent ranking reflects a solid customer base and steady sales performance, although vigilance is necessary to maintain its market position amidst rising competitors.

Notable Products

In December 2025, the top-performing product from Crude Boys was the Alaskan Thunder Fuck Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank consistently since September 2025 with sales of 28,297 units. The Maui Wowie Distillate Cartridge (1g) moved up to the second position, showing a positive trend from its consistent third place in previous months. Blueberry Widow Distillate Cartridge (1g) slightly dropped to third place, despite being second from September to November. Pineapple Express Distillate Cartridge (1g) held steady at fourth place, showing consistent performance. Grapes Of Wrath Distillate Cartridge (1g) entered the top five in November and retained its fifth position in December, indicating a growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.